Main reference: Story in Sinafinance

JUST BEFORE THE global financial system went berserk, one lucky Chinese female investor turned her 150,000 yuan original capital into three quarters of a million.

China Unicom was an early pick for one female investor. Photo: china.comHer success story is both instructive and inspirational, and her trials, trubulations and triumphs still ring true for today's post-Crisis investing environment.

China Unicom was an early pick for one female investor. Photo: china.comHer success story is both instructive and inspirational, and her trials, trubulations and triumphs still ring true for today's post-Crisis investing environment.

She has finally revealed her investment secrets to Sinafinance.

She began playing the market in August of 2006, and within the space of a year had quintupled her money.

She said that despite the favorable outcome, there was plenty of anxiety and anguished decision making going on which made it impossible to sit back and enjoy it at the time.

Her most positive takeaway from her own personal bull run was not so much the money itself, but the knowledge, experience and sense of accomplishment the winning streak gave her.

She certainly wasn’t alone with her bounty at the time as she entered the market with the benchmark Shanghai Composite at 1,650 points.

A year later, when she tallied her winnings, the Index had jumped three-fold.

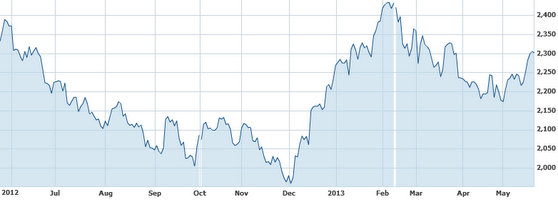

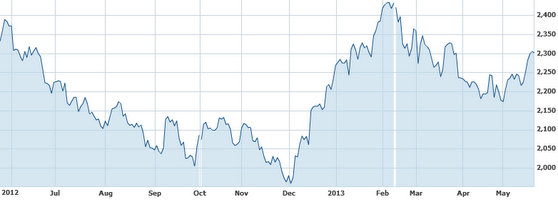

For reference’s sake, the Shanghai Composite – now nearly five years on – is currently trading at around 2,293.

“At first, I was simply led along by brand recognition, buying into China Unicom (SHA: 600050), Kweichow Moutai (SHA: 600519), Tsingtao Brewery (SHA: 600600), and I thought that as long as their buy-in price was cheap, these big names would never let me down,” she said.

But after a few initial disappointments, she began putting P/E ratios at the top of her priority list for choosing new stocks.

“I remember I bought 20,000 yuan worth of shares in China Unicom and Tsingtao, and after netting another 1,000 yuan within a couple days, I jumped ship at the first sign of trouble.

“I know it was rather panicky behavior, but I still had an extra thousand in my pocket that I hadn’t the week previous, and I recall that I felt like a seasoned trader.”

Tsingtao Brewery was also an early pick for our featured investor. Photo: CompanyShe said her first few months were characterized by obsessive share price watching and constantly jumping from one stock to another to catch any upward momentum.

Tsingtao Brewery was also an early pick for our featured investor. Photo: CompanyShe said her first few months were characterized by obsessive share price watching and constantly jumping from one stock to another to catch any upward momentum.

“It was quite a rollercoaster ride and I must have been heavily invested in no fewer than 30 different stocks in just a couple months.”

She said that her fickle and frantic share trading behavior came back to bite her.

“I soon realized that my constant switching and cashing out was causing my transaction fees to significantly eat into my potential capital gains.

“Also, I was relying more and more on market rumors and ‘tips’ from fellow investors or self-proclaimed ‘experts’ in dictating my buying and selling behavior while suspending all along most of my better personal judgement.”

She also came to realize that while the bulk of stocks were rising at the time, there was a big gap between the fast risers and the gradual gainers.

“I knew it was critical to be able to tell the difference between the two, but I had no way of reliably decoding the signals.

"There was still too little data and research available to the public that might shed more light on which plays might double in a decade and which might do so in a fortnight.”

After all was said and done, she decided to loosen her grip on her portfolio a bit, diversify into more sectors as a hedging scheme, and pay more attention to recent EPS history and overall financial potential.

“These became my new benchmarks for buying opportunities rather than simply brand name cache, P/Es or market rumors.”

She also paid more attention to which sector themes were on the rise, which weren’t, and the overall interest individual counters were paid by institutional investors.

Astute research, intuition and a little luck paid off in the end.

“Ultimately, I settled on an even 100 stock picks in my portfolio. As luck would have it, I was heavily bought into non-ferrous stocks, and we all know how prices for these commodities soared in the two years prior to the 2008 global financial crisis.”

Two stock picks in particular stood out for her as representative of her good and not so good fortunes at the time.

Recent China shares performance. Source: Yahoo Finance

Recent China shares performance. Source: Yahoo Finance

She bought into Jiaozuo Wanfang Aluminum (SZA: 000612) and Sunvim Group (SZA: 002083) at 9.3 yuan and 9.0 yuan, respectively.

“Both stocks immediately began rising and I stood by them, knowing how important aluminum was in China’s construction and auto boom at the time, while also confident of continued strong state support for the solar sector.

“They seemed so promising that I nearly emptied out my bank account and bought another 130,000 shares in the two counters at 10.2 yuan and 10.5 yuan, respectively.”

By end-October 2007, Wanfang Aluminum had soared to nearly 70 yuan while Sunvim was more or less unchanged a year later on rampant overcapacity in the industry, raw material price volatility and growing global trade friction in the solar sector.

This just proved to her that all the homework and due diligence in the world cannot foresee every single future possibility.

“Ever since then, I have been a big stickler for portfolio diversification,” she said.

She said she decided to cash out from all her shares when her portfolio increased to a satisfactory level.

“Don’t believe everything you hear, whether through brokerage reports or whisperings heard on trading floors or coffee shops.

“Establish your own guidelines, set acceptable losses and benchmark stock-buying requirements, and simply stick with them,” she advised.

See also:

Young Woman Billionaire Takes Helm At A-Share Firm

China Unicom was an early pick for one female investor. Photo: china.comHer success story is both instructive and inspirational, and her trials, trubulations and triumphs still ring true for today's post-Crisis investing environment.

China Unicom was an early pick for one female investor. Photo: china.comHer success story is both instructive and inspirational, and her trials, trubulations and triumphs still ring true for today's post-Crisis investing environment. Tsingtao Brewery was also an early pick for our featured investor. Photo: CompanyShe said her first few months were characterized by obsessive share price watching and constantly jumping from one stock to another to catch any upward momentum.

Tsingtao Brewery was also an early pick for our featured investor. Photo: CompanyShe said her first few months were characterized by obsessive share price watching and constantly jumping from one stock to another to catch any upward momentum. Recent China shares performance. Source: Yahoo Finance

Recent China shares performance. Source: Yahoo Finance NextInsight

a hub for serious investors

NextInsight

a hub for serious investors