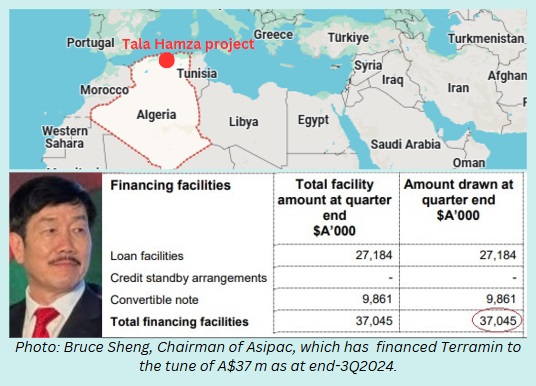

| Terramin Australia is a mining company doing something pretty different from the usual. While most pre-production companies in the mining industry keep asking their shareholders for more money, ASX-listed Terramin has a special backer in Asipac, the controlling shareholder. Asipac has been pouring money into Terramin -- about A$37 million in total as at end-3Q2024 -- without Terramin making other shareholders' shares worth less by issuing new shares to Asipac. Asipac, which has interests in property investments too, has proven to be a robust financier for the company by extending and re-extending the maturity dates of its various finance facilities, as we learnt from a meeting with Terramin management on a roadshow in Singapore this week. Terramin has had no significant operating revenue from which to repay Asipac.  Asipac's financial support has been crucial for Terramin's big project in Algeria called Tala Hamza, one of the world's largest undeveloped zinc mine. Asipac's chairman is Bruce Feng, who is also Terramin's long-time executive chairman. He was formerly the Vice Chair of the Australia China Business Council (Victoria). |

Asipac's financing contribution and leadership have finally led to a pivotal moment for Terramin after years of exploration and discovery: Construction has begun for Terramin's zinc mine.

This follows recent milestones like the EPC contract with Sinosteel, and the Algerian government acquiring the land for the project.

The project is owned by Western Mediterranean Zinc Spa, a joint venture vehicle in which Terramin holds a 49% shareholding with the remaining 51% held by two Algerian government-owned companies.

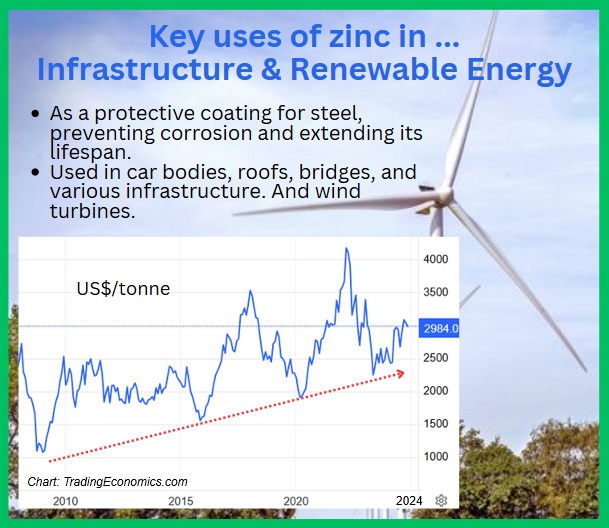

Zinc Price Trend and Use Cases

The price of zinc has been volatile, with a dip earlier in the year to around US$2,300 per tonne, followed by a rebound to near US$3,000 per tonne of late.

This price movement is attributed to mine closures and increased costs in the mining sector.

At US$3,000 for zinc, and US$2,000 for lead (a secondary product), Terramin's zinc-lead project has a Net Present Value of about US$740 million post-tax.

This is more than double the NPV of US$303 million estimated in a Definitive Feasibility Study in 2018.

The US$740 million NPV is based on, among other things, 2.0 million tonnes per annum of ore extraction (much higher than the earlier estimate of 1.3 mtpa) and a new assumed zinc price of US$3,000 per tonne.

For perspective, the market cap of Terramin (stock price: A$0.10) currently is about A$210 million, having doubled in the last 4 weeks.

Recent Developments

Sinosteel, a Chinese state-owned enterprise with multiple mining projects in Algeria, has agreed to finance the initial 18 months of construction for the Tala Hamza project, providing crucial cashflow for the initial phase of development.

"Zinc is a very robust market that's been around a long, long time. Zinc is easy to sell. You know we could bring it up today and have a contract tomorrow to sell as much as we'd like." -- Terramin CEO Martin Janes |

The entire construction period is expected to be about 30 months.

Sinosteel's commitment is worth approximately US$336 million, which signifies a strong vote of confidence in the project's potential from an international player.

Sinosteel will be paid subsequently when Terramin secures external funding from, potentially, Algerian government-backed banks along with possible equity raising and/or prepayment from an offtaker.

Algerian Government's Contribution

The Algerian government's involvement has been equally crucial. The government has facilitated the acquisition of land necessary for the Tala Hamza project, spending around US$30 million to relocate affected families.

Beyond land acquisition, the government will be providing essential infrastructure like high voltage power lines, water, and even a dedicated berth at the port for Terramin's use.

The government has also extended a 10-year corporate tax break.

These significantly reduce the project's capital expenditure, making it more financially attractive.

| The Big Picture The government's larger goal obviously is to foster growth in the mining sector in the country and diversify its economy away from oil and gas. Its partnership with Terramin positions the latter to not just get the current project into production but to explore further opportunities within Algeria. "Terramin has a very distinct competitive advantage. We believe we're at least 10 years ahead of any other western mining company in Algeria. We have a tremendous relationship now with the Algerians. They want to talk to us about other projects in joint venture with them," says CEO Janes. |