A year ago this month, Nam Cheong Limited was under trading suspension for the 4th year, as it finalised a restructuring deal with its creditors (chart below).

It is doing really well as an industry-wide shortage of OSVs and high demand drive up charter rates -- with no sign of a let-up because any meaningful orders for newbuilds has not materialised. Charter rates are expected to stay way up not only because of a lack of newbuilds but also the existing OSVs are heading closer to their use-by date. It takes 2-3 years to build them. In the first place, it's tough to get bank financing to do it, largely due to ESG reasons. It's a perfect storm (in a good way) for OSV operators. |

Nam Cheong's vessels average 8 years of age, and are far from the 20-year maximum (extended from 15 years in 2022) stipulated in Petronas' tender requirements.

Nam Cheong's vessels average 8 years of age, and are far from the 20-year maximum (extended from 15 years in 2022) stipulated in Petronas' tender requirements.

Takeaways from FY24 results briefing:

CFO Chong Chung Fen said the Malaysian-based company currently owns 37 vessels, with 26 vessels contributing significantly to 2024 revenue.

Four additional vessels have been purchased which will contribute revenue in 2025.

Two more vessels will join the fleet by the end of 2025.

Key FY2024 financial metrics

- Nam Cheong achieved revenue of RM689.4 million from vessel chartering alone, generating a gross profit margin of 53%.

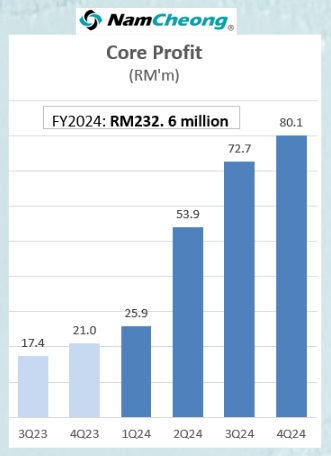

Core profit from vessel chartering came in at RM232.6 million (S$70.2 million). This excludes other income and other expenses (mainly from the debt restructuring) and contributions from joint ventures/associates.

This translates to a historical PE of 3X (based on a market cap of S$208 million at 53 cents stock price).

Unlike PE ratios, EV/EBITDA accounts for debt, and Nam Cheong's EV/EBITDA is about 3X.

These EV/EBITDA and PE figures are relatively low, indicating an undervaluation as its peers on Bursa Malaysia trade at much higher multiples.

The chart below shows the movement of Nam Cheong's share price and some milestones. The stock closed at 53 cents yesterday.

Ref: NAM CHEONG: From Debt Restructuring to Big Profits: This company is a nice turnaround story in 2024

Ref: NAM CHEONG: From Debt Restructuring to Big Profits: This company is a nice turnaround story in 2024

Market Position and Competitive Advantage

- Nam Cheong is the largest OSV provider in Malaysia, benefiting significantly from Petronas' requirements on OSVs. Cabotage rules help Nam Cheong and Malaysian operators get priority for contracts.

- The company's fleet is relatively young, averaging around 8 years compared to competitors' fleets averaging 12-15 years.

Contract Strategy and Profit Margins

- CEO Leong Seng Keat said Nam Cheong targets 70% long-term contracts (typically three years) to ensure stable revenue streams, while retaining 30% of its vessels for spot contracts (30 days to six months) to capture upside in charter rates.

- Long-term contracts help reduce Nam Cheong's costs associated with frequent vessel relocation, downtime between spot contracts, and client-specific pre-hire preparation expenses.

Recently secured long-term contracts worth RM1.22 billion for 12 vessels could be the start of Nam Cheong's move towards its 70% target as potential clients are likely to lock in vessels given the increasingly tight supply.

Core profit from vessel chartering, excluding "other income and other expenses" and contributions from JVs/associates.

Core profit from vessel chartering, excluding "other income and other expenses" and contributions from JVs/associates.

Fleet Expansion vs Debt Repayment

- Nam Cheong had RM135 million in cash at end-2024, after adding vessels strategically while starting to repay its debt (RM458 million as at end-2024), which has an agreed 7-year repayment period.

- Current net gearing is manageable at 0.57 times.

The company continues to evaluate opportunities for further fleet expansion cautiously.

- While primarily focused on oil-and-gas-related work, Nam Cheong sees potential opportunities for its vessels to work in offshore wind farms and subsea cable installations.

These areas will see more activity in future years. - Nam Cheong -- once the N0.2 OSV builder in the world -- retains its shipbuilding capacity at its Sarawak yard (currently underutilized), building small vessels for its own use.

The location is advantageous for repair and maintenace work as it's near where a number of Nam Cheong's vessels are deployed.

|

In a Nutshell

Nam Cheong basically went from being on the verge of collapse to being a major player in a now-booming market.

Overall, Nam Cheong maintains a positive outlook driven by Risks: A sharp and sustained fall in oil prices leading to slower oil & gas production by clients, etc, and higher operating costs. |

See also: The Clock’s Ticking on Aging Fleets of Offshore Support Vessels