SINGAPORE-LISTED CHINA Print Power Group Ltd (SGX: CPPG) became the latest in a string of China-based firms to seek secondary listings, adding its name to Hong Kong’s main board on Tuesday with the new ticker (HK: 6828).

The printer of books, leather-bound journals, Bibles and other specialized products saw its retail IPO tranche 100 times oversubscribed, with the offer price determined at 1.48 hkd.

Mr. Carmelo Lee, Deputy Chairman of the Listing Committee of the Hong Kong Exchanges and Clearing Ltd, was on hand to congratulate China Print Power on its successful listing.

Based on the offer price of 1.48 hkd per share, net proceeds from the issue of new shares, after deduction of related underwriting commissions and other listing expenses, is estimated to be approximately 31.6 mln.

A total of 2,556 valid applications were received, totaling 393,516,000 public offer shares and representing approximately 100.9 times of the total number of 3,900,000 public offer shares initially available under the Hong Kong listing plan.

Due to the very significant over-subscription in the public offer, the clawback mechanism has been applied and the number of offer shares allocated to the public offer has been increased from 3,900,000 to 19,500,000, representing 50% of the total number of offer shares available under the share offer.

CPP’s board intends to apply such net proceeds as follows:

• approximately 86% of the net proceeds, or approximately 27.2 mln hkd, for the expansion of production capacity including construction of new workshops

• approximately 5% of the net proceeds, or approximately 1.6 mln hkd, for the expansion of CPP’s sale and distribution network and the promotion of new products

• the remaining 9% of the net proceeds, or approximately 2.8 mln hkd will be used for the working capital of the group

Established in 2000, China Print Power is principally engaged in printing books and manufacturing specialized products, providing a full suite of services including pre-printing (including colour separation and creating ozalids), printing and post-printing services (including folding, collating, finishing and binding).

Examples of the group’s specialized products include custom-made and value-added printing products such as pop-up children’s books, board books and greeting cards, etc.

The Group also manufactures leather and fabric products such as organisers with leather or fabric covers, leather-bound journals and diaries, and products with materials other than paper.

The production plant is strategically located in He Yuan, Guangdong Province, PRC, where it operates a site with approximately 104,349 sq. m. in factory space with 12 printing presses, allowing the group to enjoy relatively lower costs for labour and utilities.

As testament to its track record in the timely delivery of high quality products, the group boasts an extensive customer base including major international publishers and retail stores across Europe, North America and Asia.

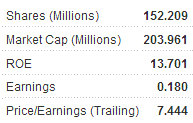

Print Power was listed on the Main board of SGX-ST in May 2007 and on the Main board of SEHK in July 2011.

See also:

CHINA PRINT POWER Prepares HK Listing; CHU KONG PIPE, TECHTRONIC Both BUYs...

CHINA PRINT POWER Grossly Undervalued, Says French Shareholder

World Precision Machinery to bolster foothold in Northeast China with new plant in Liaoning

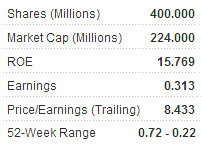

World Precision Machinery Ltd (SGX: BWPM), a manufacturer of precision stamping equipment in the PRC, said its newly incorporated subsidiary -- World Precise Machinery (Shenyang) Co Ltd (WPMS) -- will begin Phase 1 construction of its plant in Shenyang City, Liaoning Province this month.

“Over the past few decades, Shenyang has emerged as one very important manufacturing hub with robust growth prospects in China, well supported by the local government with various investment-friendly policies.

"By establishing a physical presence in Shenyang, we bring the Group closer to our key customers, both new and existing, in Northeast China, thereby gaining strategic access to the huge industrial development needs and boosting our market share in this region,” said CEO Shao Jian Jun.

He added: “At the same time, we are able to enjoy favorable raw material prices and lower transportation costs, which contributes directly to the Group’s profitability. At present, we have over 290 customers in the Bohai Rim region, contributing RMB127 million in revenue for FY2010. We expect the contribution from the Bohai Rim region to increase in the coming years.”

World Precision Machinery said the new plant will be dedicated to production of high performance and high tonnage stamping machines, and the new facility is in line with the group’s geographical expansion plans to further fortify World Precision’s market leadership in the precision stamping market.

“As we enter into the second half of the year, our sales momentum continues with the recent win of approximately RMB9.7 million order from Guangdong Midea Electric Appliances Co Ltd (a company listed in Shenzhen), a global manufacturer for industrial and home appliances,” said Mr. Shao.

Strategically located in Shenyang Economic and Technologic Zone, the Group plans to complete Phase 1 of the plant by 2H2012.

Once the plant is up and running, it is expected to achieve annual production output of RMB300 million upon optimal capacity level. The total capital investment for the new plant (phase 1 and 2) is initially estimated to be within the range of RMB400 million to RMB500 million, which includes land cost.

Set to benefit from burgeoning high-end manufacturing segment in China

Under the 12th 5-year plan, the high-end equipment manufacturing industry is identified as a key sector to be promoted by the PRC government, targeted at various applications.

By 2015, the output value of this sector is expected to grow to six trln yuan.

See also:

Hot Stocks: DMX TECHNOLOGIES, WORLD PRECISION MACHINERY

WORLD PRECISION MACHINERY: Strong Order Book Of RMB428m