| Trek 2000 International has made waves in the past with R&D breakthroughs in consumer electronics. Now, it is making a move to acquire a stake in a semiconductor start-up company in China. Trek, the inventor of Thumbdrive and a wifi SD card, among other things, said it would acquire a 20% equity stake in China Chips Star Semiconductors Co. Ltd (CCSS) for USD 1.6 million. This will enhance Trek 2000's footprint in China's booming market, particularly in the high-end industrial and enterprise-grade storage solutions sector. |

CCSS, founded in 2022 and headquartered in Shenzhen, China, is growing fast.

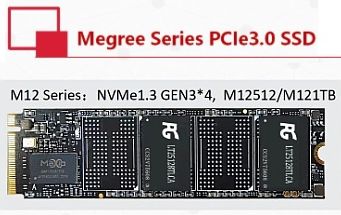

• Shenzhen-based CCSS is into R&D of solid-state drive products to meet different storage needs. • CCSS‘s customers (in the telco and electronics sectors) use these products in their network communication and server products/solutions. |

It has branches in Hong Kong and Nanjing, and handles everything from R&D to assembly to sales and servicing of its products.

Trek says CCSS's clientele include major players in the telecommunications and electronics industries in China.

Even thought it is relatively new on the scene, CCSS recorded sales revenue of USD 5.6 million and an operating profit of USD 736,000 for FY2023.

Trek Technology (Singapore), a wholly-owned subsidiary of Trek 2000, proposed to acquire 2,750,000 ordinary shares of CCSS based on a valuation of 2.5 times CCSS's net asset value as of July 2024.

Following that, the two parties will collaborate on R&D projects, leveraging CCSS's presence and customer base in China. This synergy is expected to enhance Trek 2000's product offerings and market reach.

|

Stock price |

6.4 c |

|

52-week range |

4.9 – 7.7 c |

|

PE (ttm) |

6.4 |

|

Market cap |

S$20 m |

|

Shares outstanding |

313 m |

|

Dividend |

- |

|

1-year change |

0% |

|

Source: Yahoo! |

|

The acquisition will have a positive financial impact on Trek.

Based on pro forma calculations assuming the acquisition had been completed at the beginning of fiscal year 2023, Trek's earnings per share would increase from USD 0.86 cents to USD 0.91 cents.

Similarly, the net tangible asset per share increases from USD 9.08 cents to USD 9.13 cents.

| Since 6 June 2023, Trek has been on the SGX Watchlist for companies that do not meet minimum trading price or profitability criteria. Trek was included in the watchlist due to pre-tax losses incurred for the 3 most recently consecutive financial years and an average daily market capitalisation of less than S$40 million over the last 6 months. Trek may apply to SGX-ST to be removed from the Watch-List if it records consolidated pre-tax profit for the most recently completed financial year and has an average daily market capitalisation of S$40 million or more over the last 6 months. It has to meet those requirements within 36 months from 5 June 2023, failing which the SGX-ST could delist the Company or suspend trading in the Company’s shares with a view to delisting the Company. That difficult situation is likely among the reasons why its market cap of S$20 million is far below what Trek held as cash and short-term investments. It had US$21.5 million (S$28.4 million) comprising of cash and cash equivalents of US$13.9 million and short-term investments of US$7.7 million as of 30 June 2024. It has no borrowings. This high liquidity position makes up to 72.7% of its net assets. |