Translated by Andrew Vanburen from a Chinese-language piece in Sinafinance

WISDOM AND AGE have been cast as kissing cousins throughout history and across cultures, and perhaps nowhere more so than in China.

Take the example of 88-year-old Qiu Yonghan, nicknamed the “Earning Guru” (赚钱之神) for his uncanny ability to find diamonds in the rough and add to his fortune.

He recently caused a media event when he took a group of investors to tour chemical giant Dongyue Group (HK: 189).

His take?

Buy Dongyue.

Reporters were scrambling to get his word out.

First a bit about Dongyue.

Founded in 1987, the Shandong Province-based firm specializes in chemicals used in cooling systems -- mainly fluoropolymers, organic silicon and alkali products.

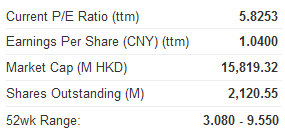

The Hong Kong-listed company had a standout 2011, with its revenue surging over 70% year-on-year to 10.2 billion yuan, producing a nearly 200% bottom line spike to 2.2 billion yuan.

On Thursday, its shares were halted from trading in Hong Kong after two major shareholders exercised significant daily transactions, cashing in convertible bonds worth some one billion yuan.

Pump-priming and cash recycling of this kind is not unusual for big chip firms like Dongyue, said the 88-year old investor Qiu Yonghan.

Mr. Qiu took a group of investors and reporters to Zibo City in northern China’s Shandong Province to see with his own eyes if things were awry at the chemical giant.

But the near nonagenarian came away from the visit with both thumbs up for the firm, with some financial dailies providing front-page coverage of Qiu’s endorsement.

The day after Qiu’s site visit, an assortment of stories said that the seasoned investor felt that two taps being suddenly opened did not make a flood, and he for one was sticking with Dongyue.

Hong Kong’s Ming Pao Daily reported that Dongyue’s two major shareholders – Executive Director Fu Jun and Financial Controller Cui Tongzheng – sold off a noteworthy chunk of their holdings in the company.

Fu offloaded 111 million shares while Cui sold 20 million, with the average price per share sold lower than the pre-trade halt price quotation on Thursday, with a maximum discount of nearly 9%.

Activities like these keep Mr. Qiu, the “earning guru,” young and active.

Despite the “unusual” trading activity in the firm’s convertible shares, Mr. Qiu was “very upbeat” on Dongyue, adding that he seldom encounters enterprises with such rapid yet healthy and sustainable growth, said another piece in Hong Kong’s Apple Daily the day after his Shandong sojourn.

It pays to have friends in high places, so the saying goes.

Apparently it also pays dividends to have friends – or advisors – who’ve been around for a few years.

See also:

SHOW ME THE MONEY: What Happens To SOE Profits In PRC?

NEW KID ON BLOCK: 21 A-Shares In Red; 4 In Hot Water

History Professor: 'PRC Headed For Hard Landing’

KINGS OF THE HILL: 12 Banks Produce Over Half Of All Listcos’ Profit