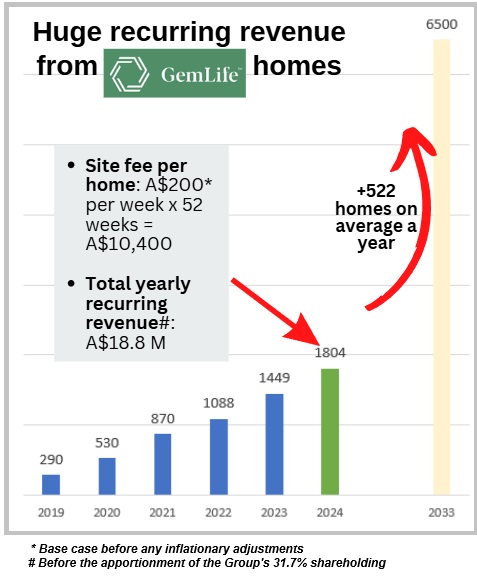

| The future of a business is usually unpredictable but here's one that looks much less unpredictable. For what it's worth, there's high certainty that the recurring revenue of GemLife (in which Singapore-listed Thakral Holdings owns a 31.7% stake) is headed for A$65 million a year. It's simple math. GemLife builds homes in resorts for people over 50 years old -- retirement homes, if you like. GemLife retains ownership of the land and facilities, and manages the resorts.  Aside from the usual property development profit, it makes money from a weekly "site fee". This is the recurring aspect of the land lease community business model used by GemLife and similar operators in Australia's over-50s housing sector. The collections allow the company to maintain the community while residents benefit from home ownership without the full costs and responsibilities of traditional property ownership.  Having secured a vast landbank, GemLife is projecting to build 6,500 homes by 2033. And that means a whopping A$65 million in site fees a year (before adjusting for future inflation). It's a positive prospect that Thakral CEO Inderbethal Singh Thakral noted at a FY24 results briefing. |

Riding the Wave of Diversification and Innovation

Thakral is growing its diverse portfolio and innovative business strategies.

At the investor briefing, the company's management team, led by CEO Bethal, unveiled an array of business ventures that are propelling Thakral forward.

"We are at an inflection point where all our businesses are positioned for reasonable growth.”

And there's a new dividend policy: CEO Inderbethal Singh Thakral. With effect from FY25, Thakral's dividend will be the higher of the following:

CEO Inderbethal Singh Thakral. With effect from FY25, Thakral's dividend will be the higher of the following:

(i) a base payment of 4 SG cents per share; or

(ii) a payout of approximately 20% of the net profit attributable to shareholders (excluding non-controlling interests and non-recurring, one-off and exceptional items), rounded to the nearest half cent per share.

GemLife: A Golden Opportunity in Australia's Aging Population

Thakral's crown jewel, GemLife, has built and sold 1,800 homes, tapping into a massive market fueled by an aging population.

Aside from collecting weekly site fees mentioned above, GemLife is also venturing into renewable energy and 5G connectivity, creating additional revenue streams.

Japan: The Land of the Rising Returns

Thakral's investments in Japanese real estate encompass 6 office buildings and a hotel in prime Osaka locations.

With occupancy rates nearing 95% and rents steadily increasing, Thakral continues to extract value from this mature market while exploring opportunities for capital recycling into new ventures.

India: The Next Frontier

Thakral isn't stopping at Australia and Japan. The company has set its sights on India, with a 13.2% stake in a 20.7-acre real estate project in Gurugram.

Various plans are being considered, including possibly one where a hospital and residential and commercial units are built over the coming years.

Lifestyle Division: Beauty, Drones, and Coffee

Thakral's lifestyle division is a potpourri of ventures:

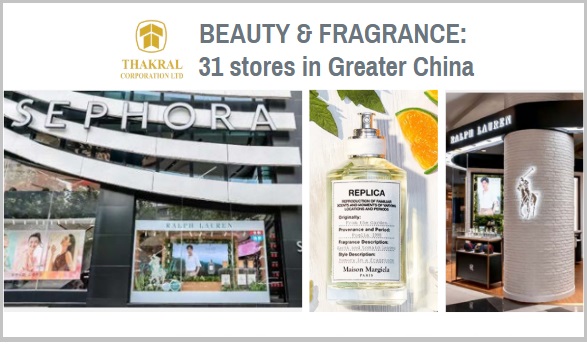

- Beauty and Fragrance: Thakral has successfully partnered with global brands to meet strong demand for niche fragrances in China.

The company distributes premium brands like Maison Margiela and Ralph Lauren in Greater China. - Drones: As the exclusive distributor for DJI drones in seven South Asian countries, Thakral is flying high in this growing market.

In addition, Thakral has taken a 23% stake in Skylark Drones which provides software solutions for drones in India.

And through Bharat Skytech, Thakral has created a B2B online portal to import drone components, including batteries, from China into India and supply them to small drone manufacturers in India.

This initiative aligns with the Indian government's push for "Made in India" products. - Nespresso: Thakral recently bagged the rights to distribute the full range of Nespresso coffee products across all channels in India, one of the last big markets for the premium coffee brand.

With plans to open 12-15 boutiques in 5-6 years and a strong focus on e-commerce, this venture could brew up some serious profits.

Financial Performance: Brewing Up Success

Thakral reported a net profit of $28.8 million in 2024, a threefold increase from the previous year.

This was boosted by $8.6 million of "other income" (FY23: vs $3.3 million) from items such as fair value changes in assets (mainly an unrealized fair valuation uplift on its 9.3% stake in The Beauty Tech Group).

Revenue hit $289 million (+36% y-o-y), with the lifestyle division contributing $273 million.

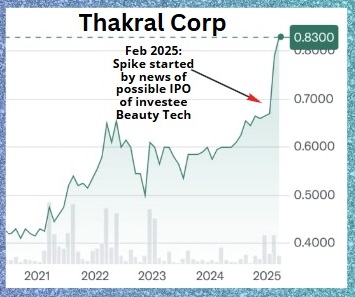

Net asset value per share stands at $1.28, yet the stock trades at just $0.83 - a potential bargain?

|

Investor Takeaway Despite its impressive performance and diverse portfolio, Thakral (market cap: $106 million) seems to be flying under the radar. With its fingers in many pies - from Australian retirement homes to Indian healthcare, Japanese real estate to beauty products in China - Thakral seeks to show that diversification is about multiplying opportunities. |

The FY24 presentation deck is here.

See also: THAKRAL: How its Aussie property biz works, why it is biggest contributor