THERE ARE two types of stocks everyone longs to own: those on the way up and those with the potential to do the same.

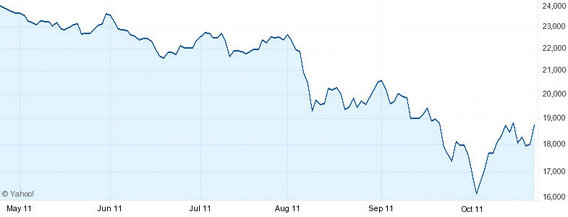

The latter, i.e. bargain counters, are there for the choosing, especially in such a downtrodden market in which the benchmark Hang Seng Index has fallen nearly 27% in a little over six months to close Tuesday at the 18,968 level.

A Chinese-language piece in Sinafinance said that recent action by the “less sick men” of the EU, i.e. Germany and France, to prop up some of their financially faltering neighbors like Greece has helped to assuage the most persistent fears of a complete breakdown of the 27 member-strong political and economic union and the joint use of its Euro currency.

However, this has failed to completely eradicate the chill enveloping major bourses from Wall Street to Fleet Street, and from Frankfurt to the Far East.

Sinafinance likened the sentiment to someone finally being able to take off their thick winter jacket only to find that spring has passed and there is an autumnal nip in the air already.

But despite the seeming benefits to bargain hunting in a down market, the whole exercise can be both stimulating and simultaneously unsettling for investors.

Most accept the fact that investors who primarily engage in bargain hunting generally lose money rather than make it.

That is because most bear markets last for at least a year, while individual shares only linger around their valuation nadirs for a few weeks or so, and it is hard to know when a particular stock, a given sector, or for that matter an entire benchmark index is at its true bottom.

Whether or not the current market has hit a virtual bottom still elicits a wide range of opinion across the spectrum. But there is compelling evidence that valuations are at least currently at a “medium-term” nadir.

Firstly, policies both here are overseas are being put in motion that effectively serve to improve market liquidity.

The more financially sound EU member states have already begun rescue operations for troubled neighbors with global markets gradually beginning to mention the EU debt crisis less often as a chronic downside sentiment driver. In fact, as things stand now, it looks like one trillion euro in bailout funds is in the works for the region.

In addition, the ever-present warnings of runaway inflation in Mainland China seem to have reached a crescendo and are on the decrease, credit-tightening policies are apparently being eased and the regular spate of interest rate hikes of late looks to become a thing of the past.

Secondly, Hong Kong’s benchmark Hang Seng Index is currently enjoying a steady -- albeit gradual -- upward technical correction.

Recent consecutive trading day climbs of six days in Hong Kong, the US and Europe coupled with the more concerted action in the EU to rescue struggling member states seems likely to be a near-term trend and is providing some level of positive reinforcement to investors.

On Wall Street and in the A-share markets in particular, the fact that individual shares have recently penetrated historic or long-term lows and then just as quickly rebounded is a clear sign that the overall market may be growing weary of testing new bottoms and is ready for a sustained recovery.

And here in Hong Kong, Monday’s topsy-turvy trade is further evidence of this trend -- with the Hang Seng heading down, bouncing back, then closing slightly lower all in one day -- is displaying a readiness by investors to begin buying once again.

If the Hang Seng can hold get a grip on the 19,000 level for a sustained period, then a medium-term recovery is all but certain.

Thirdly, most economists are forecasting that the global economy (read Europe and North America) will likely get worse before they it gets any better over at least the next few months, with the bottom of the barrel expected to be witnessed by the end of the first quarter 2012.

However, that is not all bad news for capital market investors as typically Hong Kong’s bourse has usually bounced back a full half-year before the global economy during extended downturns.

And with so many stocks clearly oversold of late, it is hard to expect anything other than a buying spree for perceived bargains just around the corner.

Sinafinance said bargain hunters should keep the following ground rules in mind before launching a buying campaign:

- If a share hasn’t plummeted, leave it alone. If it hasn’t fallen enough, leave it alone. These tend to be defensive stocks that almost by reflex move up (and down) with the benchmark index.

- Look for decent-to-solid sales performances within industries not overly impacted by global downturns in demand, policies or raw material pricing pressures. And avoid counters that are chronically “misunderstood” and underappreciated, with little historical precedence of a sustained rally.

- After an extensive, broad-based, multi-sector bounceback in the benchmark index, it is generally a bad idea to go after those very few stocks that somehow missed the boat and are still lingering near or at their historical lows. They are likely still underperforming for a reason.

Seven Best Bargains

That being said, which are the best bargains on the Hong Kong stock exchange right now?

Sinafinance’s analyst believes that the following offer the best risk-reward tradeoffs for bargain hunters at this point:

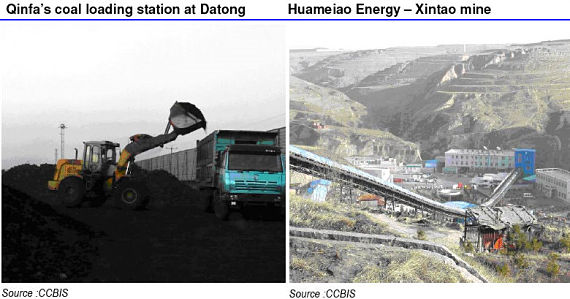

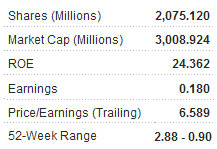

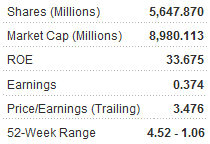

China Minsheng Bank, China Merchants Bank, Citic Bank, China Lumena New Materials (HK: 67), China Qinfa (HK: 866), Guotai Junan (HK: 1788) and China Singyes Solar (HK: 750).

They include four financial sector plays and two energy counters, which perhaps says something about both an expected recovery in trading turnover as well as more vibrant economic growth ahead.

See also:

HK-LISTED CHINA QINFA Jan-Sept Coal Trade Volume Surges 186%