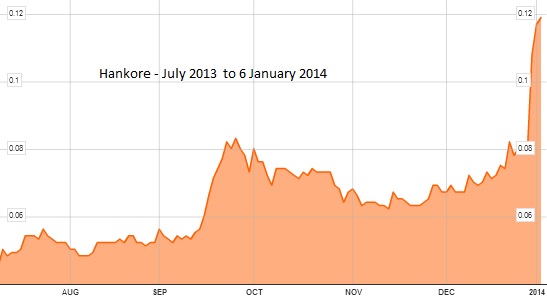

From 8c on 24 Dec 2013, Hankore's stock price is up 53% at 12.2c just 2 weeks later on 6 Jan 2014. Bloomberg data

From 8c on 24 Dec 2013, Hankore's stock price is up 53% at 12.2c just 2 weeks later on 6 Jan 2014. Bloomberg dataINVESTORS ARE showing strong renewed interest in build-operate-transfer (BOT) water treatment players.

From 8 cents on Christmas Eve, Hankore Environment Tech (BIOT SP) was up by 53% at 12.2 cents on 6 Jan and that's in just two weeks.

Hankore executive chairman David Chen. NextInsight file photo

Hankore executive chairman David Chen. NextInsight file photoInvestors jumped on the news and chased up Hankore’s stock price on hopes that it will replicate SIIC Environment’s (SIIC SP) good fortunes that transpired after the latter was taken over by Shanghai Industrial Holdings (SIH, SEHK 363).

Meanwhile, SIIC Environment was up by 47% in 3 weeks and reached 20 cents.

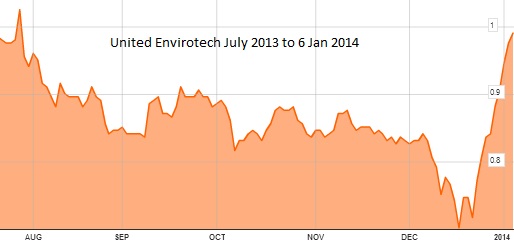

Sector peer United Envirotech (UENV SP) was up 41% over the same period and reached 99 cents.

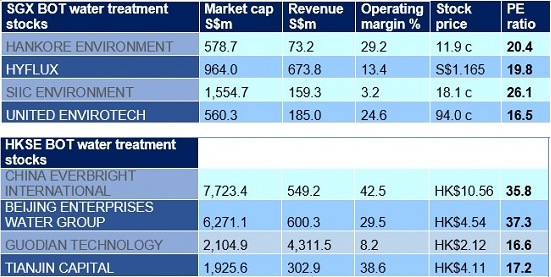

These 3 water treatment plays are now trading at price earnings multiples of between 15 to 30 times, high by Singapore standards.

"The water sector on the Singapore bourse has transformed greatly in the past one to two years," said Hankore executive chairman David Chen during a media interview on Friday.

"Its industry representation, trading volume and sector valuation are catching up with Hong Kong listed peers," he said.

PE of Singapore listed BOT water treatment stocks range from 15 to 30 times, versus 15 to 40 times for Hong Kong listed peers. Bloomberg data

PE of Singapore listed BOT water treatment stocks range from 15 to 30 times, versus 15 to 40 times for Hong Kong listed peers. Bloomberg dataStigmatized S-chips turn PRC state-owned vehicles

From 13.6c on 17 Dec 2013, SIIC Environment's stock price is up 47% at 20c just 3 weeks later on 6 Jan 2014. Bloomberg data

From 13.6c on 17 Dec 2013, SIIC Environment's stock price is up 47% at 20c just 3 weeks later on 6 Jan 2014. Bloomberg data SIIC Environment is the leading example of a BOT water treatment player that has bucked the trend of the low single digit price earnings valuation that frequently plagues small caps stocks and S-chips.

Formerly known as Asia Water Technology, SIIC Environment’s stock price traded below 10 cents for more than 3 years from 2010 to the middle of 2013.

By 2013, its market valuation had reached PE of 10 to 20 times, after SIH transformed the loss-making company into a profitable, fast growing one. SIIC Environment executive chairman Zhou Jun is also Deputy CEO of the Hong Kong listed Shanghai Industrial Holdings.

SIIC Environment executive chairman Zhou Jun is also Deputy CEO of the Hong Kong listed Shanghai Industrial Holdings.

NextInsight file photo

Formerly known as Asia Water Technology, SIIC Environment’s stock price traded below 10 cents for more than 3 years from 2010 to the middle of 2013.

By 2013, its market valuation had reached PE of 10 to 20 times, after SIH transformed the loss-making company into a profitable, fast growing one.

SIIC Environment executive chairman Zhou Jun is also Deputy CEO of the Hong Kong listed Shanghai Industrial Holdings.

SIIC Environment executive chairman Zhou Jun is also Deputy CEO of the Hong Kong listed Shanghai Industrial Holdings.NextInsight file photo

SIIC Environment's earnings grew rapidly because as the venture capital unit of the Shanghai municipal government, SIH was able to facilitate the injection of state-owned water treatment assets into SIIC Environment.

It also has the financial muscle to support SIIC Environment in its big ticket acquisitions of water treatment plants.

When SIIC Environment announced in August last year that 1H2013 net profit attributable to shareholders was up a whopping 80.1% year-on-year at Rmb 80.5 million, its stock price was only 7 cents.

In the ensuing 5 months, its stock price trebled to 20 cents.

In October last year, PRC sovereign wealth fund China Investment Corp took a 7.68% stake in SIIC Environment.

This time, its price earnings multiple further surged to cross the 25 times mark.

It also has the financial muscle to support SIIC Environment in its big ticket acquisitions of water treatment plants.

When SIIC Environment announced in August last year that 1H2013 net profit attributable to shareholders was up a whopping 80.1% year-on-year at Rmb 80.5 million, its stock price was only 7 cents.

In the ensuing 5 months, its stock price trebled to 20 cents.

In October last year, PRC sovereign wealth fund China Investment Corp took a 7.68% stake in SIIC Environment.

This time, its price earnings multiple further surged to cross the 25 times mark.

Clearly, big league shareholders put a stock on a different valuation scale.

On 30 December, Hankore announced a framework agreement to merge with China Everbright International.

Like SIH and CIC, China Everbright International is backed by the PRC government: Its parent company, China Everbright Group, is a conglomerate operated under the direct supervision of China’s chief administrative authority, the State Council.

(There are only four such conglomerates under the State Council - the other three are China CITIC Group, China Investment Corp and China Railway Corp.)

China's problems with water shortage and pollution is creating huge demand for water treatment players such as Hankore, SIIC Environment, United Evirotech and Memstar.

China's problems with water shortage and pollution is creating huge demand for water treatment players such as Hankore, SIIC Environment, United Evirotech and Memstar. SGX potential as hub for water stocks

“The Singapore bourse holds enormous potential for becoming the preferred listing destination for water treatment players," said Mr Chen.

"Many water industry experts are based here. It has a strong representative of important water treatment players as well as investment analysts and fund managers who understand the sector,” he said.

It certainly helps that Singapore has a rapidly evolving water treatment sector.

PUB’s WaterHub is home to renowned water-related organizations such as the Singapore Water Association, International Water Association, Netherlands Water House, and the Singapore Society for Trenchless Technology.

It is also the R&D base of other global research institutes such as Siemens, Nitto Denko and Optiqua Technologies.

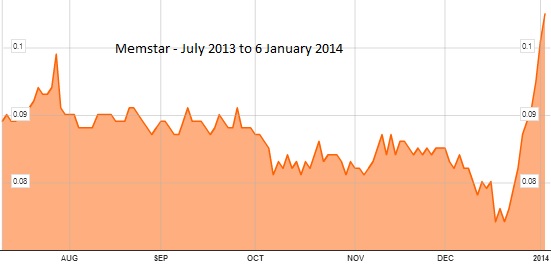

Even Memstar Technology (MSL SP), a water treatment membrane manufacturer which will become a cash shell after its sells its assets to United Envirotech, is now part of the stock market speculation.

The stock price of engineering company Tritech Group (TTGP SP) has also surged by more than 40% over the past month to 46 cents on Thu (10 Jan), likely because of investor interest in the development of its water treatment business segment.

Last year, Tritech completed a factory for water treatment membranes in July and announced in November that it completed the acquisition of a PRC wastewater treatment company.

Tritech has said it expects revenue contribution from its newly acquired business in the financial year ending 30 September 2014.

From 7.4c on 19 Dec 2013, Memstar's stock price is up 49% at 11c less than 3 weeks later on 6 Jan 2014. Bloomberg data

From 7.4c on 19 Dec 2013, Memstar's stock price is up 49% at 11c less than 3 weeks later on 6 Jan 2014. Bloomberg data DLF to further improve S-chips valuation

Separately, China’s stock market reform is also having a knock-on effect on the valuation potential of China companies listed in Singapore.

China halted all IPOs during October 2012 to November 2013 as authorities cracked down on fraud and misconduct.

To alleviate the bottleneck of China companies seeking capital market funds, SGX and the China Securities Regulatory Commission (CSRC) set up a framework that speeds up their listing process in Singapore.

The good news is, there is now stricter local supervision even with the faster listing process.

The Direct Listing Framework (DLF) that took effect on 26 November 2013 now requires PRC businesses seeking to list in Singapore to obtain approval from the CSRC prior to filing for listing with the SGX.

“The DLF is a breakthrough for the Singapore bourse," said Mr Chen.

"Ït was not easy to persuade China Everbright to accept a Singapore listing status because S-chips suffer from the stigma of undervaluation," he said.

"Thankfully, the implementation of the DLF persuaded them that the market valuation of S-chips will improve significantly as CSRC weeds out the weaker SGX listing aspirants from China," he added.

"We are seeing more undervalued and underperforming S-chips becoming RTO targets of large companies on the lookout for listing vehicles to spin-off non-core assets," said Financial PR Associate Director Ngo Yit Sung.

Mr Ngo heads the leading investor relations agency's S-chip team, which counts water stocks such as Hankore and SIIC Environment as clients.

"Now that CSRC is playing the watchdog role for S-chips IPOs, we expect the S-chips sector to be increasingly characterised by larger and better companies.

"We believe that the DLF will revive investor interest in what was once a hotly traded sector," said Mr Ngo.

From 70c on 17 Dec 2013, United Envirotech's stock price is up 41% at 99c 3 weeks later on 6 Jan 2014. Bloomberg data

From 70c on 17 Dec 2013, United Envirotech's stock price is up 41% at 99c 3 weeks later on 6 Jan 2014. Bloomberg dataRecent stories:

Ans: The jailing of CAO Chen Jiulin sent shockwave through the community and let the GMs of SOE realize it is not worthwhile to do anything improper in SG,after all they are just mere employee collecting a paycheck every month, so their financial are relatively more proper.

Therefore sgx should really get its house in order and flush out all those fraudulent companies which is so obvious(tons of cash on hands but still saddled with debts and lack of dividend payout).if fraud is detected, use the diplomatic channels to pursue the culprits at all costs to let them know singaporeans are not wimps. And pls separate the role of sgx of being both a regulator and player...

Until sgx can get its house in order, s chip will always trade at distressed valuations as investors will shun them