Photo: Company

Translated by Andrew Vanburen from a Chinese-language piece in Investor Journal

A CASUAL SPIN around the screens arrayed outside major brokerages in Shanghai and Shenzhen near China’s two capital markets will reveal a growing phenomenon if one takes the time to chat with strangers.

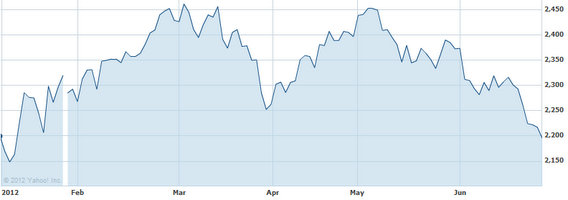

Namely, investors are losing their appetite for selling.

That can only mean one thing... the bears may very well be preparing for an unseasonably warm hibernation.

The general sense is that the downturn has run its course and there’s not a lot of momentum left to drag things further south.

That being said, there’s no hard and fast rules guaranteeing that the bears won’t be back for one more mid-year mauling.

Take last week for example, when generally good news on the financial front graced the front pages of papers worldwide and there were no new shocks to the system.

And what happened?

Of course, investor sentiment in Shanghai and Shenzhen took another inexplicable hit with many shareholders and funds either pulling out or standing idly by on the sidelines.

But we already knew that accurately predicting investor reaction to any raft of news, foreign or domestic, is one of the hardest jobs in the world.

Peeking behind the veil, we now know that 34.16% of registered A-share accounts have been completely gutted at present.

This is a nearly four-year high, a level not seen since the beginning of the global financial crisis in 2008, which can only mean that we may be on the cusp of a turnaround for A-share buying and/or holding sentiment.

From a macroeconomic viewpoint, things are still weak but the recent prime rate cut and the likelihood of a sizeable stimulus package from Beijing are helping keep sentiment from going submarine.

Despite the fund pullback last week, we do know that those staying put or looking for greener pastures are concentrated in a few sectors.

And we also know which industries were a turnoff for funds of late.

According to Shenyin Wanguo Securities, over the past three weeks of trading activity, the sectors that saw the most capital flight were non-ferrous metals (ie: copper, aluminum), financial services, machinery and construction materials.

In addition, the long stalwart of the capital markets – the property sector – also showed signs of investor flight of late.

With accounts suddenly very light in these five sectors, it is only inevitable that the newly-formed vacuums will be filled.

After all, markets – just like nature – can’t stand vacuums.

As proof, three of the most unpopular stocks of late have been Inner Mongolia Baotou Steel Rare-Earth (SHA: 600111), Tangshan Jidong Cement (SZA: 000401) and Inner Mongolia Baotou Steel (SHA: 600010).

But just as soon as they were on the ropes, they rebounded strongly this week, once again proving how distasteful vacuums are to market players.

One other thing to watch is daily trading turnover levels, which softened once again in both Shanghai and Shenzhen last week.

But given the continuously low investor participation rates of late, I only see this as more proof that the bears have had their fill, and they may be preparing to go sleep it all off for a spell.

See also:

MARKET MAYHEM: Making Sense Of China Shares

Middle East Kingdom To Boost Middle Kingdom Shares?

CHINA ANALYST: ‘Why I’m Back On Diving Board’

IPO DROUGHT: New China Listings Hit 3 Year Low