• With these wins, Singapore-listed Nam Cheong has 24 out of its 38-vessel fleet (63%) under long-term charters, progressing toward its stated goal of 70% fleet coverage. This provides a stable income base while leaving some vessels available for potentially higher-paying short-term jobs. • Nam Cheong's stock (46.5 cents) trades at a low valuation (see below) -- investors' conservative sentiment could be due to its outstanding debt following an early 2024 debt restructuring. • Sentiment could shift quickly as confidence in the company’s turnaround story grows -- and analyst coverage starts, and Nam Cheong continues to reinvest its strong operating cashflows (2024: RM191 million) into acquiring vessels. Its property, plant and equipment spending was about RM100 million in 2024, mainly due to the acquisition of vessels. |

| Why These Contract Wins Matter |

-

Nam Cheong’s announcements cover three major tranches of long-term contracts:

Contract Value & Date

Vessels

Client/

RegionHow long

RM1.22 billion

(Announced Nov 2024)12 vessels:

- Anchor Handling Tug Supply

- Platform Supply

- Safety Standby

- Landing CraftRegional & int'l oil majors

(mainly Southeast Asia)3 years, starting 2025

RM317.1 million

(Announced Apr 2025)9 vessels:

- 7 Anchor Handling Tug Supply (AHTS)

- 2 others unspecifiedLeading regional oil majors

Operating in Malaysia, ThailandUp to 2 years, with extension options

USD47.5 million

(~RM200.7 million, Announced Jun 2025)3 vessels:

- AHTS

- Fast Crew BoatsEnvironment projects (Middle East)

Offshore wind farm (Japan)

Entry to renewablesUp to 2 years, with extension options

Revenue Visibility: Multi-year contracts lock in predictable cash flows, reducing earnings volatility and supporting long-term planning.

Market Positioning: The deals reinforce Nam Cheong’s reputation for operational excellence and a modern, capable fleet.

Sector Diversification: Expanding into environmental and renewable projects in the Middle East and Japan helps reduce reliance on traditional oil and gas markets and mitigates geographic risks.

CEO Leong Seng Keat: “These contract-wins further strengthen our presence in the OSV chartering market across both offshore sectors and geographies ....

CEO Leong Seng Keat: “These contract-wins further strengthen our presence in the OSV chartering market across both offshore sectors and geographies ....

While Oil and Gas remains a core market for us, we are seeing growing potential in offshore renewables and marine environmental services.

Leveraging a modern and advanced fleet .... Our target of having 70% of the fleet on long-term contracts not only provides earnings stability, but also gives us the flexibility to pursue attractive opportunities ....”

| Non-Disclosure of Charter Rates |

Nam Cheong has not disclosed charter rates for these contracts. This is not uncommon as rates are often commercially sensitive.  Market conditions -- tight vessel supply, especially -- and the company’s relatively young fleet make it plausible that these contracts are being struck at or near current market rates where gross margins hover at 50%, not at steep discounts.

Market conditions -- tight vessel supply, especially -- and the company’s relatively young fleet make it plausible that these contracts are being struck at or near current market rates where gross margins hover at 50%, not at steep discounts.

Additionally, the contracts are with major oil companies and reputable international clients, who typically prioritize reliability and operational excellence over price alone.

Regardless, it is hoped that Nam Cheong in its future announcements could guide investors a little bit by commenting in some way or other on the charter rates for its long-term contracts.

| Stock suspension, then rebound |

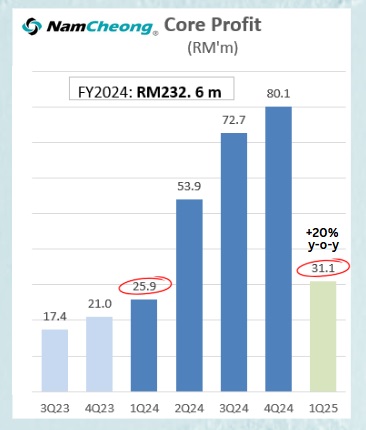

Nam Cheong’s stock, listed on the Singapore Exchange, has rebounded since its trading suspension was lifted in early 2024.  Core profit from vessel chartering, excluding "other income and other expenses" and contributions from JVs/associates.

Core profit from vessel chartering, excluding "other income and other expenses" and contributions from JVs/associates.

Ref: NAM CHEONG'S Offshore Vessels Score 20% Profit Boost in Q1, Set to Be Busier in Q2, Q3 ... Yet, even after positive contract news and a clear uptrend in operating performance, the shares trade at just around 3 times price-to-earnings (P/E) and 3 times enterprise value to EBITDA (EV/EBITDA)—levels well below the broader market and many peers in the offshore support vessel (OSV) sector.

Nam Cheong’s debt situation has improved dramatically, but it seems to be an overhang on investor sentiment.

After restructuring, the company’s debt was slashed from over RM1 billion with a new seven-year repayment plan in place.

As of March 2025, its long-term debt stood at RM404.4 million versus RM125.9 million cash in the bank.

It also had RM35 million in short-term borrowings and RM30 million in financial guarantees.

| Sustaining Nam Cheong’s Strong Metrics |

Securing these contracts is a game-changer for Nam Cheong’s bottom line.

They will sustain the strong metrics of FY2024:

|

Metric |

FY2024 value |

Notes |

|

Gross margin |

53.1% |

35.5% in FY2023 |

|

Operating Cash Flow |

RM190.2 mn |

Up 682% year-on-year |

|

Free Cash Flow |

RM91.9 mn |

|

|

Total Borrowings |

RM458.4 mn |

Down 56% from FY2023 |

|

Net Gearing Ratio |

0.56x |

Improved post-restructuring |

|

Cash |

RM135.1 mn |

|

|

PE Ratio (core earnings) |

~3x |

Peers average ~8x |

Dividends are not expected as the company rebuilds its balance sheet and prioritises repayment of its debt.

All of this is happening against a backdrop of a supply-and-demand squeeze in the OSV market:

|

See also: Petronas’ 5,000-Job Cuts Signal Restructuring, Not OSV Market Slowdown