|

HI-P INTERNATIONAL: After giving guidance of a profitable 2Q, compared to just breakeven as guided earlier, the company bought back its shares.

Tan Ai Teng, an analyst at DBS Vickers, said on June 21 when stock price was 51 cents, that “chances are high that Hi-P could surprise on the upside if component shortages in the industry are relieved in 2H.”

She added that Hi-P is not expensive at 6.3x FY11.

Excluding net cash of S$0.28/share, the stock is even cheaper at 6.5x FY10 and only 2.9x FY11. She upgraded the stock to a ‘buy’.

Hi-P (market cap: S$532.million) provides manufacturing services and electro-mechanical modules to customers in the telecommunications, consumer electronics & electrical, computing, life sciences & medical and automotive industries.

Recent story: HI-P: Shareholders welcome 36% increase in dividends

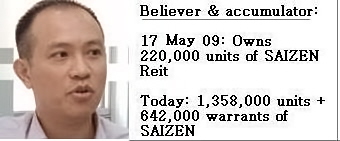

SAIZEN REIT: Chang Sean Pey, the CEO, bought 200,00 warrants of the REIT last week, bringing the total to 642,000 warrants.

He also owns 1,358,000 units of the REIT, a holding which he has steadily grown in the past year or so.

Last Friday, Saizen (market cap: S$152 m) announced that Moody’s Investors Service has revised the outlook of Saizen REIT to stable from negative.

At the same time, Moody’s has affirmed Saizen REIT’s Caa1 corporate family rating.

The REIT, which is the only one on the Singapore Exchange which invests in Japanese residential properties, ended the first 3 months of 2010 (3Q2010) with gross revenues of JPY 1 billion (S$15.8 million), largely unchanged from the preceding quarter in 2Q2010.

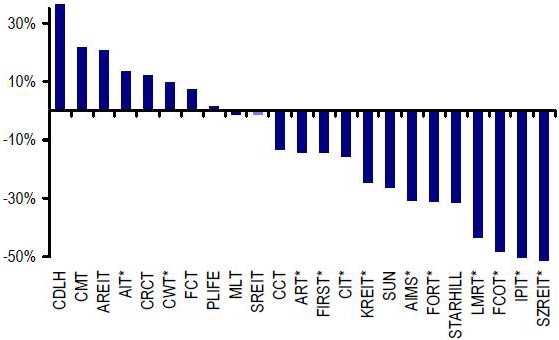

On June 21, when Saizen was trading at 16 cents a unit, UBS Investment Research published a report on Singapore-listed REITS, among whom Saizen has the most attractive discount to NAV.

See chart below:

Mr Chang is among several Saizen insiders who have been accumulating their interest in the REIT since last year.

The REIT will resume distributing cash to unit-holders this Sep (halted in Jan 2009), now that it has refinanced all but one of its commercial mortgage-backed securities (CMBS) loans.

”We think people should look us in new light now that we have turned the corner,” said Saizen’s executive director Raymond Wong at an analyst briefing recently.

Recent story: SAIZEN REIT: Out of woods and resuming cash distribution

The stock is currently trading cum-bonus warrant, with the warrants to be issued at the rate of 1 for every five ordinary shares. The exercise price is 30 cents, which is lower than the recent market price of the stock of 34 cents.

This implies that the warrants are likely to be exercised, and will bring in funds for the business which currently has a massive net cash of $36 million (versus a market capitalization of $70 million and a historical PE ratio of 7.2).

The exercise period for the warrants is six months from the date of their listing and up to 3 years.

Best World International sources, formulates, brands, and distributes a range of health and lifestyle products.

Recent story: BEST WORLD: 6,000 distributors gather to celebrate 20th anniversary