| Thakral Corporation's 1HFY2025 results were excellent, with a record high attributable profit of S$109.3 million. This was boosted by GemLife Communities Group's successful listing on the Australian Stock Exchange, enabling a whopping 912.2% year-on-year surge in Thakral's net profit.  GemLife's listing on July 3 raised A$750 million at a market cap of A$1.58 billion—the largest IPO in Australia so far this year. Thakral enjoyed a one-off net gain after tax of S$102.4 million on fair valuation. But its stake was diluted from 31.7% to 16.8%, reducing future contribution from GemLife. In early July, GemLife repaid all of Thakral Group's debt notes and other obligations, totaling around S$35 million.

Thakral's dividends have been consistent, as shown in the table but the dividend yield has shrunk with the stock's rise. |

While the headline 1HFY2025 numbers are impressive, the real story lies in the strategic repositioning and latent value embedded in Thakral's diversified portfolio.

It's been a dozen years since Thakral Group decided, in 2013, to exit the consumer electronics business that it ran since its listing on the SGX 30 years ago.

It pivoted into distributing premium beauty devices, skin and hair care, and eventually fragrances.

Along the way, it added real estate as a core business, building a growing investment portfolio in Australia, Japan, and Singapore.

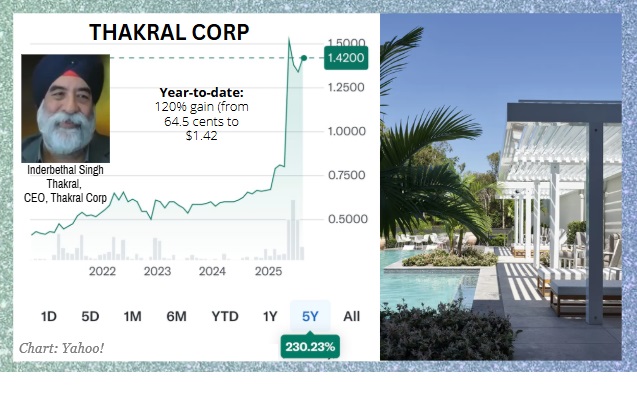

It took time for investors to recognise the growing intrinsic value of these businesses, so over the past few years, Thakral's stock price just treaded water.

It only started to climb in 2H2024 and accelerated with more newsflow of the impending GemLife IPO, reflecting growing market recognition of its value creation. Thakral's rerating owes much to its successful investment in GemLife, which develops lifestyle resorts in Australia specifically for people over 50.

Thakral's rerating owes much to its successful investment in GemLife, which develops lifestyle resorts in Australia specifically for people over 50.

| Robust Revenue Growth |

Beyond the windfall from the GemLife IPO, Thakral's core operations showed resilience.

Total revenue climbed 25% YoY to S$160.5 million, driven by the Lifestyle segment's 26% growth to S$156.6 million.

Thakral says this was "driven by strong demand" for fragrance and beauty in China, and lifestyle products such as drones, gimbals, and action cameras in South Asia amid growing adoption of drones and related accessories.

|

S$'000 |

1H FY2025 |

1H FY2024 |

Change (%) |

|

Revenue |

160,525 |

128,392 |

25 |

|

- Investment Segment |

3,900 |

4,114 |

(5.2) |

|

- Lifestyle Segment |

156,625 |

124,278 |

26 |

|

Profit from Operations |

7,157 |

6,934 |

3.2 |

|

Net Gain After Tax on Fair Value of Associate upon IPO |

102,366 |

- |

N.M. |

|

Share of Profit of Associates |

3,931 |

8,495 |

(53.7) |

|

Profit Before Tax |

157,519 |

15,000 |

950.1 |

|

Net Profit Attributable to Equity Holders |

109,325 |

10,801 |

912.2 |

Thakral has forged strong partnerships with established global names like L'Oréal for beauty and fragrance distribution in Greater China, DJI as the exclusive distributor for drones and accessories in seven South Asian markets, and Nespresso for retail and B2B expansion in India.

Referring to this strategic shift, CEO Inderbethal Singh Thakral, 65, said in a 2023 interview: "We’ve re-invented ourselves from VCRs (video cassette recorders) to drones," highlighting the company's evolution from consumer electronics to high-growth lifestyle businesses.

The segment's results rose 11% to S$7.3 million, tempered by startup costs for new Nespresso boutiques in India.

Investment Segment

The Investment segment saw revenue dip 5.2% to S$3.9 million, with share of associates' profits halving to S$3.9 million due to GemLife's partial-year inclusion.

• Japanese properties remained stable, with 98% occupancy in Osaka yielding consistent returns.

• GemLife expanded its retirement communities portfolio by a whopping 51% to 9,836 homes via the so-called Aliria acquisition of properties and sites.

Complementing this, Thakral holds a 9.4% stake in The Beauty Tech Group (formerly CurrentBody), an e-commerce platform for at-home beauty devices.

In India, Nespresso's expansion and real estate venture, like a 13.6% stake in Gurugram, a prime real estate hub adjacent to the capital, for a healthcare-mixed use development, signal untapped potential.

|