Tuan Sing shares have jumped 20% as at 4 pm today on heavy volume following a Business Times report that it is undervalued. We have just discovered a blog article published on Nov 2 by an investor 'hyom' and have received his kind permission to reproduce it here.

TUAN SING is a straightforward case study of an asset play which is composed of easy-to-value and hard-to-defraud assets.

As of 29 Oct 2010 (when the stock price was 24.5 cents), it has a market capitalization of SGD281m. After divesting one of its investment properties (Kallang Mall), it has a massive cash hoard of SGD207m which is >70% of the market capitalization. This cash cushion allows one to sleep well even if the 2008 credit crisis returns.

On top of this cushion, its crown jewels are investment properties like Robinson Towers, International Factors Building which are worth SGD261.65m. These properties are in Singapore. You can physically see and touch these assets. There is no room for fraud.

Its subsidiaries consist of companies like Gultech and SP Corp which are listed on the Singapore exchange. You can obtain the asset values of these listed companies on a real-time basis.

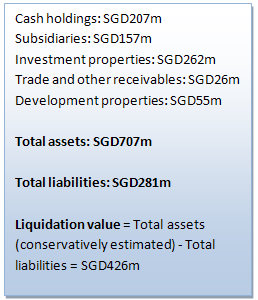

Below is a breakdown of the assets backing this company worth SGD281m. Assets like inventories, intangibles, plant and equipment whose value will be deeply marked down in the event of liquidation are ignored (assigned a value of zero).

To provide for a comfortable margin of error, we shall halve the value of assets whose values cannot be ascertained with comfortable certainty like cash and marketable securities. This is the reason why certain asset values will look significantly lesser than what is stated on the latest balance sheet (2010Q3).

The market cap of SGD281m is only 48.6% of the conservatively estimated liquidation value. This is adequate margin of safety for a risk-averse investor like me.

For a good asset play, the assets alone should already provide adequate backing for the price you are paying. Therefore, as long as there are no future losses, it is okay for the asset play to have no future profits.

Zero profit growth will not endanger the margin of safety. Any profit growth is viewed as a desirable bonus.

Tuan Sing's profit growth in 2009 and 1st 9 months of 2010 are a big bonus. Its profit in 2009 was more than 16 times higher than in 2008 (which was actually an indication of how bad 2008 was, not how good 2009 was). 2009 earnings were good enough to reduce the PE ratio down to only 6.1.

For the first 9 months of 2010, profit grew 53% compared to same period in the previous year. Last quarter earnings were disappointing. Again, earnings growth is not a major consideration for asset plays. Of course, profits are always good to have.

Dissenting views are most welcome.

Think Hiap Hoe & Roxy Pacific