Excerpts from analysts' reports

OSK-DMG keeps 'buy' call on MTQ but lowers target to $2.47 Analyst: Lee Yue Jer (left)

Analyst: Lee Yue Jer (left)

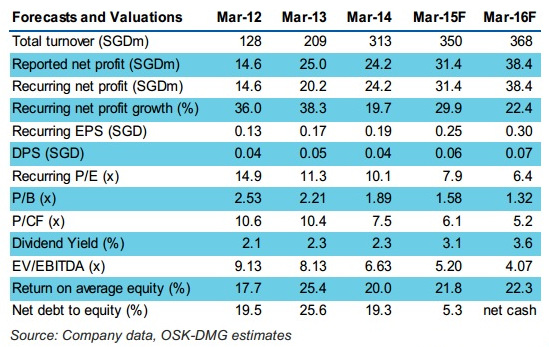

MTQ’s FY14 PATMI came in at SGD24.2m, 8% below our forecast due to slower-than-expected overhead cuts. Even so, cash from operations jumped to a new high of SGD32m (from SGD22m a year ago). We lower FY15 estimates by 12% to stay conservative, and introduce FY16F figures. Our TP is adjusted to SGD2.47, and we maintain our BUY call on its strong earnings growth profile, rising cash generation ability, and attractive valuations.

• Core earnings grew 20% in FY14. MTQ adjusted its FY13 figures after the purchase price allocation for Neptune was completed. Cutting to the chase, FY14’s PATMI of SGD24.2m was 20% higher than the FY13 core income of SGD20.2m (See Figure 1 for full elaboration).

• 1-for-5 bonus shares; 2 cents final dividend. MTQ announced a 1-for-5 bonus share issue, and a 2 cents final dividend payable in cash or scrip. The bonus shares will be entitled to the dividend. Again, we recommend taking scrip (which is usually offered at a 10% discount to the market price) as MTQ shares still look attractively-priced.

• Bahrain revenue up to SGD8.5m from SGD4.8m. MTQ’s business in Bahrain grew 77% y-o-y. It is currently cash-positive, though still at accounting breakeven. We continue to expect profitability in FY15. With a production area 2.8x the size of MTQ’s Singapore facility, this is a key organic growth driver for MTQ.

• Accelerating cash flow. The star attraction of MTQ has always been the strong cash flow, and this has strongly improved. Cash from operations grew to SGD32m from SGD22m, largely due to the full-year contribution of Neptune. MTQ is now trading at 6x operating cash flow.

• Maintain BUY with SGD2.47 TP (from SGD2.64). As we lower our FY15F forecast by 12% and roll over to 10x FY15 P/E, our TP is adjusted to SGD2.47 (from SGD2.64). We continue to like MTQ for: i) strong cash generation; ii) high 20-30% earnings growth; iii) attractive P/E and EV/EBITDA of 7.8x and 5.2x; iv) strong ROE of 22% and v) low gearing at 19%. Driven by the operating expenditure of the oil majors, MTQ’s earnings are highly recurrent and less risky than other capex plays in the long run, and arguably deserve higher valuations.

(Full report is available here).

Recent story: MTQ: Dividend Payout Up 50% As Share Price Doubles

|

Earnings slightly above expectations. Riverstone’s 1Q14 net profit of RM16.0m was 6% above our expectation due mainly to better-than-expected gross profit margins expansion but partially offset by higher-than-expected taxation. The group has maintained its high utilisation rate at 89% in 1Q14 compared to 91% in 4Q14. |