|

|

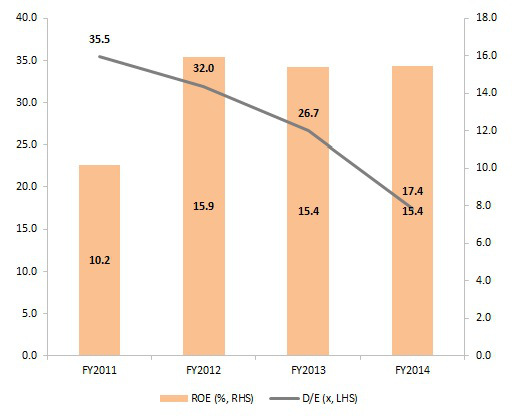

Consistent profitability with prudent debt management

Tai Sin has demonstrated highly consistent profitability in the last 3 years.

ROA has increased from 9.5% in FY12 to 10.7% in FY14.

While ROE decreased marginally from 15.9% to 15.4% for the corresponding period, the decrease is merely a mechanical implication of lower financial leverage, and not a reflection of lower profitability.

Management has been consistently paring down borrowings – debt to equity has declined from 0.32x in FY12 to 0.17x in FY14.

Overall, we believe this to be indicative of a highly stable business, helmed by prudent management.

Earnings consistency is always important for a dividend play and Tai Sin has little issue in ticking that box. Between FY12 and FY14, revenue and profit grew at a CAGR of 5.0% and 7.7% respectively.

The Building and Construction Authority (BCA) has forecasted average construction demand to be sustained between $26 billion and $37 billion from 2016 to 2019, in view of the mega public sector infrastructure projects lined up to meet the long-term needs of Singapore’s population and economy.

To put things into perspective, 2014’s demand of SGD37.7bn was the highest ever recorded.

This is good news for the company, but we caution against any crystal ball-gazing based on the statistics.

|

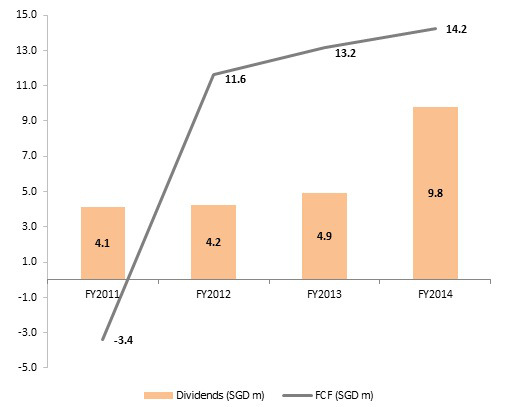

Strong cash generation underpins high dividend yield

Based on its current price of SGD0.35, investors are rewarded with a dividend yield of 6.4% which we believe to be sustainable, given that it corresponds to a payout ratio of 0.7x.

Our payout ratio differs from the conventional and is calculated by dividing dividends paid with free cash flow.

We believe this conservative approach to be more appropriate given that both are cash-based in nature.

In addition, with regards to the sustainability of dividends, capital expenditure has exceeded the level of depreciation in the last 3 years.

This portends that management has not been overly-aggressive in paying out dividends, at the expense of under investing in operating assets which we deem to be especially important, due to the nature of Tai Sin’s business.