Excerpts from Lim & Tan Securities report

| Investment Thesis: |

| Attractively valued at 0.4x P/B… At S$0.94, Uni-Asia is trading at just 0.39x P/B (Net asset value as of 30 June 2022: US$1.82 or S$2.42/share), with its balance sheet backed predominantly by hard assets including property, plant and equipment (“PPE”) - which is made up mainly of the Group’s shipping vessels), investments and investment properties and cash. |

… with an even more undervalued book? According to Clarksons January report, the price of a 10-year-old 32k handysize carrier nearly doubled from US$8.3m in 2020 to US$16m in 2022 due to the surge in charter rates in the dry bulk carrier market.

| PPE valued at $2.23/share |

| The Group’s vessels are held at cost, and as of 30 June 2022, the Group’s PPE (where the value of the Group’s wholly owned shipping vessels formed almost 100% of its PPE) was US$131.5m (or S$174.9m or S$2.23/share). |

Despite the recent weakness in the dry bulk carrier market, the value of handsize carriers had remained steady due to the tight supply for the vessels.

The Group’s vessels are held at cost, and as of 30 June 2022, the Group’s PPE (where the value of the Group’s wholly owned shipping vessels formed almost 100% of its PPE) was US$131.5m (or S$174.9m or S$2.23/share).

If we just assume a 50% discount to the potential fair value premium of the vessels, it will still suggest the Group’s net asset value may be understated by as much as 46%.

In its AR2021, the Group had mentioned that it has been monitoring the market for opportunity to realise disposal gain for its smaller 28k DWT ships, which could act as potential catalysts, should the Group decide to sell some of its older vessels.

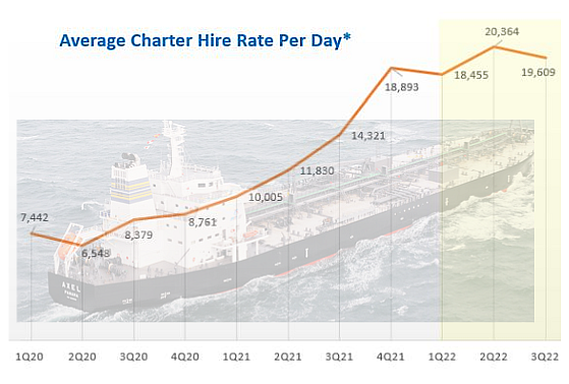

| Still on track for a record 2022? Uni-Asia reported a more than 120% jump in net profit in 1H2022 to US$16.5m, thanks to a surge in charter income which benefitted from a robust dry bulk market. While the dry bulk market started to decline in 2H2022, we believe Uni-Asia may have a more resilient performance in the short term, thanks to the Group’s risk management strategy. According to its 2021 annual report, the Group mentioned it tends to fix shorter charter period with rates closer to spot rates for its 28K DWT ships, while for its bigger 37k DWT ships, it tends to fix slightly longer-term charters. In its 3Q2022 update, the Group’s average charter rate was down just 3.7% from the high of US$20,364/day in 2Q2022. |

* 10 wholly-owned handysize dry bulkships

* 10 wholly-owned handysize dry bulkships

Steady dividend compounder. Uni-Asia has been consistently paying dividends since 2012, and during bumper years, the Group has also shared its fruits of its success with shareholders through an increase in dividends.

In 1H2022, in line with the surge in profit, Uni-Asia declared its highest interim dividend since inception of S$0.065.

Prior to COVID-19, Uni-Asia has generated US$15-36m/year of free cashflow (or S$0.35-0.82/share) from 2018-2019.

While the Group’s 2H2022 performance may be affected by the decline in charter rates in the dry bulk market, Uni-Asia’s strong cashflow generation and low net debt position (US$31m in 1H2022), suggests that they have more than enough cashflow to continue paring down debt while paying (or even increase dividend). (Not to mention the lower finance expenses now vs pre-COVID with the lower gross debt position).

Full report here.

See also: UNI-ASIA: Charter rates surprisingly strong in 3Q. Why? Will they stay that way?