• Tai Sin Electric's stock (59 cents) has done well this year, gaining 51% year-to-date with most of the gain happening in 3Q when it popped 40%, as investors increasingly recognised its fundamentals anchored in the construction boom and proliferation of data centres in Singapore and Malaysia. • Tai Sin provides the wires that power and connect critical systems in infrastructure and data centers, ensuring electricity flows, data moves, and safety is maintained. Its products are like the veins and nerves of these projects.

Tai Sin did not increase it despite a record profit for FY25 (ended June), likely due to higher working capital needs as its business volume goes up. • While its stock has done well of late, it lags behind that of its Malaysian peer, Southern Cable Group, which has gained 94% year-to-date and trades at 26X PE compared to Tai Sin's 10X. (See: Construction Boom Powers Electrical Cable Manufacturers, S'pore Player Trades at Half The PE of M'sia's) Read more below... |

Excerpts from UOB KH report

Analyst: Roy Chen, CFA

Tai Sin Electric (TSE SP)

|

| Analysis |

• A diversified regional industrial group with core strengths in electrical cable & wire manufacturing. Tai Sin Electric (TSE) is one of the leading electrical cable and wire (C&W) manufacturers in Southeast Asia with production bases in Singapore, Malaysia and Vietnam that support sales across the region.

In FY25, C&W contributed to 86% of TSE’s operating profit.

Through its other subsidiaries, TSE also:

| a) carries and distributes a wide range of third-party electrical products in Singapore, supporting the needs of local contractors and manufacturers; b) provides independent testing and inspection services for construction projects in Singapore, Malaysia, and Indonesia; and c) manufactures electrical switchboards in Brunei. |

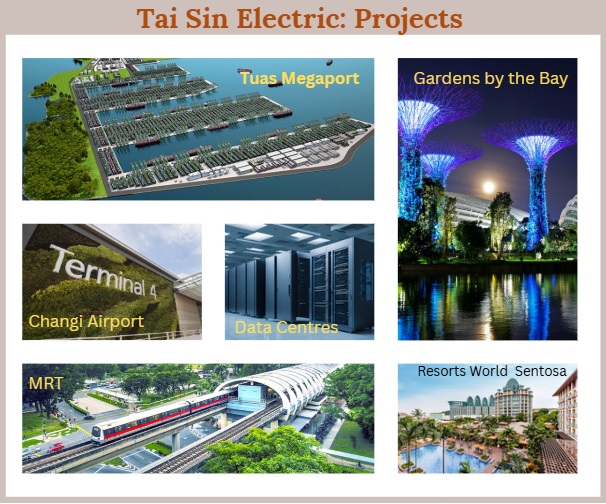

• A major supplier to Singapore’s key infrastructure and iconic landmarks. TSE is a trusted brand with a leading market share of the cable and wire supplies in Singapore.

TSE’s cable and wires are widely used in Singapore’s key infrastructure including MRT lines, Changi Airport, and Tuas Mega Port.

It is also a primary supplier to many of Singapore’s iconic landmarks such as Jewel at Changi, Gardens by the Bay, and Resorts World Sentosa.

TSE supplies to over 70% of data centres in Singapore.

• TSE’s core competitive advantages include:

|

a) its sizeable local production facility that can cater to large and mega projects while offering superior logistics experiences (short turnaround time and multiple deliveries within a day); |

| Financial review |

TSE has been consistently profitable for 28 years since its listing in 1998, though its profits and margins may fluctuate with infrastructure development cycles and copper prices.

|

Tai Sin |

59.5 cents |

|

52-week range |

38-59.5 c |

|

Market cap |

S$271 M |

|

PE |

9.9 |

|

Dividend yield |

4.1% |

|

P/B |

1.2 |

|

52-week change |

45% |

While TSE routinely hedges a portion of copper demand after a project is entered, its contract margins may still be somewhat eroded if copper prices sharply rise.

This happened during the pandemic when the supply chain was severely disrupted, resulting in TSE ending up with onerous contracts (older contracts that were entered when copper prices were low) that dragged its financial performance in FY23-24.

With the onerous contracts largely depleted, TSE’s net profit was more normalised in FY25, reaching a record-high level of S$25.9m (+78% yoy).

• Outlook: Geared to the region’s upbeat infrastructure development.

TSE would continue to benefit from the upbeat infrastructure demand in Singapore, including new MRT Lines, Changi Airport T5, the Paya Lebar Air Base relocation, the Marina Bay Sands integrated expansion, the East Coast “Long Island”, and the Woodlands Regional Centre projects.

TSE is also a key beneficiary of the data centre boom in Malaysia, with many new data centres being built in south Johor Bahru, close to TSE’s Malaysian production facility.

|

→ Full UOB report is here. → Full UOB report is here.→ See also: TAI SIN ELECTRIC: Construction & Data Centre Boom Boosts This Company's Cable Business But It Has to Navigate Copper Risks |