MTQ Corporation’s impending US$20-million investment in a greenfield venture in Bahrain was a subject of much discussion during a results briefing held for analysts and fund managers last Wednesday (Apr 29).

Why Bahrain? Is this the right time? Will the investment drain cash from the company over the next 2-3 years? Will dividends be cut?

For the year ended Mar 31, MTQ reported a 6% rise in revenue to $89.9 million.

Net profit dropped 68% to $12.1 million – a percentage change that should be seen in the light of a one-off divestment gain of $28.2 million in the year ended Mar 31 ’08.

Excluding the divestment gain, the latest-year profit would have grown 26%.

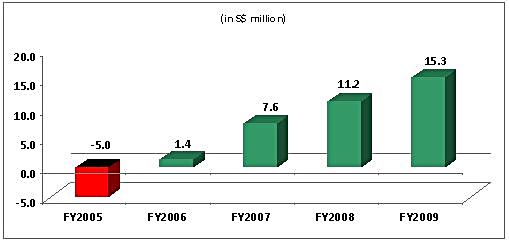

With its latest result, MTQ has chalked up its third year of rising profit from operating activities – up from a mere $1.4 million in FY06 to $15.3 million in FY09 (see chart below).

It has now recommended a final dividend payout of 2 cents a share, unchanged from the previous year. MTQ had paid 1 cent a share as interim dividend.

Mr Kuah Kok Kim, chairman and CEO, said: “We have no reason to believe, barring unforeseen circumstances, that we will not be able to maintain our current dividend payout.”

At 3 cents a share in dividend, the yield is 5.8% based on a recent stock price of 52 cents. The historical PE ratio is 3.9X. Net asset value per share was 66.58 cents as at end of March 31. MTQ has bought back 7.48 million shares from the open market.

Asked if MTQ had performed not as well in the second half as it had expected, group financial controller William Fong replied that there was a write-back of A$1.1 million from a litigation case in the first half, resulting in a net profit of $7 million.

Stripping that one-time effect off, the operations in the second half can be seen to have performed slightly better.

On the current business condition, Mr Kuah said: “We do feel a weakening in demand for our services. We also feel customers are more fussy about prices because of their tighter operating budget.”

Pressed for more details, he added: “In January and February this year, we were doing very well. March onwards there was some slowdown.”

Given the current circumstances, should MTQ proceed with its plan to replicate its business on a big scale in Bahrain? “This is our core business, and we have to look at the long term,” said Mr Kuah. “This is a good time to invest when costs are low.”

To a question on the capex for the Bahrain venture, Mr Fong said the sum would be relatively small in this financial year, but it would jump the following year. Figures have not been finalized yet.

Mr Kuah said: “We have not decided exactly how to finance it but we have many options and in the meantime we are generating very healthy cashflow from operations.”

In January this year, we published a lengthy interview with Mr Kuah on a wide range of issues relating to the Bahrain venture. Please click here.

Read also: MTQ'S William Fong: From lorry driver to group financial controller