Translated by Andrew Vanburen from a Chinese-language piece in Sinafinance

CHINA'S SUMMER HAS been getting cooler and cooler.

At least as far as share prices are concerned.

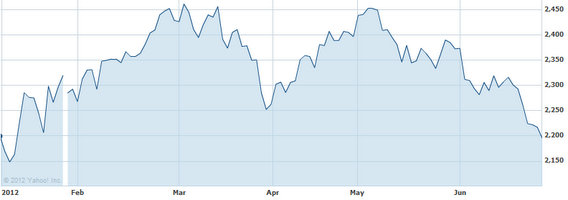

A double-digit decline for PRC shares since May has investors spooked.

Here is what four brokerages have to say about the fall as well as chances for a recovery.

China Merchants Securities said that Shenzhen-listed shares have been overperforming this week while Shanghai-listed peers have been doing the opposite, resulting in a hamstringed performance for the benchmark Shanghai Composite Index.

One bright spot of late is daily trading turnover, which is trending higher and is helping lift listed brokerages.

However, the five- and ten-day moving averages for the benchmark index are both virtually flat despite some volatility – a condition likely to carry forward.

The 2,150 mark is considered a support level over the near term, and for the ten-day moving average going forward.

However, if this two-week tracker is breeched for any appreciable period, 2,250 could be a near-term possibility.

The house recommends investors stay focused like a laser beam on macroeconomic data coming out this week and next, including fallout from Friday’s 2Q GDP figures.

More importantly, shareholders should pay close attention to any possible moves from Beijing over the weekend, as surprises on the downside for major macroeconomic data often precipitate a reflexive adjustment after market close on Friday.

Citic Futures said it too recommends investors to await moves from Beijing following the slew of economic data due out near term.

It expects possible economic adjustment from the capital after China announced its second quarter GDP grew by 7.6% year-on-year, its slowest three-month pace in three years and slightly below Citic Futures’ forecast of 7.8%.

“Given the two market downturns so far this year and the very aggressive move by Beijing to implement two interest rate cuts in the space of a month, we think the government is definitely leaning towards a more proactive ‘growth-friendly’ set of policies,” the research house said.

In addition, business leaders have been calling for a more comprehensive range of measures to help all sectors, leading Citic Futures to believe that Beijing may have even more pro-growth policies up its sleeve.

Shenyin Wanguo said that reports of accelerating loan growth by banks and a looser than expected monetary policy have sent a charge of confidence through China’s capital markets.

Like other research houses, it too recommended that investors pay close attention to Friday’s GDP growth figures and industrial output data as well as a raft of other macroeconomic results due out soon.

The outlook is trending toward an improvement in liquidity given the easing credit environment.

“There is still the near-term possibility of a drastic fall and corresponding strong bounceback, so investors need to remain highly vigilant,” Shenyin said.

Tebon Securities said that market sentiment remains very cautious, and warned against betting on any near-term significant rebounds.

“Economic officials have now been discussing prospects for three straight days, and the likelihood that policymakers will put stable growth as their top priority rather than controlling inflation or ‘hot’ sectors is becoming increasingly likely.

“This can only be good news for the equities market,” the research house said.

Tebon added that it believed the benchmark index was overdue for a rebound, but that it might be smaller than investors are hoping for.

“Foods and beverages as well as pharmaceuticals have been steadily rising, but engineering, machinery, construction materials and railway stocks have fallen out of favor, all suggesting the skittish and nervous sentiment prevailing in the market.

“We still advise extreme caution for near-term investing.”

See also:

What’s Depressing P/Es In China?

DAMAGE CONTROL: Retail Investors Losing Confidence In PRC Mkt?

TOUGH SELL? China Bears May Be Packing Bags

MARKET MAYHEM: Making Sense Of China Shares