Tai Sin Electric is quietly benefiting from the mushrooming of data centres across the region -- in addition to the multi-year construction boom in Singapore.

Tai Sin Electric is a Singapore-listed powerhouse in manufacturing cable & wire (C&W), electrical material distribution (EMD), and test & inspection (T&I) services. Its FY2025 (ended June) saw 25% revenue surge in C&W to $340 million and 13% in EMD to $107 million—fueled partly by demand from data centres, according to the company. It did not give a revenue split for data centres and construction in its response to a shareholder question in advance of its AGM this Friday (31 Oct). As previously reported, Tai Sin Electric counts 70% of data centres in Singapore as clients -- which points to its market share dominance. Can Tai Sin Electric ride the data centre market in Southeast Asia which is increasingly supercharged? |

A construction boom, like the one thriving in Singapore currently, significantly benefits Tai Sin. Amplying this opportunity is a mushrooming of data centres in Southeast Asia.

A construction boom, like the one thriving in Singapore currently, significantly benefits Tai Sin. Amplying this opportunity is a mushrooming of data centres in Southeast Asia.

According to a research report, Southeast Asia's data centre market is projected to hit USD 30.47 billion by 2030, growing at a blistering 14.24% CAGR. (This refers to the market size in terms of the aggregate value of services, infrastructure, and equipment such as construction, power, cooling, and IT services).

Country by country, the outlook is positive, especially for Singapore and Malaysia:

- Singapore, the region's undisputed hub, boasts over 1 GW of IT load capacity.

Despite past land constraints, Singapore lifted a construction moratorium in 2022. - Malaysia is stealing the spotlight as the top investment magnet, with MYR 90.2 billion (USD 20.9 billion) approved for 12 projects since 2021—six already operational.

- Indonesia has 80 live data centres and about 30 in the pipeline.

- Vietnam is the dark horse, surging from a nascent base to USD 1.75 billion by 2030 at 17.93% CAGR.

- Thailand is gradually emerging as an attractive data centre spot, and anticipates USD 3.19 billion in investments by 2030 (12.64% CAGR).

The opportunities are there for Tai Sin Electric to seize, as it owns manufacturing sites in Singapore, Malaysia and Vietnam that supply cables, wires, busbar trunking systems, and testing services for data centre builds across Southeast Asia.

|

As per its AGM response, "Apart from Singapore and Malaysia, the Group also supplied products and services to data centre projects in Vietnam, Thailand, and Indonesia."

However, specific quantitative data on the manufacturing capacity (such as output volume, production limits, or facility size metrics) are not available, so it's not possible to estimate how much data centre business it potentially can aim for.

On revenue nature, Tai Sin Electric clarified: "During the construction phase of data centres, the products or services provided are generally one-off in nature.

"However, once the data centres are completed and operational, there may still be opportunities for replacement or maintenance-related business within the respective business segments, albeit at lower values depending on the products and services provided." No massive FY2025 capex splurges, but as stated, "The Group has continuously upgraded its manufacturing capacity and undertaken R&D initiatives aligned with the requirements of the data centre industry, particularly in enhancing delivery speed and expanding product mix, as data centres remain an important portfolio within our business."

No massive FY2025 capex splurges, but as stated, "The Group has continuously upgraded its manufacturing capacity and undertaken R&D initiatives aligned with the requirements of the data centre industry, particularly in enhancing delivery speed and expanding product mix, as data centres remain an important portfolio within our business."

It doesn't seem like a capex-intensive business.

Tai Sin Electric said, "the Group will continue to upgrade its manufacturing capacity and invest in R&D in alignment with market demand for data centre related products."

| FY25 profit -- highest in 10 years |

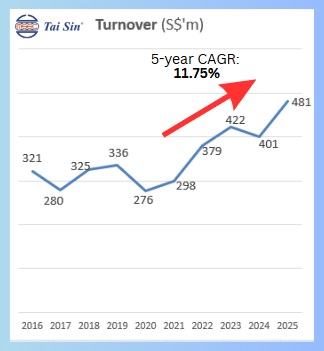

Tai Sin Electric's FY2025 revenue reached S$480.73M, up 19.98% YoY.

Tai Sin Electric's FY2025 revenue reached S$480.73M, up 19.98% YoY.

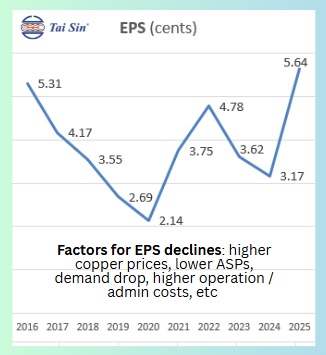

Net profit attributable to shareholders surged 77.74% YoY to S$25.95M, boosted by operational leverage, no impairments, and a one-off subsidiary disposal gain.

Gross profit margin improved marginally to 16.68%.

Results by segment:

|

FY 2025 |

Revenue (S$M) |

YoY Growth |

Operating Profit* (S$M) |

Profit Margin |

|

Cable & Wire |

340.15 |

+25.4% |

28.37 |

8.3% |

|

Electrical Material Distribution |

107.50 |

+13.1% |

2.18 |

2.0% |

|

Test & Inspection |

29.94 |

+0.8% |

2.44 |

8.2% |

|

Switchboard |

3.14 |

-31.1% |

0.14 |

4.5% |

|

* Operating profit = segment result before interest, etc. |

||||

Tai Sin Electric has done well in FY2025 -- thanks to the construction boom and mushrooming data centres.

|

|||||||||||||||||||||||||

See the full Tai Sin Electric response to shareholder questions here.

See the full Tai Sin Electric response to shareholder questions here.

Also, read about another data-centre play: CSE GLOBAL: AI Needs Power, and This Company Is Helping To Fit Out Data Centres