Guoco: LUK FOOK ‘Cheap’

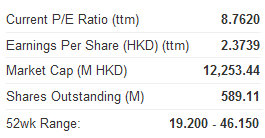

Guoco Capital said it is maintaining its ‘Buy’ recommendation on Luk Fook (HK: 590), a leading retailer of gold and jewelry products in Hong Kong and China.

The brokerage has a 6-month target price of 35.0 hkd on the retailer based on 12x FY13 earnings.

“The valuation of Luk Fook is cheap,” Guoco said.

The brokerage forecasts Luk Fook’s earnings to reach 1.4 billion hkd in FY12 (year ended March) and 1.71 billion in FY13, up 65% and 20% y-o-y, respectively.

Its EPS will be 2.59 hkd in FY12 and 2.91 in FY13, up 52% and 12% y-o-y, respectively, due to the dilution effect from share placements in December 2010 and January 2012, Guoco estimates.

“Our EPS forecasts are 8% above street estimates. In fact, analysts have consistently under-estimated Luk Fook’s earnings over the past few years. Traded at FY13 PER of 10x with EPS growth of 12%, the valuation of Luk Fook is attractive to long term investors.”

Luk Fook raised net proceeds of 1.34 billion hkd from share placement of 46.6 million new shares at 29.25 per share on 19 January 2012.

“The placement surprised the market since the company had net cash of approximately 300 million hkd as of September 2011. We believe the listing of its competitor Chow Tak Fook (HK: 1929) in December 2011 has forced Luk Fook to accelerate the pace of network expansion in China to avoid losing market share.”

Guoco added that Luk Fooks’ sales of jewelry, watches and valuable gifts increased by 35% y-o-y in November 2011 and 49% y-o-y in the first 11 months of 2011.

“We believe the gold and jewelry industry is likely to grow 15%-20% in both the China and Hong Kong markets in 2012 taking into account a slowdown of the PRC economy.”

See also:

CHOW SANG SANG Kept At ‘Buy’, HK Property Initiated ‘Outperform’

HK Jewelry Retailers: 'Buy CHOW SANG SANG, LUK FOOK On Weakness'

Kingston: SA SA Seeing Substantial PRC Growth

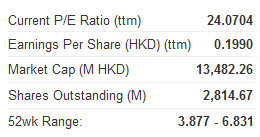

Kingston Securities said cosmetics and beauty care products retailer Sa Sa International (HK: 178) is benefitting from strong exposure to robust demand in the PRC.

The brokerage has a buy-in price on the Hong Kong-listed firm of 4.5 hkd, a target price of 5.1 hkd (recently: 4.8 hkd) and a stop-loss of 4.35 hkd.

For the three months ending Dec 2011, Sa Sa recorded a 28.9% increase in sales to 1.81 billion hkd, which was lower than the 31.2% growth of the first three quarters.

“The growth of the group’s retail sales in Hong Kong and Macau was 15% while same-store-sales growth rate was 9% during the Lunar New Year, slightly below expectations. However, China market business recorded substantial growth in revenue.”

However, Kingston said not all was coming up roses in China.

“The relatively cheap price has been the selling point of the group’s products, but a higher tax was imposed on imported cosmetics in China, coupled with the weak HKD/RMB exchange rate, would cancel out the group’s price advantage when compared with Sa Sa Hong Kong.”

The brokerage added that Sa Sa has been actively expanding its sales network, and working with a number of established beauty brands.

“Yet, brands including L’Oréal, Maybelline and Yue Sai, under the L’Oréal Group, and Za of the Shiseido Group, mainly captured the mass market instead of the high-end market. Therefore the group’s overall earnings performance may be affected by the pricing constraints.”

See also:

MING FAI Gets ‘Buy’ On Retail; TIANYI ‘Positive’ On Strong Earnings

MING FAI: Hotel & Airline Supplier Has Standout 1H, Yet Shares At 52-Wk Low

Kingston: FOSUN Adds Nearly 3 Mln Square Meters

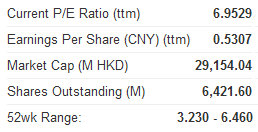

Kingston Securities said conglomerate Fosun International (HK: 656) struck while the iron was hot, boosting its property holdings amid a pricing slump.

“Fosun seized the opportunities on the decline in land prices and added a new land reserve of 2.7 million square meters for 11 billion yuan, resulting in a total land bank of 12 million sq m.

“Apart from the construction of the IFC mega-project, the group extended its geographical presence to second-tier cities in Mainland China,” the brokerage said.

Meanwhile, Fosun’s still significant steelmaking operations took a big hit last year.

“Fosun’s steel segment recorded a net profit of 34.3 million yuan last year, down by 91.6%. The group will not increase investments in the steel business.”

Kingston’s buy-in price on Fosun is 4.4 hkd, the target price is 4.9 (recently: 4.5) and the stop-loss is 4.2.

The company’s property segment engages in the development and sale of urban complex projects, including hotels, commercial spaces, and apartments, as well as providing real estate fund management, property circulation and consultation, and sales agency services.

See also:

CHINA NEW TOWN Inks Landmark Beijing Fund Deal

HOUSE MONEY: Top 500 PRC Developers Assets Up 50% To 5 Trillion Yuan

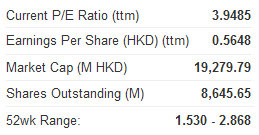

Guoco: Staying ‘Buy’ on NEW WORLD CHINA LAND

Guoco Capital said it is maintaining its ‘Buy’ recommendation on property developer New World China Land (HK: 917) with a target price of 2.47 hkd (consensus 2.63).

The real estate firm focuses on land development and investment in Mainland China.

“Recently, New World China Land’s share price recently rose and stayed above 2.10 hkd, its highest level since October 2011. Our short-term target is 2.47 hkd, slightly below the bottom reached in the first half last year,” the brokerage said.

Its cut-loss price for NWCL is 1.97 hkd.

See also:

Hong Kong Developers On PRC Bargain Hunting Spree

"HK Housing Market To Fall Up To 15% This Year"