JUNE MAY usher in summer and warm weather, but things were ice cold on the Hong Kong stock exchange, with the benchmark Hang Seng Index losing over 5.4% last month alone.

But this of course gives rise to numerous bargains, with rock-bottom single-digit P/E plays mushrooming up all over the place, especially PRC-based H-shares, says a Chinese language piece in Sinafinance.

And despite the major selloffs last month, June ended with an upward flourish, regaining 1.0% in the final holiday-shortened week, meaning there was plenty of volatility and therefore several bargains worthy of attention.

The report said that investors should be particularly on the lookout for near-term bargains in the resources, retail and construction materials sectors.

One of the main downside movers in the market last month was a flurry of foreign investors selling off Mainland Chinese concept stocks.

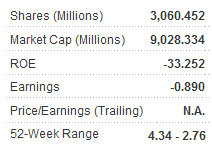

Of these, one of the more notable cases was that of PRC-based meat producer China Yurun Food Group Ltd (HK: 1068), which lost nearly 30% of its value in just three trading days last week, with short sellers cashing in their holdings, pushing the Nanjing-based firm’s shares to 52-week lows on June 28.

Investors were also gun shy about the possibility the firm would be downgraded by Muddy Waters Research for accounting regularities and rumors of Beijing implementing price controls on pork prices in the country.

Another PRC-based agricultural play, China Forestry Holdings Ltd (HK: 930), has had its shares suspended from trade for the past six months after auditors discovered auditing inconsistencies, and short-sellers have been particularly fond of betting against these counters as rumors of auditing irregularities and asset exaggerations abound.

Private equity firm Carlyle paid 55 mln usd in 2008 for a stake now at around 11% in China Forestry, only to learn in February of this year that the Hong Kong-listed firm's former CEO was arrested by PRC authorities for allegedly embezzling 30 mln yuan from the company.

Hong Kong is very much captive to the fate of “H-shares” -- PRC-based firms listed in the Special Administrative Region (SAR) -- with such counters comprising over 70% of the total trading volume on Hong Kong’s bourse.

China Forestry at one point had dozens more short-share activity than usual prior to and following negative reports from Muddy Waters earlier this year, causing its share price to now be 60% lower than pre-trading ban levels.

Blue chips were also unable to steer clear of the choppy waters of late, with PRC-based financial counters being particularly buffeted.

Reports of spiraling local government budget overruns, the ongoing Greek bailout headache as well as chronic worries of more rate action from Beijing have kept banks and insurers particularly on edge.

These factors were chiefly responsible for the nearly 2,000-point dropoff in the Hang Seng Index in the first three weeks of June.

Perhaps the single most stabilizing event last month was the speech given by PRC Premier Wen Jiabao just after his mid-June visit to Europe in which he said that he fully expected Beijing to get a firm handle on inflation in the second half of this year.

This apparently was all foreign investors in Hong Kong needed to hear, and the index immediately began a sustained crawlback which continues to this day, with expectations of a relatively looser monetary policy from Beijing going forward.

However, the final verdict on price increases in the world’s second largest economy is a story that has not yet been fully told, and investors would be wise to remain vigilant for any sudden credit adjustments from Beijing over the coming months.

In addition to potential downside drivers from within both the SAR and the PRC, pressures from afar will continue to keep the Hong Kong stock market on tenterhooks.

Greece’s recent sovereign debt downgrading to "CCC" was long expected, but the parliament’s decision in Athens to pass the five-year austerity program as a condition of the country’s bailout came as a relief to markets worldwide, with Hong Kong being no exception, sending indices up globally.

But the crisis in Southern Europe is far from resolved, and Hong Kong will be watching closely to see how the street protests in Greece and lingering financial crises in other EU member states are handled, with the second half likely to be overshadowed by these developments.

So where are things headed, valuation wise?

Long term investors should take comfort, because there appears to be considerable upside potential in the market going forward, especially after the bloodletting for most of the first half, reaching a climax in the first half of June.

There are some “very attractive” valuations out there, says well-known fund manager Zhang Chengliang.

He adds that historically the Hang Seng China Enterprises Index (HSCEI) – the critical sub-index which tracks H-shares – when its level falls to at or below average P/E ratios of 10 times, there is a “strong probability” that covered shares will rebound over the next three years by around 100%.

On Monday, the benchmark Hang Seng Index rose 1.7% to 22,770.47, adding to two consecutive weeks of gains, with financial companies leading the charge.

Meanwhile, the HSCEI did even better on Monday, jumping 2.4% to 12,873.60. Therefore, in Mr. Zhang’s view, H-shares will very likely hit between 17,000-18,000 over the next two to three years.

Resource stocks are set for a comeback, with investors urged to keep a close eye on Yanzhou Coal (HK: 1171) and Jiangxi Copper (HK: 358).

Also, Hong Kong-based retailers are expecting healthy 1H earnings, and construction materials stocks are set for a sustained recovery.

See also:

MAN WAH: Sofamaker’s FY11 Sales Surge 30% To 3.8 Bln HKD, US Mkt Afire

CHINA PRINT POWER Prepares HK Listing; CHU KONG PIPE, TECHTRONIC Both BUYs...