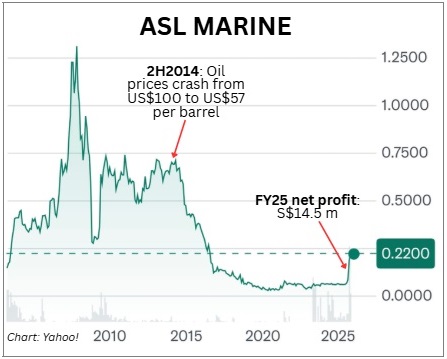

The perfect storm that marine-related companies sailed into saw many sink and the rest struggle to stay alive. Then one by one, the survivors of grueling restructurings emerged -- Marco Polo Marine, Nam Cheong, Pacific Radiance, Valliance, Hiap Seng Industries .... One more broke through in recent months: ASL Marine, whose PowerPoint deck at the FY25 (ended June) results briefing this week is aptly titled "Revitalised. Resilient. Ready." ASL has a vertically integrated portfolio spanning shipbuilding, ship repair and conversion, and ship chartering. Following its FY25 results, its stock shot up from ~7 cents to 21 cents, reflecting its turnaround which also enabled it to raise ~S$7 million in a share placement to renew its vessel fleet. |

| The Turbulent Years: A Perfect Storm Hits |

ASL Marine’s resilience was severely tested from 2014, when the price of oil crashed and created a long crisis period that affected entire oil and gas and marine sectors.

ASL Marine faced issues with ship owners unable to take delivery of large ships and numerous clients going under and defaulting on payments.

For years, management’s primary objective was survival, focusing on cash flow management, ensuring paychecks and covering expenses. Ang Kok Tian, Chairman, MD & CEO of ASL Marine. File photo.This period also highlighted the inflexibility of bond structures, making rapid restructuring difficult due to the stringent requirement of over 75% consensus from scattered bondholders for any extensions.

Ang Kok Tian, Chairman, MD & CEO of ASL Marine. File photo.This period also highlighted the inflexibility of bond structures, making rapid restructuring difficult due to the stringent requirement of over 75% consensus from scattered bondholders for any extensions.

ASL Marine went through two rounds of restructuring for its bonds, first obtaining a three-year extension, and then another round in 2019, just months before the onset of COVID-19, which compounded the tough market conditions.

Unlike many peers, ASL chose not to ask for "haircuts" on the debts, citing ethical grounds.

In March 2025, a lifeline came when it secured S$132 million in a "club deal" from UOB, DBS, and OCBC.

ASL put up collateral (vessels and land) valued at S$268 million, far exceeding book values due to aggressive depreciation policies.

| Debt Settlement: Clearing the Decks |

The crowning achievement: Settling S$130 million in bonds in March 2025, a milestone after nine years of disciplined payback.

Asset sales, including idle vessels, bridged gaps, slashing interest costs and operating expenses, boosting margins.

The average Adjusted EBITDA over the past five years stands at a healthy S$64 million, with average Net Cash Flow from Operations at S$54 million.

The improvement is notable, with Gross Profit Margin rising from 13.1% in FY2024 to 17.3% in FY2025.

|

Metric |

FY2025 |

FY2024 |

% Change |

|

Revenue |

S$350.1m |

S$349.3m |

+0.2% |

|

Net Profit (Attributable to Owners) |

S$14.6m |

S$3.9m |

+272.3% |

|

Adjusted EBITDA |

S$83.7m |

S$85.7m |

-2.4% |

|

Earnings Per Share (EPS) |

S$0.015 |

S$0.0058 |

+153% |

|

Operating Cash Flow |

S$45.8m |

S$40.4m |

+13.4% |

|

Total Debt (Interest-Bearing) |

S$178.9m |

S$227.4m |

-21.3% |

|

Cash & Equivalents |

S$22.8m |

S$17.2m |

+32.6% |

Page 5 of ASL Marine's FY2025 presentation outlines the "Accelerated Repayment Roadmap for New Term Loan," detailing the strategy to settle a S$132 million loan from UOB, DBS, and OCBC, used to redeem bonds.

This 5-year facility follows a 10-year amortization profile with a 50% balloon payment in year 5.

Repayments accelerate via vessel sales, applied from the back end to cut principal and interest early.

Potential proceeds from sales over the next two financial years total S$75.6 million (S$52.6m + S$23m), more than halving the loan.

This reduces financing costs (averaging a whopping S$23 million/year over the past two years), enhancing cash flow and profitability.

Ship repair is highly valued for its recurring, service-based nature, offering better margins and stability compared to shipbuilding. In essence, ASL's revival from near-collapse to profitability (net profit S$14.7 million in FY2025) has strengthened its focus on stability over speculation. For investors, ASL isn't just surviving—it's ready to thrive. |

The FY25 results PowerPoint deck is here.

The FY25 results PowerPoint deck is here.

See Lim & Tan Securities' take: ASL MARINE: From Headwinds to Tailwinds, Here's a Company Ready For A Profit Upswing