CFO Lim Kai Ching briefing analysts and fund managers on the 3Q results at Uni-Asia's office in Shenton Way. Photo by Leong Chan Teik

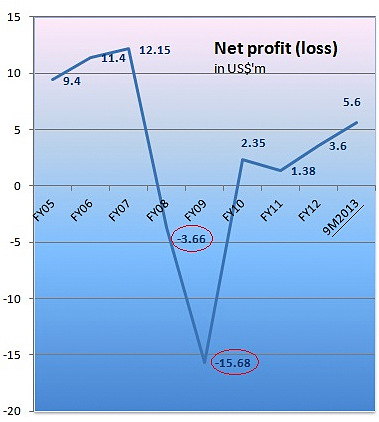

CFO Lim Kai Ching briefing analysts and fund managers on the 3Q results at Uni-Asia's office in Shenton Way. Photo by Leong Chan Teik  In the wake of a shipping slump, Uni-Asia suffered losses in 2008 and 2009 but is now on the mend. Its 9M2013 profit of US$5.6 million was 46% higher y-o-y.UNI-ASIA HOLDINGS' stock (19.1 cents) trades at about 50% discount to its book value -- and it's not an S-chip!

In the wake of a shipping slump, Uni-Asia suffered losses in 2008 and 2009 but is now on the mend. Its 9M2013 profit of US$5.6 million was 46% higher y-o-y.UNI-ASIA HOLDINGS' stock (19.1 cents) trades at about 50% discount to its book value -- and it's not an S-chip!At a briefing this week, an analyst asked what the reasons for the discount might be, and Chief Operating Officer Michio Tanamoto ventured that one reason could be its earnings were recovering but they were still far from the levels achieved before the global financial crisis (see chart).

Uni-Asia chalked up US$5.6 million net profit in the first nine months of this year, up 46% y-o-y.

In 3Q, all business segments grew and were profitable.

Non-Consolidated Uni-Asia: This segment's profitability in 3Q was aided by a fair value gain of US$2.1 million on its Hong Kong property investment which was completed in 3Q2013.

This segment bears the burden of the headcount and expenses of the Group's staff who work for the shipping and property business segments in Hong Kong and Singapore.

This segment bears the burden of the headcount and expenses of the Group's staff who work for the shipping and property business segments in Hong Kong and Singapore.

Uni-Asia Shipping: This segment enjoyed higher charter income in 3Q from the addition of a vessel -- the fifth - to its charter fleet in June 2013. There was also a gain from forex hedging.

Uni-Asia Capital (Japan): This segment, which develops small-scale residential properties in Japan and manages property assets there, recorded US$1.2 m in profit in 9M2013 after it booked one-off fees from the disposal of assets under management.

Uni-Asia Capital (Japan): This segment, which develops small-scale residential properties in Japan and manages property assets there, recorded US$1.2 m in profit in 9M2013 after it booked one-off fees from the disposal of assets under management. Uni-Asia Hotels: This segment, which operates hotels in Japan, enjoyed higher occupancy rates (as more tourists flocked to Japan whose currency has been on a downtrend) and better cost control.

It recognised US$486,000 net profit in 9M2013 (compared to a US$603K loss in 9M2012) despite a 26% fall in hotel revenue.

The lower hotel revenue was, as CFO Lim Kai Ching explained, due to a depreciation of the yen vs USD and the end of an onerous hotel operating contract.

By now, it is apparent to readers that Uni-Asia is made up of many business parts -- which is also a reason ventured by the Group's COO for the market according its stock a sharp discount to Uni-Asia's book value.

However, Uni-Asia has no plans to divest any part and reiterates its growth strategy of expanding its ship charter fleet and developing properties in Japan.

In particular, its income from the ship sector is set to grow further as Uni-Asia positions itself for a continued recovery of ship values and charter rates.

It has placed orders for 3 bulk carriers: one will be delivered in each of the next 3 years, expanding its charter fleet from 5 to 8.

Since Dec 2012, the Group's ship portfolio has grown from 16 vessels to 22 vessels now. These 22 are wholly-owned/majority-owned vessels, joint investment vessels, and vessels held under a shipping fund.

Of these 22, 16 are chartered out and 6 are under construction.

Uni Challenge is one of the dry bulk vessels owned by a joint venture which Uni-Asia Holdings is part of. Photo: http://www.shipspotting.com

Uni Challenge is one of the dry bulk vessels owned by a joint venture which Uni-Asia Holdings is part of. Photo: http://www.shipspotting.comTo a question on the duration of their charters, COO Tanamoto said 5 vessels are on 10-year charters, 2 MR product tankers are on 3-5 year charters, 5 bulk carriers are on 3-5 year charters and the remaining 4 bulk carriers, one-year charters.

One of Uni-Asia’s founders and its chief operating officer, Michio Tanamoto (left), with Jackson Yeow, an analyst at boutique fund 8 Investment. Photo by Leong Chan Teik Of the 6 vessels being built, 4 have secured charterers on 3-7 year charters.

One of Uni-Asia’s founders and its chief operating officer, Michio Tanamoto (left), with Jackson Yeow, an analyst at boutique fund 8 Investment. Photo by Leong Chan Teik Of the 6 vessels being built, 4 have secured charterers on 3-7 year charters."We placed orders for the 6 vessels in the first half of this year when prices were lowest. I think we got the cheapest prices, and our charter hires can give us a good profit," said Mr Tanamoto. " In the second half, vessel prices showed signs of recovery."

Typically, Uni-Asia uses 30% equity and 70% borrowings to finance the purchase of vessels.

Of the 6 newbuild vessels, 3 will be fully-owned and the remainder owned as minority interests in joint ventures.

Uni-Asia considers it a key move that it made in August 2013, which was recently approved by Chinese regulators, to acquire 51% of Wealth Ocean Ship Managment Co.

"With this acquisition, the Group's ability to offer an array of integrated ship-related services is greatly enhanced," said CFO Lim Kai Ching.

Previous stories: