Excerpts from OSK-DMG analyst's report

|

|

Better quarters ahead. Almost all of the 19% y-o-y fall in revenue was due to the lack of a vessel campaign at Neptune, and somewhat lower activity at MTQ’s Singapore facility, which operated at c.60% in 1Q15 vs. c.80% in FY14. Management explained that a combination of delay factors and scheduled starts in 2Q15 contributed to the lower topline. Notwithstanding this, MTQ’s gross margin improved to 34%, driven by improvements in Bahrain and Neptune. We expect a pick-up in activity in Singapore, Bahrain and Neptune in the coming quarters. MTQ's 52-week high is $1.83. Chart: www.marketwatch.comBahrain now taking more orders. Where management once hesitated to take more orders, preferring to focus on productivity, the margin improvements have given MTQ the confidence to start building up a sizeable orderbook in Bahrain. This is an important development – transitioning from skills-building to surmounting overheads, and then to sustainable profitability.

MTQ's 52-week high is $1.83. Chart: www.marketwatch.comBahrain now taking more orders. Where management once hesitated to take more orders, preferring to focus on productivity, the margin improvements have given MTQ the confidence to start building up a sizeable orderbook in Bahrain. This is an important development – transitioning from skills-building to surmounting overheads, and then to sustainable profitability.

Slow start for Binder Group. MTQ acquired Binder Group in a loss-making position. While there have been some improvements, Binder Group still exerted a small drag on MTQ’s bottomline in 1Q15. MTQ also took one-off redundancy costs this quarter to control costs there, which should be positive for the longer term.

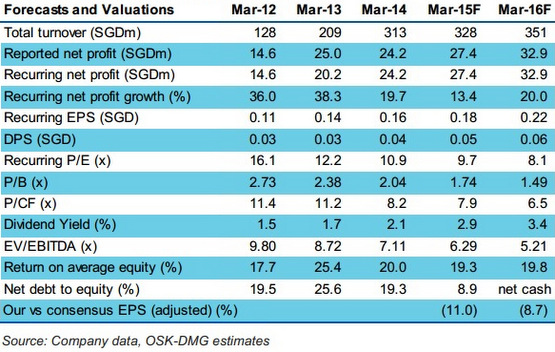

Plenty of organic growth drivers. We see ample organic growth drivers to fuel MTQ’s growth over the next few years: i) The Bahrain facility is twice the size of that in Singapore with the Middle East growing its rig count at the highest pace in the world; ii) Neptune only delivered a 3.5% net margin in FY14, and management focus is on improving it; and iii) a turnaround in Binder. We lower our FY15/16 forecast by 11.6/14.3% but peg our TP to 12x FY15 P/E (from 10x) on the stronger earnings potential in Bahrain. Further factoring in the 1-for-5 bonus issue, we adjust our TP to SGD2.16 (from SGD2.47).