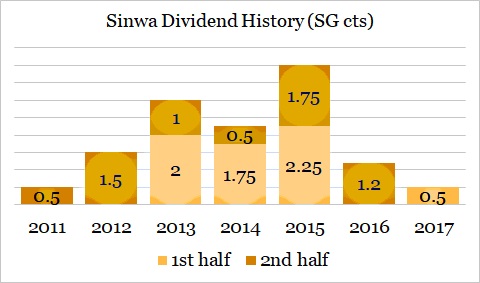

Sinwa Global has paid dividends every year through the shipping and marine & offshore downturn. Sinwa Global has paid dividends every year through the shipping and marine & offshore downturn.

Sinwa Global has kept up its momentum of paying dividends annually for the past 7 years in spite of intense competition in the sluggish shipping and offshore markets. |

"Our new warehouse and upgraded facilities helps us to optimize our operations and diversify our revenue streams," said CEO Bruce Rann. (NextInsight file photo) In May 2017, it announced that it had secured new supply agreements totalling about A$8.0 million for vessels involved in the Shell Prelude Floating Liquefied Natural Gas project.

"Our new warehouse and upgraded facilities helps us to optimize our operations and diversify our revenue streams," said CEO Bruce Rann. (NextInsight file photo) In May 2017, it announced that it had secured new supply agreements totalling about A$8.0 million for vessels involved in the Shell Prelude Floating Liquefied Natural Gas project.

The LNG project will be located in the Browse Basin, about 475 km northeast of Broome and over 200 km off the coast of Western Australia.

The Group will be servicing this project from its 10,000 sqm Darwin Facility.

The Group’s redevelopment of its warehousing infrastructure in Singapore was completed in 2QFY2017.

| Stock | 24c |

| 52-week range | 20.5c-28c |

| Market cap | S$81.86 m |

| Cash reserve (30 Jun '17) |

S$24.98 m |

| Gross gearing | 0.05 |

| Source: Bloomberg / Company | |

54,000 square feet of space was added with increased freezer, chiller and ante-room capability.

It also upgraded its fleet of delivery vehicles to include refrigerated delivery trucks, enabling products to be procured directly from international manufacturers in bulk and at a more competitive price.

The redevelopment will be equipped with ISO 22000 and HACCP certification, enabling the Group to tender to additional industry sectors, including defence and cruise.

The management expects Sinwa to remain profitable for FY2017.