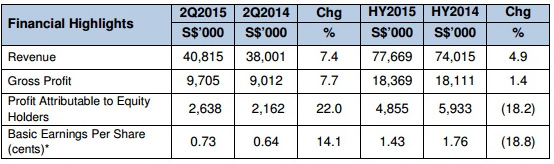

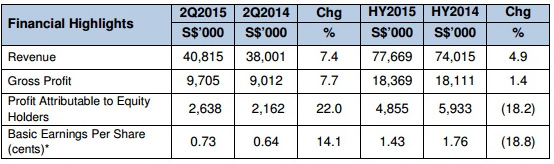

SINWA LIMITED reported a 7.4% year-on-year increase in revenue to S$40.8 million for 2Q2015. Net profit attributable to equity holders increased 22.0% to S$2.6 million.

The company said it would pay a special dividend of 2.25 Singapore cents per share.

(This is higher than the FY2014 interim dividend of 1.75 cents per share (which consisted of a special dividend of 1.25 cents from the proceeds of disposal of a vessel and an interim dividend of 0.5 cents per share).

Its revenue growth stemmed from a wider customer base and increased sales volume from existing customers for the marine and offshore supply business.

Gross profit margin remained relatively constant at 23.8% from 23.7% for 2Q2014.

Administrative expenses decreased to S$5.1 million for 2Q2015 from S$5.4 million for 2Q2014. This was due to higher professional expenses incurred for 2Q2014.

Cash flow from operations rose 6.2% to S$0.7 million and 24.4% to S$4.0 million for 2Q2015 and HY2015 respectively.

The Group also maintained a robust balance sheet, reporting cash and cash equivalents amounting to S$26.5 million as at 30 June 2015.

Overall, the Group is in a net cash position with borrowings reduced by S$0.7 million from 31 December 2014 to S$2.6 million as at 30 June 2015.

|

CEO Bruce Rann. NextInsight file photo.On the Group’s business outlook, Mr. Bruce Rann, Group CEO of Sinwa, said, “We have continued our strategy to streamline our business model and focus on our core marine, offshore supply and logistics business. It has been validated over the last two quarters and shown its effectiveness despite a slow recovery in the shipping industry. CEO Bruce Rann. NextInsight file photo.On the Group’s business outlook, Mr. Bruce Rann, Group CEO of Sinwa, said, “We have continued our strategy to streamline our business model and focus on our core marine, offshore supply and logistics business. It has been validated over the last two quarters and shown its effectiveness despite a slow recovery in the shipping industry.

"The current outlook in the offshore oil and gas industry remains bearish, especially with the anticipation of Iran’s return as a substantial producer of crude oil, which could significantly affect oil prices. As a result, the effects of capital expenditure cuts and fallen margins have been impressed upon the offshore and marine industry and it is facing a situation of lower demand. However, the adversities in the market will not divert us away from our long-term strategy.

"Our core business has shown great resilience and our management has displayed strong proficiency in response to the headwinds faced. We will remain watchful of any developments in the marine and offshore industry and regularly review our business operations to continue the momentum of our progress. Our operations in Thailand have commenced this year and we look forward to the myriad of opportunities it presents.

"Moreover, we will stay focused and springboard ourselves to further expand our client base and business in the Asia Pacific region. We will take a conservative and methodical approach to do our utmost to place ourselves in a prime position when the market recovers.”

|