Excerpts from this morning's analyst reports....

OSK-DMG initiates coverage of MTQ with $1.66 target

Analyst: Lee Yue Jer

We initiate coverage with a Buy rating and TP of S$1.66. MTQ’s core business of oilfield equipment servicing is booming due to the high rig utilisation worldwide, yet this gem has gone completely unnoticed by the market – it is trading at only 5.6x FY13F EPS compared to peers at 6-19x.

This sharp undervaluation may be the result of low liquidity, which is not a fundamental worry. All the indicators (profitability, balance sheet, cash-flow, valuations) are positive, and the step-up to another record-high core profit should be the catalyst to a revaluation.

20% ROE. Strong cash generator. 4.3% yield and rising. MTQ has been steadily profitable through the GFC, and earnings are now jumping to a new level. The company generates strong operating cash flows with modest capex requirements. Dividends have increased from 2¢ in 2008 to 4¢ in 2012. We expect the dividend to be raised to 5¢ this year on the back of record earnings.

Acquiring Australian subsea player. MTQ has made a takeover offer for Neptune Marine Services at a 33% discount to NAV, effectively writing down almost all the intangibles left on Neptune’s books. Having flushed almost all the goodwill from its books over the last two years, Neptune is at the cusp of a turnaround. It is a cheap entry-point for MTQ into the subsea segment which is experiencing an upswing as a result of increased offshore oil & gas activity. As of today, MTQ owns 80% of Neptune.

Oil & gas play at 5.6x FY13F P/E. The current business is available at a steep discount, and should Neptune begin delivering normal returns, this multiple drops below 4.5x. Peers in the oil & gas industry, with similar margins, trade at 11.5x on average.

Valuation: TP $1.66 backed by DCF-value of $2.00. We value MTQ at 8x FY13F EPS, at the low end of peers’ multiples due to its small size. We have assumed breakeven profits in Neptune until further clarity emerges, and this provides a large upside potential to estimates. The strong cash flow of the MTQ business plus Neptune yields a DCF-value of $2.00 at 11.5% WACC. While liquidity is a concern, nimbler investors can still purchase this stock today at a massive discount.

Recent stories:

MTQ CORP: Why take over Neptune? How's Bahrain business doing?

MENCAST, MTQ, TECHNICS OIL & GAS: Subsea contractors growing strong

UOB KH expects more earnings growth from Sino Grandness, raises TP to 91 cents

Analyst: Brandon Ng, CFA

Photo: Company

We expect forward earnings growth in 2013 to propel share price further. The canned food segment is expected to register a 15.7% growth in revenue for 2013 by securing new customers and introducing new products with higher margins, while the revenue of its beverage segment under Garden Fresh (GF) is set to jump 60% to Rmb1.4b with its new enlarged capacity.

The group can also enjoy the earnings expansion of its new distribution networks such as the 600 7-Eleven convenience stalls in Guangdong province secured in 2012. All in all, we forecast SGF to report a yoy revenue and net profit growth of 39.0% and 27.3% in 2013, respectively.

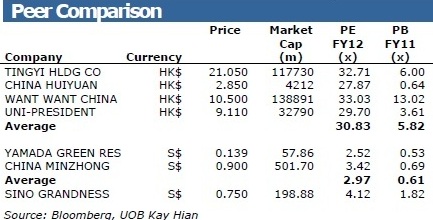

• Undemanding valuation with positive rerating catalyst in 2013-14. SGF is trading at 3.7x 2012F PE (year ended Dec 12), a fraction of the average valuations of 30.8x 2012F PE commanded by its Hong Kong-listed fast-moving consumer goods (FMCG) peers.

As SGF is also looking to do a separate listing for GF in 2014, this would be a positive rerating catalyst for the group. We note the potential upside of S$1.28/share if the listing comes through, assuming a holding company discount of 20% to SGF’s GF stake and a 4.5x 2014F PE valuation for its remaining business.

Recent stories:

DMX, SINO GRANDNESS, BIOSENSORS: More than 50% upside?

SINO GRANDNESS – potential spin-off in the making