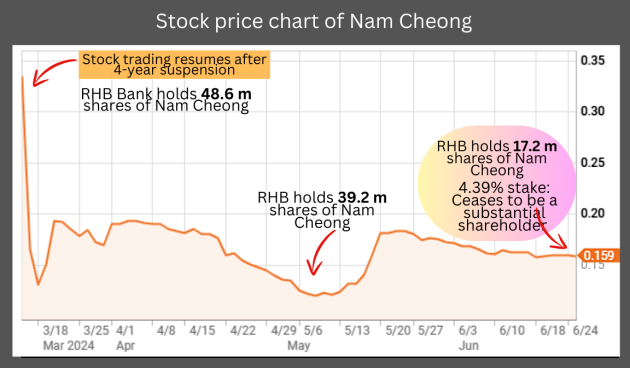

| Nam Cheong's stock chart looks weighed down. There's one big weight indeed: It's the consistent selling by RHB Bank. In March 2024, RHB was issued a large number of Nam Cheong shares as part of a debt restructuring agreement between Nam Cheong and its creditors. RHB was the largest creditor, and has been selling Nam Cheong stock since the trading suspension was lifted in March 2024. Why sell? Certainly not because Nam Cheong's business prospects are dim. Far from it (more below). Likely, it's because RHB views that it's not in the business of holding such shares in anticipation of higher capital gains.  RHB sold 31.4 million shares in 3.5 months. The sales look well-absorbed at above 15.5 cents/share. RHB's got another 17.2 million to go as of 21 June. RHB sold 31.4 million shares in 3.5 months. The sales look well-absorbed at above 15.5 cents/share. RHB's got another 17.2 million to go as of 21 June.Whatever the reason, now it has just arrived at a key milestone: On June 21, it pared its stake to below 5% and is no longer a substantial shareholder. RHB is not required to update the market on any further change in its holding. In all likelihood, it will continue to sell down its Nam Cheong stake to zero. No one knows when it will be done but you can guess that it will not be long. By end-July, perhaps? |

With RHB out of the way, the stock price will have an opportunity to find its level based on fundamentals.

The 2Q results to be released in Aug 2024 will provide greater clarity on how Nam Cheong is doing following a sterling 1Q profit of approximately RM25 million (excluding debt restructuring effects and other one-offs).

The stock price may be affected if some relatively small creditors decide to exit if the stock price gets higher.

Nam Cheong is one of the largest offshore support vessel (OSV) operators in the region with a fleet of 32 vessels supporting oil majors in their offshore activities in Malaysian waters.

Demand for OSVs is strong and supply is limited because vessels are aging and there has been no newbuildings in recent years.

Currently about 230 OSVs operate in Malaysian waters, making it one of the most active markets in Asia. Source.

Source.

Below are excerpts of a Kenanga Research report dated 18 June 2024 where you can read about the booming OSV sector.

The report also highlights Keyfield International, a direct comparable Malaysian peer of Nam Cheong.

From an IPO price of 90 sen in April 2024, Keyfield's stock recently reached RM2.36. It trades at 13X PE (while Nam Cheong likely is depressed at 3X, thanks to the RHB sales):

| Excerpts from Kenanga report |

| We maintain our OVERWEIGHT call on the sector. The sector’s earnings delivery (against our forecasts) in 1QFY24 was comparable sequentially, with most companies beating or meeting our expectations, particularly those in the offshore support vessel (OSV) and midstream segments. We expect the earnings strength for these subsectors to sustain into coming quarters and Brent crude prices to average at USD84/bbl in 2024, a level that is conducive to upstream spending by oil majors. |

KEYFIELD (OP; TP: RM2.69) outperformed expectations despite 1QFY24 being traditionally weak due to the monsoon season.

The sustained boom in daily charter rates (DCR) and decent vessel utilization, supported by dynamic positioning 2 (DP2) capabilities, allowed some vessels to remain operational during the monsoon season.

We expect this trend to continue in the OSV sector, as there are still no signs of overbuilding of new OSV vessels.

"...OSV players (are) already experiencing significant improvements in fundamentals due to a notable rise in DCR (daily charter rates), particularly in the maintenance-focused accommodation work boat category." "...OSV players (are) already experiencing significant improvements in fundamentals due to a notable rise in DCR (daily charter rates), particularly in the maintenance-focused accommodation work boat category." |

We expect Petronas to meet its RM60b capex budget in 2024, with a greater emphasis on upstream investments, particularly in the local market, to address the urgent need for mitigating natural production declines.

In 1QFY24, the group’s capex increased slightly by 2% YoY. However, the share of domestic capex rose significantly, increasing by 20% YoY, indicating the group’s growing focus on the local upstream market.

The shift is beneficial for local upstream service providers, with OSV players already experiencing significant improvements in fundamentals due to a notable rise in DCR, particularly in the maintenance-focused accommodation work boat category.

We believe that as the bull market progresses in the upstream services subsegment, the bullish trend will extend to the anchor handling tug & supply (AHTS) sub-segment, especially for capacity below 5000bhp, as the DCR has yet to reach its all-time highs, which the AWB category has already achieved.

Full report here.