Lum Chang's new 9-storey HQ in Kung Chong Road, in the Leng Kee area. Photo: Company

Lum Chang's new 9-storey HQ in Kung Chong Road, in the Leng Kee area. Photo: CompanySINCE EARLY this year, Lum Chang Holdings staff have moved into the company's own new building in Kung Chong Road, in the motor dealers' hub of Leng Kee.

On the 8th floor, the bust of founder Lum Chang stands proudly in the reception area -- a reminder to visitors of the long history of the company.

Lum Chang founded the company about 7 decades ago.

Lum Chang founded the company about 7 decades ago. Photo: Leong Chan TeikStarted sometime in the 1940s, it has become a leading construction firm listed on the Singapore Exchange.

Its portfolio of projects since 1970 is valued at over S$8 billion and includes iconic buildings of Singapore, such as the National University of Singapore, the National Library, Paragon, UOB Plaza 1 and City Hall MRT station.

Not surprisingly, such an established company (which has about 12,500 shareholders) lives by a steady and conservative approach to business and dealings.

For example, where it directly matters to minority shareholders, that translates into steady dividends.

For the fourth consecutive year now, Lum Chang has held it at 2 cents a share a year (assuming the final dividend proposed is approved by shareholders at the upcoming AGM this week).

In our meeting last week, executive director Tony Fong affirmed that the dividend would stay at that level, barring unforseen circumstances. "It's a level we are comfortable with," he said.

"We are a steady company, producing steady profits and steady dividends. We have potential to grow but we are very careful.

"At the same time, we are always looking for new businesses that can complement our core businesses. The idea is to diversify and to get more regular income."

Here are other key takeaways from our meeting:

1. Orderbook: It stood at $474 million as at end-June. Is this a cause for concern?

Just one financial year ago, at end-June 2012, the orderbook stood at S$946 million. Then it halved, as a number of big projects were recognised which led to the revenue for the FY ended June 2013 to jump 75% to $494.6 million.

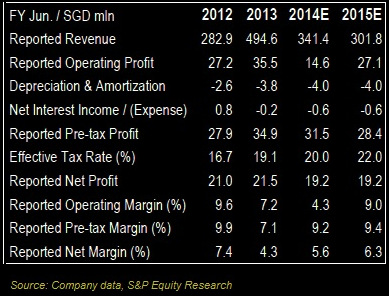

This high level of revenue won't be repeated in the forseeable future, though. (See Standard & Poor's forecast in the table below)

In the past two years, when the orderbook was massive, Lum Chang had been conservative in tendering for work. In the last 6 months or so, it looked hard for deals.

Still, it had to be careful because labour supply has tightened and worker levies are higher, he said. And with construction projects being bountiful, attempts to poach Lum Chang's personnel by rival contractors are not uncommon.

Lum Chang submitted a bid for work on the Thomson MRT Line but was not successful as competitors were prepared to take a chance on lower profit margins.

Lum Chang currently is about two-thirds done on an existing MRT project -- the construction, design and build works of the $504.5 million Bukit Panjang station on the Downtown Line 2.

The remaining one-third of the project will be completed by the end FY2015.

Subsequent to our meeting, Lum Chang announced on 25 Oct that it had won a $178.6-million contract to build a condominium, The Glades, in Bedok Rise. This bumps up its outstanding order book to $566.4 million.

2. Overseas: If Singapore market faces constraints, how about overseas opportunities?

Lum Chang stock closed last week at 35 cents, up 12.9% since the start of the year. Its trailing PE is 6X and dividend yield is 5.7%.

Lum Chang stock closed last week at 35 cents, up 12.9% since the start of the year. Its trailing PE is 6X and dividend yield is 5.7%. Chart: BloombergMr Fong said Lum Chang has ongoing property development projects in Malaysia but it would not likely enter into construction sector.

Reason: Construction projects are of relatively lower margins in the first place and would not be able to support a team of relatively high-cost Singapore managers over the duration of a project.

3. Property investments

To smoothen out the lumpiness of Lum Chang's construction projects, the company invested in a London property - Old Court House along Kensington High Street -- for £40.19 million.

It will earn an income of S$3.4 million a year, which is a yield of 4.5%, according to a UOB Kay Hian report. Its tenants are global brands such as Zara and Uniglo, occupying large floor areas of about 10,000 sq ft each.

Rentals will be up for revision starting from 2015. Meanwhile, the capital value of the property is rising, said Mr Fong.

"London still offers opportunities, and we know our way around there. Our sister company, LC Development, has been there for some 20 years, running Crowne Plaza hotel. Our group MD, David Lum, is also executive chairman of LC Development and is familiar with the scene there," said Mr Fong.

In Singapore, there is rental income from its new HQ. Two levels with a total floor area of about 20,000 sq ft will soon be rented. The rental income has not been disclosed.

L-R: Independent Director Kenneth MacLennan, Independent Director Dr Willie Lee, Executive Chairman Raymond Lum, Executive Director Tony Fong, MD David Lum, Independent Director Peter Sim, Independent Director Daniel Soh. Photo: annual report

L-R: Independent Director Kenneth MacLennan, Independent Director Dr Willie Lee, Executive Chairman Raymond Lum, Executive Director Tony Fong, MD David Lum, Independent Director Peter Sim, Independent Director Daniel Soh. Photo: annual report4. Property revenue recognition

S&P Equity Research's report dated Sept 2 forecasts steady profit in FY2014 and 2015.Lum Chang has a 20% stake in a joint venture that developed Esparina Residences executive condominium in Punggol. The project has been completely sold and achieved TOP in 3Q of this calendar year.

S&P Equity Research's report dated Sept 2 forecasts steady profit in FY2014 and 2015.Lum Chang has a 20% stake in a joint venture that developed Esparina Residences executive condominium in Punggol. The project has been completely sold and achieved TOP in 3Q of this calendar year.The bulk of the profit attributable to Lum Chang will be recognised in its 1QFY2014 results to be announced on Nov 7, said Mr Fong.

It's not quite 100% recognition as a small amount will be recognised in the next quarter or beyond, depending on when the keys to the condo units are handed over to the owners. In addition, a small number of buyers has defaulted on their purchase.

In Malaysia, Lum Chang has 2 private property development projects, which are released in phases. In Lum Chang's books, the revenue and profit for the phases are recognised only on completion.

Mr Fong said little would be recognised in the current FY. The rest of the financials are expected to be reflected in the books in FY15 and FY16, assuming all the housing units are sold.

Related stories: