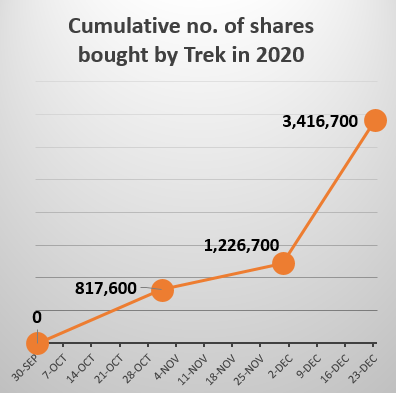

| Trek 2000 International's renewed share buyback since October 2020 has been providing a tailwind to the stock price. Trek, inventor and patent owner of the ThumbDrive® among others, last bought back shares in 2019 (2,573,400 shares were bought back). Since October this year, it has bought back 3,416,700 shares, attracting some market attention and aiding in a 33% rise, from 7.7 cents to 10.2 cents today.   Chart: Yahoo Chart: Yahoo |

The share buyback would have helped to attract attention to its undervaluation.

Trek's market cap at the start of October 2020 was S$25 million (at stock price of 7.7 cents).

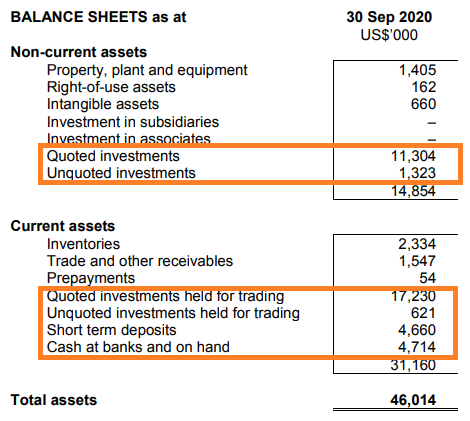

But its balance sheet was quite pretty: Zero borrowings and nearly US$40 million (about S$54 million) in real solid assets which comprise cash, bonds, quoted and unquoted funds (as highlighted below):

Its NAV as at end-Sept 2020 was 12.16 US cents, or 16.4 SGD cents. That's way above its trading stock price for a long time.

All this is not to say Trek is a stock to buy.

The accumulated holding of cash and investments is clear for investors to appreciate but there are significant issues to note, including:

| • CAD investigation and court cases involving four former top executives. • Business headwinds (See 3Q20 results announcement here.) • Being on SGX watchlist. End-2021, Trek will reach the third and final year to meet the criteria to exit the watchlist, failing which Trek may be delisted or suspended from trading. The exit criteria: Volume-weighted average price of at least S$0.20 and an average daily market capitalisation of S$40 milion or more over the last 6 months. |

And by the way, does anyone know why Trek appointed a restructuring veteran, Neo Ban Chuan, 68, as a non-executive independent director this month?

Mr Neo was previously the Head of Restructuring with one of the Big Four accounting firms in Singapore.

Is he to help restructure Trek?

| Another question: Given Trek's deep cash holding, will it continue to buy back its shares till at least it clears one exit criterion of the watchlist, ie a 20 cent share price? |