HanKore hit a high of about S$1.49 in March prior to the CEI deal but has since fallen to 90.5 cents.

HanKore hit a high of about S$1.49 in March prior to the CEI deal but has since fallen to 90.5 cents.Chart: BloombergMaybank Kim Eng says HanKore's "current share price weakness presents a good buying opportunity"

Analyst: Wei Bin

HanKore’s share price has corrected by 25% since details of the reverse takeover by China Everbright International (CEI) was announced on 2 June.

The market viewed the deal negatively on the back of a higher-than-expected transaction price, causing a larger-than-expected EPS dilution.

The market viewed the deal negatively on the back of a higher-than-expected transaction price, causing a larger-than-expected EPS dilution.

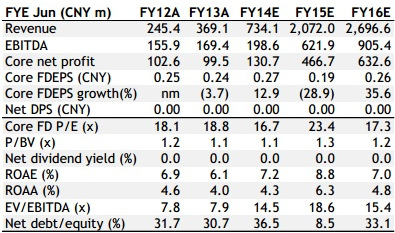

This has the effect of inflating HanKore’s FY6/15E P/E multiple to 23.4x, exceeding that of its closest peer SIIC, which is priced at 22.1x FY15E.

Remain sanguine on the stock

Remain sanguine on the stock We believe the benefits that CEI could bring, such as stronger project sourcing ability, lower cost of borrowing and stronger balance sheet remain underappreciated by the market.

With the backing of CEI, we expect HanKore to embark on an acquisition drive to position itself as a key player in the wastewater treatment (WWT) industry. We are now looking at an annual acquisition of 1m ton/day WWT capacity in FY6/15E and FY6/16E vs our original forecast of 500k ton/day.

After incorporating the final details of the CEI deal, we expect HanKore’s FY6/15E EPS to contract by 28.9% (vs +8.1% previously) before rebounding to 35.6% in FY6/16E.

Accordingly, we cut our TP to SGD1.23, still based on 30x FY6/15E P/E. We believe the current share price weakness presents a good buying opportunity.

Accordingly, we cut our TP to SGD1.23, still based on 30x FY6/15E P/E. We believe the current share price weakness presents a good buying opportunity.

With the backing of CEI, HanKore is expected to embark on an acquisition drive of 1m ton/day waste water treatment capacity in FY6/15E and FY6/16E vs Maybank's original forecast of 500k ton/day.

With the backing of CEI, HanKore is expected to embark on an acquisition drive of 1m ton/day waste water treatment capacity in FY6/15E and FY6/16E vs Maybank's original forecast of 500k ton/day.Recent story: Sell calls : UMS -- target 47 cents; HANKORE -- 74 cents

Phillip Capital says conservative fair price of Valuetronics is 63.7 cents (including 3.2-c dividend)

Analyst: Kenneth Koh

Investment Action

Considering most of their peers also have forecasted growth of single digits, we believe Valuetronics cannot trade less than the peer average PE of 7.9x given that Valuetronics has

1) operated on better net margins of >5% vs the typical 3%,

2) have never turned in a loss making year even from before IPO,

3) has an ROE of 22% vs peer average of 10%,

4) and has done so without leverage (having a net cash ratio to market cap of ~50%) - making its ROE performance even more impressive.

1) operated on better net margins of >5% vs the typical 3%,

2) have never turned in a loss making year even from before IPO,

3) has an ROE of 22% vs peer average of 10%,

4) and has done so without leverage (having a net cash ratio to market cap of ~50%) - making its ROE performance even more impressive.

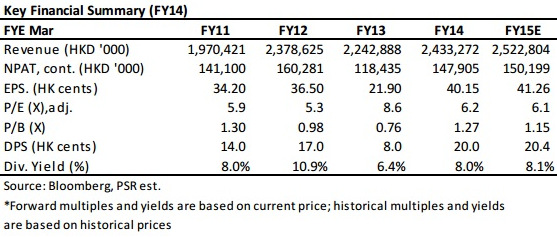

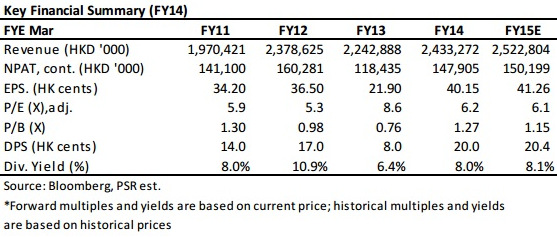

An estimated FY15 net earnings of HK$150.2M implies an FY15 PE of 6.2x at last traded price of S$0.405. Valuating Valuetronics at an undemanding 8.0x (slightly higher than peer average) implies a value of S$0.53 on earnings alone. Adding S$0.125 per share of idle cash gives us S$0.655.

This is conservative considering we are only taking 60% of net cash into our value consideration, and the global GDP recovery, favorable LED lighting cycle and encouraging earnings momentum into FY15 (better seasonal Q4) should provide a tailwind buffer.

This is conservative considering we are only taking 60% of net cash into our value consideration, and the global GDP recovery, favorable LED lighting cycle and encouraging earnings momentum into FY15 (better seasonal Q4) should provide a tailwind buffer.

Adjusting for potential dilution, assuming that all in-the-money outstanding stock options are exercised, leads us to a conservative fair price of SG$0.637 (before dividend) which is S$0.605 excluding the 3.2 SG cent dividend payout.

This represents a total upside, including dividends, of 57% from the last traded price of S$0.405.

This represents a total upside, including dividends, of 57% from the last traded price of S$0.405.