HanKore is commissioned by municipal governments to build and operate plants that treat wastewater (left), transforming it into clear water (right).

Photos by Ngo Yit Sung

HANKORE ENVIRONMENT TECH GROUP is a beneficiary of China's plans to invest Rmb 430 billion in urban wastewater treatment and recycling in its 12th 5-Year Plan (2011 to 2015).

HanKore's core business is in wastewater treatment, water recycling, water supply and sludge treatment.

Its 1QFY2014 (Jul to Sep) net profit more than doubled (up 149%) year-on-year to Rmb 30.4 million, thanks to increases in revenue from plant construction and recurring water tariffs. Analysts inspecting a HanKore facility with management.Last week, I had the chance to visit two of Hankore's wastewater treatment projects with 3 analysts from UOB Kayhian, OSK-DMG and CIMB-GK.

Analysts inspecting a HanKore facility with management.Last week, I had the chance to visit two of Hankore's wastewater treatment projects with 3 analysts from UOB Kayhian, OSK-DMG and CIMB-GK.

HanKore's executive director and CFO, Felix Yau, showed us the Phase 1 operations of Suzhou Jindi Wastewater Treatment Plant and Kunshan Gangdong Wastewater Treatment Plant, as well as works in progress for Phase 2.

Currently, HanKore has municipal water treatment projects with a total treatment capacity of 750,000 tons a day.

When Phase 2 is completed at the end of next year, its total capacity will increase by more than 30% to 1.1 million tons a day.

The discharge standards for several of its projects are being upgraded from Grade 1B to Grade 1A, resulting in cleaner water being discharged into the rivers.

For that, higher water tariffs are expected to be paid to HanKore by the authorities.

The tariff increase could be as much as 40% to 50%, as in the case of its Xianyang Eastern Suburbs Wastewater Treatment Plant located in Shaanxi Province.

It has also ventured downstream into equipment design and manufacturing.

In June, it acquired Jiangsu Tongyong Environment Engineering, a manufacturer of water treatment equipment. The acquisition strengthens its EPC capability.

Control room with an interactive flowchart of the various wastewater treatment processes at Suzhou Jindi plant.

Control room with an interactive flowchart of the various wastewater treatment processes at Suzhou Jindi plant.CIMB target price is 7.8cts

The analysts had a favorable impression of Hankore's operations.

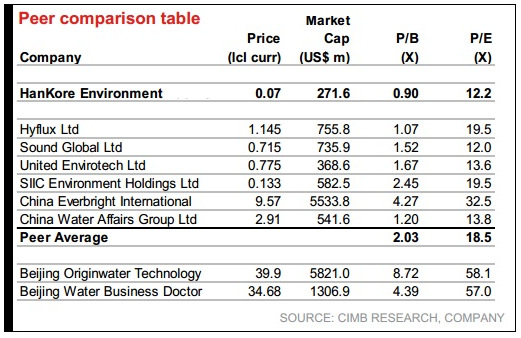

Following the visit, CIMB-GK analyst Roy Chen issued a non-rated report with a target price of 7.8 cents, about 10% above its recently traded price of 7.1 cents (Mon market close).

Filtration facility (foreground) and aeration sedimentary pool (background).

HanKore's septic tank is a key component of sewage treatment. Anaerobic bacteria in the water tank decomposes waste discharge.

HanKore's septic tank is a key component of sewage treatment. Anaerobic bacteria in the water tank decomposes waste discharge.  Surface of preliminary filtration facility.

Surface of preliminary filtration facility. Ultra-violet radiation is the final stage of the water treatment process, after which clean water is discharged into the river.

Ultra-violet radiation is the final stage of the water treatment process, after which clean water is discharged into the river.

Recent story: HANKORE, YANGZIJIANG Singled Out In Respective Industries

If hankore water treatment capacity is too small, they will likely be phased out soon due as they will not be able to secure a license issued by the central govt allowing them to operate water treatment plans...cosolidation is on the cards!

Pls help ask these questions to the management if u are a diligent analyst.

Thanks.