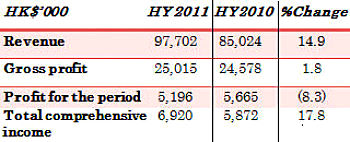

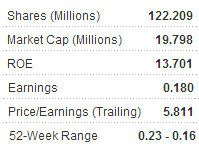

CHINA PRINT POWER (SGX: CPPG; HK: 6828), which dual-listed in Hong Kong last month, boosted its top line by nearly 15% in the first half on stronger sales of printing services and specialized products.

The book and specialised products printing group serving the international market reported total revenue of 97.7 mln hkd in the first six months, an increase of 14.9% compared to HY2010.

The increase in revenue was due to an increase in sales orders and average selling prices.

The overall gross profit margin was 25.6% compared to 28.9% in the year-earlier period.

China Print Power said this was mainly due to higher labour costs as a result of an increase in the number of workers and wages.

The company was still basking in the glow of a recent Hong Kong listing.

“The additional trading platform in Hong Kong not only provides more potential investors but also increases our reputation in the PRC market.

“Under the charge of our management with over a decade of experience, along with newly-raised funds, I trust that we can achieve our targets according to our schedules,” said China Print Power CEO Thomas Sze.

He added that financial troubles overseas were prompting China Print Power to take a realistic approach to business down the road.

“In the past six months, the global economy was affected by the challenging economy and an uncertain outlook. The group maintains a cautious outlook for 2011.”

In the January-June period, China Print Power’s other income increased by 243.9% from approximately 0.3 mln hkd in HY2010 to approximately 1.0 mln in HY2011. This was mainly due to proceeds of HK$0.2 million on sales of scraps and the collection of 0.4 mln from customers which had been impaired in previous years.

As a result of the above, the group booked a total comprehensive income for the period attributable to owners of the company of 6.9 mln hkd for HY2011. This represents an increase of 17.8% compared to HY2010.

As at 30 June 2011, the Group has a healthy cash position amounting to approximately 21.9 mln hkd.

Looking ahead, China Print Power said it will leverage its dedicated strength in printing and production expertise and experience in specialised products to enhance market position and capture higher market share.

The group intends to focus on the development of children’s booklets and the stationery market where more specialised skills and techniques are required and hence enjoy a higher profit margin. The firm will also endeavour to market value-added children’s products by participating in international and domestic trade fairs.

Along with sustained economic growth, rising average disposable incomes and higher living standards in the PRC, China Print Power believes increasing demand in the PRC for high-end premium products presents tremendous opportunities for its future development.

“Thus, we plan to set up sales offices and showrooms for specialised products in major cities in the PRC to identify potential customers, and strive to seek new business opportunities,” Mr. Sze said.

Established in 2000, China Print Power is principally engaged in printing books and manufacturing specialised products, providing a full suite of services including pre-printing (including colour separation and creating ozalids), printing and post-printing services (including folding, collating, finishing and binding).

Examples of the group’s specialised products include custom-made and value-added printing products such as pop-up children’s books, board books and greeting cards, etc. CPP also manufactures leather and fabric products such as organisers with leather or fabric covers, leather-bound journals and diaries, and products with materials other than paper.

The production plant is strategically located in Heyuan, Guangdong Province, PRC, where it operates a site with 104,349 sq. m. in factory space with twelve printing presses, allowing the group to enjoy relatively lower costs for labour and utilities. As testament to its track record in the timely delivery of high quality products, the group boasts an extensive customer base including major international publishers and retail stores across Europe, North America and Asia. Print Power was listed on the Main board of SGX-ST in May 2007 and on the Main board of SEHK in July 2011.

See also:

CHINA PRINT POWER, WORLD PRECISION MACHINERY: Latest Happenings...

CHINA PRINT POWER Prepares HK Listing; CHU KONG PIPE, TECHTRONIC Both BUYs...

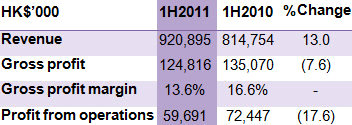

COMBINE WILL (SGX: COMW) saw its Jan-June revenue rise 13% to 921 mln hkd on robust moulds, toolings and machine sales with management “cautiously optimistic” on full-year prospects.

And in the second quarter (April-June), with stable orders from existing premium customers, Combine Will’s overall revenue increased 7.0% compared to the previous corresponding period.

The Asian market segment’s revenue increased by 110.9 mln hkd or 39.8% y-o-y.

Although the ODM/OEM business decreased by 11.1%, moulds and toolings as well as machine sales increased by 16.8% and 120.1%, respectively, during the three-month period.

“Quality becomes one of the main factors for customers placing orders with various ODM/OEM suppliers. Most of our customers have been with us for over 10 years as a result of our premium quality products,” said Combine Will’s Executive Director Simon Chiu.

“With steady growing demand from our loyal customers, our main strategies are to optimize the production process and minimize costs.”

The increase in other income in the second quarter by 70.2% is mainly due to an increase in interest income from pledged time deposits. The group’s administrative expenses decreased by 5.8 mln hkd or 19.6% primarily due to the result of exchange gains on RMB deposits. Finance costs in the April-June period increased by 30.5% to 6.1 mln hkd mainly due to the interest expense from utilization of more term loans.

As a result, net profit for the first half of this year was 38.0 mln hkd, a 28.9% decrease y-o-y.

Combine Will said that this year presents a challenging environment for some of the less capable ODM/OEM companies in an environment of increasing raw material prices and labour costs in the PRC.

The industry is entering a period of consolidation and the less competitive firms are being weeded out. Automation and innovative product design have become vital elements for successful companies.

Management is familiar with these challenges and has been taking appropriate measures to minimize their impact on the group’s business.

The group says it is "cautiously optimistic" that it will maintain continuous profitability by engaging in the development and production of high quality premiums and consumer products.

See also:

PORTEK, COMBINE WILL, ROXY PACIFIC: Latest Happenings...

COMBINE WILL: More Strong Growth To Come This Year But...