| Industry players are saying this is a high moment in their business. The industry in question is the offshore supply vessel (OSV) market.

|

Among the Singapore listcos in this space are ....

| • Marco Polo Marine: Its stock price has surged ~230% since the start of 2021 (from 1.8 cents to 5.9 cents). • Atlantic Navigation: Its performance has been a stunning ~1170% in the same period (from 2.8 cents to 35.5 cents). • Nam Cheong: Coming out of a 4-year trading suspension in March 2024, its stock price has been bogged down by the disposal of shares by major creditor RHB Bank. |

Another player, Pacific Radiance, unfortunately had to sell 33 vessels for US$200 million to pay off a chunk of debt as part of a restructuring deal concluded in 2022.

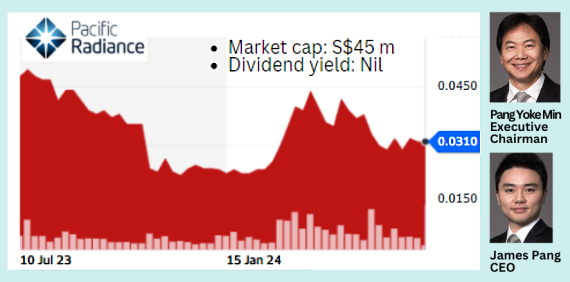

That paved the way for Pacific Radiance to emerge from a 4-year trading suspension in Sept 2022. Its stock performance has been muted, though, for reasons described below. Stock has been range-bound, recently trading at 3.1 cents for a market cap of S$45 million.

Stock has been range-bound, recently trading at 3.1 cents for a market cap of S$45 million.

The buyer of its vessels, E-NAV Offshore, a Mexican offshore company, appointed Pacific Radiance as ship manager for the majority of the acquired vessels via management contracts.

For FY2023, Pacific Radiance's revenue of US$31.4 million and gross profit of US$12.5 million were derived from ship management and shipyard activities.

The bottomline was US$14.5 million, boosted by non-cash writebacks of US$12.5 million.

Recognising the recovery of the oil & gas sector, Pacific Radiance wasn't going to be missing out on the opportunities for vessel owners.

It raised S$22.8 million in a rights issue in Feb 2024, applying some of the cash to activate or acquire vessels.

As a result, its fleet currently numbers five fully-owned vessels and two under joint ownership, and is expected to grow further using borrowings.

The charter income from the current 7 will become more evident from 2H2024 while ship management income will be stable and recurring (but slow to scale up).

CEO James Pang, in a webinar organised by Phillip Securities on 11 July 2024, pointed out that there is high demand for OSVs currently because oil companies are increasing their exploration and production spending.

Mr Pang highlighted the acute shortage of OSVs:

| • About one-third of the existing supply is either stacked and unrecoverable (because of unattractive economics for reactivation of old vessles) or has been scrapped. • 60-70% of offshore operators in Singapore have gone bankrupt and liquidated during the years when oil prices slumped. • Globally, more than 50% of operators have been bankrupted and liquidated. |

New supply is very limited because:

• New building prices have increased significantly.

• Construction times have increased to over 3 years for new vessels. • Shipyards are busy with orders from other shipping sectors like containers and tankers. |

SourceMeanwhile, oil companies are increasing their exploration and production spending, driving demand for OSVs.

SourceMeanwhile, oil companies are increasing their exploration and production spending, driving demand for OSVs.

To try to alleviate the supply situation, some oil majors, like Shell, are offering long-term contracts (10-15 years) to incentivize shipowners to build new vessels.

The order book for new OSVs is at a historic low, only about 2% of the existing fleet, compared to a historical average of 20-25%, said Mr Pang.

"We think this is going to be the start of a multi-year boom that will last at least three to four years because there's virtually no new supply in the next three to four years. As a result, day rates across the markets, across the asset classes, you see a very drastic U shape."