• If you’ve never heard of Straits Trading, here’s the lowdown: it’s one of Singapore’s oldest investment groups, founded way back in 1887 to tap into the booming tin industry. Starting out with just tin smelting, the company quickly made a name for itself as a global player, running massive smelters in Singapore and Malaysia. • Over the years, Straits Trading didn’t just stick to mining—now they’re into property, hotels, and investments too.  • Today, they own a big slice of Malaysia Smelting Corporation and handle all sorts of property and hospitality projects across Asia-Pacific and the UK, with plenty of other investments tossed in. Basically, Straits Trading has evolved from old-school tin smelters to a modern, diversified group that’s always looking for fresh ways to grow. • Straits Trading is grossly undervalued -- but here comes a 22-page analyst report accessible on the SGX website that highlights it as a gem hiding in plain sight. Read excerpts below ..... |

Excerpts from tickrs report

Analyst: Jaimes Chao

| We maintain our BUY call on The Straits Trading Company Ltd (STC) following its 1H FY2025 results. Despite a headline loss due to non-recurring fair value impacts, STC’s core business segments remain resilient.

Our 12-month Target Price of S$2.20 is derived from a blended valuation (applying a steep conglomerate discount to RNAV and peer relative earnings multiples), and implies ~34% upside from the current price of S$1.64. |

||||

STC reported a 1H2025 net loss as expected, driven by one-off, non-cash valuation losses in its property and investment portfolio.

Group revenue held steady at S$309.5 million (-1.0% YoY), but a net loss of S$40.8 million (EPS –9.0¢) reversed from a S$5.2 million profit in 1H2024 (EPS +1.2¢).

The swing was largely due to

| (i) a fair value loss in an associate’s UK properties amid weaker market conditions, and (ii) a remeasurement loss of S$29.4 million on exchangeable bonds triggered by the privatisation of ESR Group. |

These valuation losses are non-cash and do not affect operating cash flow.

Excluding such items, underlying operations were relatively stable – the Resources (tin smelting) segment remained profitable and Hospitality showed signs of post-pandemic recovery outside of refurbishment downtime.

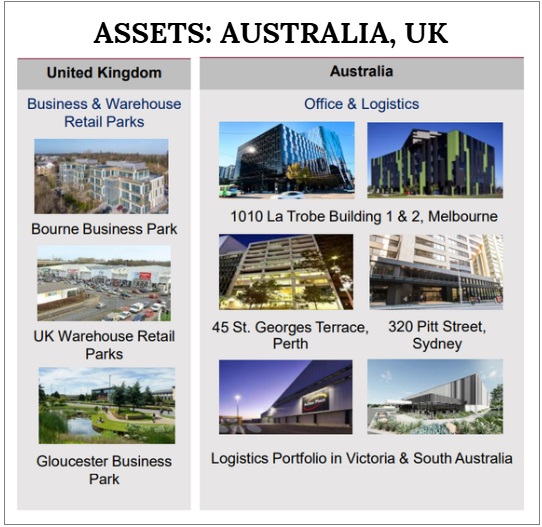

STC also continued to recycle capital, divesting assets (e.g. an Australian property sale and a UK asset held for sale) and using proceeds to redeem debt.

In August, the company redeemed S$284 million of exchangeable bonds, slashing outstanding bond debt to S$86 million. This significantly improves leverage and interest cost going forward.

Management maintains its interim dividend of 8.0¢ per share (unchanged despite the loss), reflecting confidence in the Group’s long term cash generation.

|

Metric |

Value |

Comments |

|

Share Price (23 Sep 2025) |

S$1.640 |

52-week range S$1.33 – 1.78; at ~50% of RNAV |

|

Market Capitalisation |

~S$800 million |

~S$0.8B; conglomerate with diversified assets |

|

NAV per Share (Jun’25) |

S$3.12 |

Book NAV; RNAV (revalued) est. ~S$3.20 |

|

Price / NAV |

0.53x |

Historically trades at steep NAV discount |

|

P/E (FY2025E / FY2026E) |

n.m. / ~20x |

FY25 loss expected; FY26E normalised ~8–9¢ EPS |

|

EV / EBITDA (FY2024) |

~16x |

EBITDA S$124.4m in FY2024; EV post-bond cut ~S$1.7B |

|

Return on Equity (FY2024) |

–0.5% |

Slight loss in FY24; ROE to improve as one-offs abate |

|

Dividend Yield |

4.9% |

Annual 8.0¢ DPS sustained (>\100% payout in FY24) |

|

Net Debt / Equity (Jun’25) |

90.4% → <70% (pro-forma) |

90% at 30 Jun; falls below 70% after Aug bond redemption |

|

Upside to Target Price |

+34% |

TP S$2.20 vs S$1.64; valuation gap expected to narrow |

Key Catalysts: Looking ahead, we expect asset monetisation to unlock value – STC’s assets (72% in property by value) are carried at a RNAV of around S$3.20/share, about twice the current share price.  Execution of planned disposals or redevelopment (e.g. the ongoing Straits City project in Penang and other property fund investments) could catalyse a re-rating.

Execution of planned disposals or redevelopment (e.g. the ongoing Straits City project in Penang and other property fund investments) could catalyse a re-rating.

Meanwhile, the hospitality arm (30%- owned Far East Hospitality) is poised for a stronger 2H as travel demand recovers and refurbishment works conclude.

The resources arm (52%-owned Malaysia Smelting Corp) stands to benefit from firmer tin prices and operational efficiencies as a new smelter ramps up.

With net gearing now <70% (vs ~90% in June) after the bond redemption, STC has financial headroom for new investments or higher capital returns.

We value STC using a blend of RNAV (reflecting its deep asset base) and earnings metrics (capturing the normalisation of profits into FY2026).  Jaimes Chao, analystOur S$2.20 Target Price equates to ~0.7× forward book value – still a hefty discount to RNAV, but justified until more catalysts materialise. Jaimes Chao, analystOur S$2.20 Target Price equates to ~0.7× forward book value – still a hefty discount to RNAV, but justified until more catalysts materialise. Key risks include further declines in property market valuations (UK, China exposure), tin price volatility, and macro headwinds (rates, FX) which we discuss herein. On balance, we see STC’s current 50% discount to NAV as excessive given the Group’s ongoing portfolio streamlining and resilient cash flows. |

→ See full report here. → See full report here.

→ Also, check out this mispriced stock: This Company's Deep Discount Attracts Insider Buying, Sparks Privatisation Speculation in Analyst Report |