Translated by Andrew Vanburen from a Chinese-language piece in Sinafinance

ITALY WARNS of pending collapse in the EU, Beijing is on the verge of opening its pursestrings to spur growth and the US sees an uptick in industrial activity.

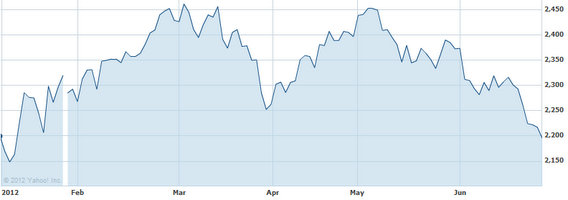

The benchmark Shanghai Composite Index was all over the map this past week, jumping up 1.35% on Friday but still managing to finish the five-day session down 1.59% at 2,225.

What does it all mean for China’s topsy-turvy stock market?

Here’s four experts’ takes.

China Minzu Securities: 2,132 Just Matter of Time

The new near-term bottom is likely to be the 2,132-point level, and it will be tested sooner rather than later.

Although investors are keenly awaiting a likely gift from Beijing in the form of a stimulus, the fact of the matter is that the domestic economy remains a question and the shaky international financial regime is still making for a far from ideal investing environment.

Adding to some of the volatility is the recent inrush of funds chasing perceived bargains that is helping distort the intrinsic value of many counters and sectors.

There is a distinct possibility that A-shares will continue June’s softening trend into July.

Shanghai Shiji: Hair-trigger Volatility

We’ve seen these past few weeks that sentiment in the market is very flighty and it doesn’t take much at all to trigger a sudden dip or surge.

The three selloffs in June have all been more or less been filled in and paved over.

Especially from around the 2,253 level, we can see that this has been a fulcrum point of late around which rallies and slumps have rotated.

As for turnover, daily trading in Shanghai has reached 40 billion yuan more than once of late with the Index at 2,242 during this period.

Meanwhile, when trading is at around 30 billion yuan, we are more likely to see the bourse at around the 2,132 level.

The trending toward a smaller number of shares trading hands suggests that buying sentiment is still on the weak side.

Shenyin Wanguo: Awaiting Upside Drivers

Investors are well-used to the bursts of confidence that can come from policy-side decisions from Beijing, including the long-anticipated stimulus that might very well be one of the first major financial news events of the second half.

But even more important to sentiment would be a raft of good news on the earnings front, and if guidance or reports themselves surprise on the upside for first-half results, that would be enough to provide sustainable momentum going forward.

That’s not to downplay the benefit that the stimulus itself will provide, and although many sectors are likely to weaken even further – including coal, non-ferrous, steel and banks – there will be a perceptible uptick following the anticipated move by Beijing.

Huatai Securities: Policy & Funds in Driver’s Seat

July will be a month in which the direction of the benchmark index will be predominantly driven in either direction by policy moves and/or fund activity.

Barring unforeseen external shocks from the EU or elsewhere, investors would do well to keep a close ear to the ground to anticipate major events from either the macroeconomic policy side, or the fund participation rate in the market.

See also:

Middle East Kingdom To Boost Middle Kingdom Shares?

CHINA ANALYST: ‘Why I’m Back On Diving Board’

IPO DROUGHT: New China Listings Hit 3 Year Low

Greek Vote Comedy Or Tragedy For China Shares?