Faking Revenue Quality

Factoring is a big thing for Asian companies that want to improve the appearance of their cash flow metrics. A business can sell business receivables to a financial institution (a factor) at a discount to the outstanding amount stated on the invoice. The debtor would then direct his payment to the new owner of the invoice.

That are two types of factoring: The first is when the invoice ownership is transferred with recourse, giving the factor (purchaser of the receivables) the right to collect the unpaid invoice amount from the transferor (seller) in event of account debtor default. The second is when the invoice ownership is transferred without recourse, which means the factor must bear the loss if the account debtor does not pay the invoice amount.

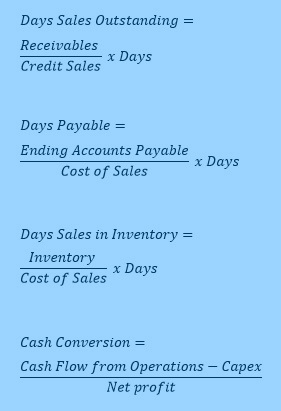

High quality revenue is marked by predictability, profitability and diversity. The factoring of receivables without recourse can mask revenue growth that ends up with uncollectible receivables. Huge increases in factored receivables will decrease the Days Sales Outstanding (DSO), giving the appearance that the company collects quickly on its credit sales. A low DSO can be due to the derecognition of receivables.

High quality revenue is marked by predictability, profitability and diversity. The factoring of receivables without recourse can mask revenue growth that ends up with uncollectible receivables. Huge increases in factored receivables will decrease the Days Sales Outstanding (DSO), giving the appearance that the company collects quickly on its credit sales. A low DSO can be due to the derecognition of receivables.

Factoring will also provide an early boost to Cash flow from Operations because of earlier cash inflow (from the factor), when there was actually a haircut to the receivables.

Faking Cash Conversion Rate

Here is an example of a company meeting a steep cash conversion target by not paying suppliers.

Elekta, the leading provider of radiotherapy equipment for treatment of cancer and brain disorders, had steep targets for revenue growth and cash conversion.

Cash conversion was 44% during 9MFY2013 versus a full-year target of 70%. During 4QFY2013, it grew revenues by 20% and raised full-year cash conversion to 76%, thereby achieving both full year targets.

However, the time it took to pay suppliers increased to an all-time high (Days Payable was close to 60 days). This was not matched by an increase in inventory. Days Sales of Inventory declined year-on-year.

Typically, when a manufacuring or distribution company is in its growth phase and its payables increase, it is important to check the payables increase against the inventory trend.

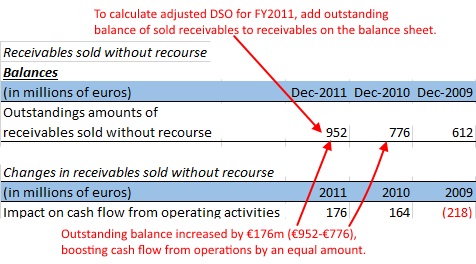

If a company discloses the amount of receivables it has factored (as in the case of Alcatel Lucent above), an analyst can adjust the DSO by adding the outstanding balance of sold receivables to the receivables on the balance sheet. If the company does not disclose factored receivables, its quantum can be inferred by movements in finance/interest expense. When receivables are factored, a discount is effectively ‘paid’ to the buyer and this discount is recorded as a finance cost by the seller. Rising finance costs may highlight higher factoring levels. Chart: CFRA Research

If a company discloses the amount of receivables it has factored (as in the case of Alcatel Lucent above), an analyst can adjust the DSO by adding the outstanding balance of sold receivables to the receivables on the balance sheet. If the company does not disclose factored receivables, its quantum can be inferred by movements in finance/interest expense. When receivables are factored, a discount is effectively ‘paid’ to the buyer and this discount is recorded as a finance cost by the seller. Rising finance costs may highlight higher factoring levels. Chart: CFRA Research