Excerpts from OCBC report

Analyst: Eli Lee

Analyst: Eli Lee

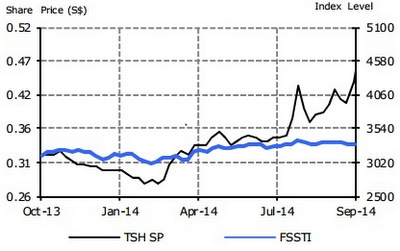

Tuan Sing stock has outperformed the STI since April 2014. Chart: Bloomberg.A significant shareholder emerges

Tuan Sing stock has outperformed the STI since April 2014. Chart: Bloomberg.A significant shareholder emerges On Friday evening (Sept 26), it was reported that Mr Koh Wee Meng, Chairman and CEO of the Fragrance Group, brought his shareholding of Tuan Sing from 4.46% to 5.02% via share purchases in the open market, making him a substantial shareholder.

Mr Koh had purchased, from the open market on 25 Sep 2014, 6.5m shares at an average price of S$0.432 per share. After this news, Tuan Sing shares soared to a 5-year high yesterday, closing at S$0.455 per share with 26m shares traded (~5.5% of float).

While this closing price represents a still-significant 30.1% discount to Tuan Sing’s book value of S$0.651 per share, we also note this is broadly in line with comparable peers currently trading at an average discount of 27.7%

Recently acquired remaining interests in two 5-star AZ hotels

Tuan Sing is a real estate developer with assets in Singapore, Australia and China. Its residential developments in Singapore include projects such as Sennett Residences (91% sold as at end 2Q14), Cluny Park Residences (33% sold) and Seletar Park Residence (95% sold).

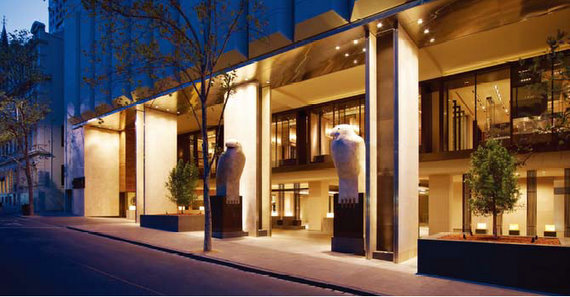

From 50%, Tuan Sing now owns 100% of Grand Hyatt Melbourne. Photo: CompanyCommercial projects include Robinson Tower (currently under redevelopment), Robinson Point and also Century Warehouse.

From 50%, Tuan Sing now owns 100% of Grand Hyatt Melbourne. Photo: CompanyCommercial projects include Robinson Tower (currently under redevelopment), Robinson Point and also Century Warehouse.

In Sep 2014, Tuan Sing also recently acquired the remaining 50% interests, that it did not already own, in two five-star hotels in Australia, namely Grand Hyatt Melbourne and Hyatt Regency Perth, for A$126m.

Australian assets could be particularly attractive

From 50%, Tuan Sing now owns 100% of Grand Hyatt Melbourne. Photo: CompanyCommercial projects include Robinson Tower (currently under redevelopment), Robinson Point and also Century Warehouse.

From 50%, Tuan Sing now owns 100% of Grand Hyatt Melbourne. Photo: CompanyCommercial projects include Robinson Tower (currently under redevelopment), Robinson Point and also Century Warehouse. In Sep 2014, Tuan Sing also recently acquired the remaining 50% interests, that it did not already own, in two five-star hotels in Australia, namely Grand Hyatt Melbourne and Hyatt Regency Perth, for A$126m.

Australian assets could be particularly attractive

Tuan Sing is currently controlled by the Liem family, who owns at least 53.5% collectively, and we highlight that it remains speculative as to what Mr Koh’s intentions are.

That said, we note that Mr Koh, a seasoned real estate developer, has publicly indicated his plans for expansion in Australia following the slowdown in the Singapore residential market, and his company Fragrance Group has also recently proposed plans to spin-off its property business in Australia on the Catalist board.

As such, in addition to Tuan Sing’s attractive valuation, its two prime hotels in Melbourne and Perth could be of special interest to Mr Koh. We currently have do not have a rating on Tuan Sing.

Previous story: TUAN SING Shares Soar 20% On Heavy Volume

That said, we note that Mr Koh, a seasoned real estate developer, has publicly indicated his plans for expansion in Australia following the slowdown in the Singapore residential market, and his company Fragrance Group has also recently proposed plans to spin-off its property business in Australia on the Catalist board.

As such, in addition to Tuan Sing’s attractive valuation, its two prime hotels in Melbourne and Perth could be of special interest to Mr Koh. We currently have do not have a rating on Tuan Sing.

Previous story: TUAN SING Shares Soar 20% On Heavy Volume