The stock price of Nam Cheong Limited closed at 48.5 cents on Friday, the highest point since the stock resumed trading in March 2024 after 4 years of suspension (chart below).

It has had a pretty rough time with debt in prior years, culminating in a restructuring agreement with its creditors in early 2024. It is doing really well now as an industry-wide shortage of vessels and high demand drive up charter rates -- with no sign of a let-up because the supply of newbuilds has not taken off. |

The chart below captures the initial impact of large-scale selling of shares issued to creditors in exchange for debt. (See: NAM CHEONG: Will stock re-rate when creditor finishes selling down shares?)

After about 2 months, this was followed by a spike up of the stock as the 1Q result was positive.

It took the 2Q result to reinforce the strong business fundamentals. The stock then took off in a big way.

Ref: NAM CHEONG: From Debt Restructuring to Big Profits: This company is a nice turnaround story in 2024

Ref: NAM CHEONG: From Debt Restructuring to Big Profits: This company is a nice turnaround story in 2024From Debt Mess to Making Bank

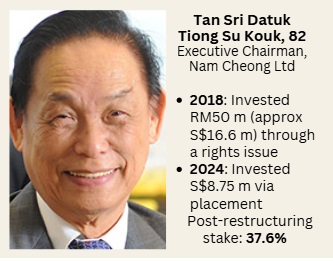

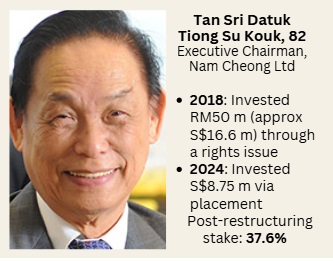

Nam Cheong's creditors forgave half of what Nam Cheong owed, and the big boss at Nam Cheong, Tan Sri Datuk Tiong Su Kouk, chipped in a load of his own money to keep things afloat.

Ref: NAM CHEONG: This man's large cash contribution was decisive in his company's survival. Now business is boomingThey now have a 7 year repayment plan.

Ref: NAM CHEONG: This man's large cash contribution was decisive in his company's survival. Now business is boomingThey now have a 7 year repayment plan.

They managed to bring their debt down from a whopping RM1 billion to RM454 million by the end of Q3 of 2024.

Nam Cheong's creditors forgave half of what Nam Cheong owed, and the big boss at Nam Cheong, Tan Sri Datuk Tiong Su Kouk, chipped in a load of his own money to keep things afloat.

Ref: NAM CHEONG: This man's large cash contribution was decisive in his company's survival. Now business is boomingThey now have a 7 year repayment plan.

Ref: NAM CHEONG: This man's large cash contribution was decisive in his company's survival. Now business is boomingThey now have a 7 year repayment plan.They managed to bring their debt down from a whopping RM1 billion to RM454 million by the end of Q3 of 2024.

The Perfect Storm (in a Good Way)

Things have really turned around because the whole OSV market, not just Southeasia but worldwide, is booming:

• Loads of Demand: Everyone's scrambling for offshore energy, so there's huge demand for vessels that can carry workers and supplies to oil and gas rigs.

There's talk of billions being invested in offshore gas projects in Southeast Asia.

• Not Enough Boats: The supply of new vessels is super tight. It takes 2-3 years to build them, and it's tough to get bank financing to do it, largely due to ESG reasons.

There has been very little investment in new vessels for years, and many older ones are heading closer to their use-by date.

• Local Advantage: Nam Cheong has an edge because they're a local Malaysian operator. Cabotage laws in Malaysia mean they get priority for contracts.

• Loads of Demand: Everyone's scrambling for offshore energy, so there's huge demand for vessels that can carry workers and supplies to oil and gas rigs.

There's talk of billions being invested in offshore gas projects in Southeast Asia.

• Not Enough Boats: The supply of new vessels is super tight. It takes 2-3 years to build them, and it's tough to get bank financing to do it, largely due to ESG reasons.

There has been very little investment in new vessels for years, and many older ones are heading closer to their use-by date.

• Local Advantage: Nam Cheong has an edge because they're a local Malaysian operator. Cabotage laws in Malaysia mean they get priority for contracts.

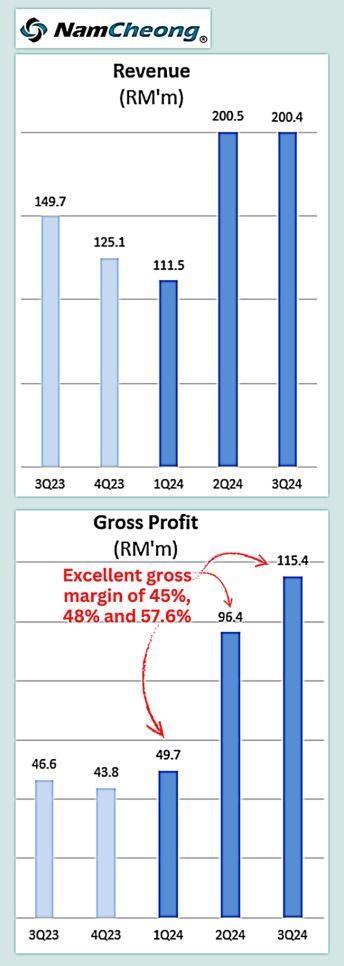

Results: Ka-Ching! The financials tell a compelling story:

Gross profit growth in 9M 2024 has outpaced revenue growth on higher charter rates, leading to excellent gross margins.

Gross profit growth in 9M 2024 has outpaced revenue growth on higher charter rates, leading to excellent gross margins.

- Profit Margins: Gross profit margins have soared to around 50%, thanks to higher charter rates and efficient operations.

(In Malaysia and elsewhere, similar margins are being reported: US-listed Tidewater, the biggest OSV operator in the world, has projected it would record a gross margin of approximately 51% for 2024). - Fleet Utilization: Vessel usage jumped from 60% in Q1 2024 to about 85% by Q3—a clear sign of growing demand.

- Big Contracts: Recently secured contracts worth RM1.22 billion for 12 vessels (about one-third of the fleet) will provide steady revenue starting this year.

4Q utilistion of vessels is typically weaker than 3Q but stronger than 1Q -- because the monsoon season starts mid-Nov and runs to end-March.

What's Next?

Things are looking good for Nam Cheong as the vessel supply stays tight and demand keeps going up.

They have debt to pare down which limits things like paying out dividends, and the monsoon season slow things down in 4Q and 1Q.

The new long-term contracts should give them more consistent work and assured revenue.

They also have a relatively young fleet, with an average age of 7-8 years, which is another advantage.

They have debt to pare down which limits things like paying out dividends, and the monsoon season slow things down in 4Q and 1Q.

The new long-term contracts should give them more consistent work and assured revenue.

They also have a relatively young fleet, with an average age of 7-8 years, which is another advantage.

|

In a Nutshell

Nam Cheong basically went from being on the verge of collapse to being a major player in a booming market.

They sorted out their debt, are benefiting from a sweet spot in the industry, and are making some serious cash. Obviously, they need to use some of the money to progressively pare down their debt but things are looking very positive. Risks: A sharp and sustained fall in oil prices leading to slower oil & gas production by clients, etc, and higher operating costs. |

See also: The Clock’s Ticking on Aging Fleets of Offshore Support Vessels