Hiding Capex in a JV Vehicle

By classifying deferred payment for capex as financing, rather than as use of cash in investing, a company can make its capital expenditure look very healthy.

Intel formed a joint venture with Micron in January 2006 to manufacture NAND flash memory products. The JV was IMFT and production began in early 2006.

As part of the initial capital contribution of US$1.2 billion to IMFT, in exchange for a 49% share stake in IMFT, Intel paid US$615 million in cash and issued US$581 million in non-interest bearing notes.

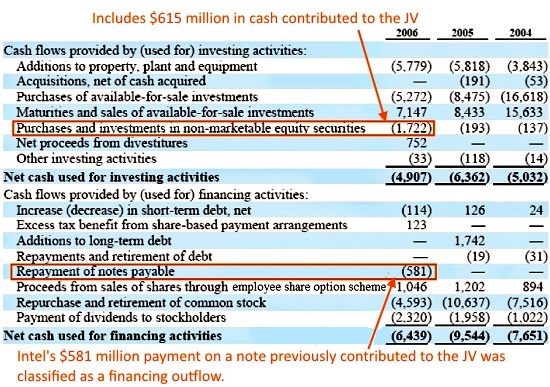

The table below shows that Intel masked US$615 million of capital expenditure as purchases and investments in non-marketable equity securities.

CFRA analysis of Intel's cash flow |

During 2006, Intel paid the entire balance of US$581 million toward the non-interest bearingnotes, and posted it as a financing activity on the consolidated statement of cash flows.

It is important to look at cash flow from capital contribution to JVs. This can be hidden in cash flow from operations. Ask the management:

- “Is the cashflow capital expenditure to fund infrastructure or equipment?”

- “Is it working capital for operations?“

Then, reclassify the financial metrics accordingly.

Capital Leases

The use of capital leases can also make cash flow from investing activities look very healthy and provide an unsustainable boost in cash flow from operations.

Capital leases increase the company’s accounts payables as it needs to make principal payments on the capital investments going forward.