MTQ Group CEO Kuah Boon Wee. NextInsight file photoMTQ CORPORATION has doubled its 1HFY2014 Group revenue after it acquired a 86.81% stake in ASX-listed Neptune Marine Services in a deal that was completed in April.

MTQ Group CEO Kuah Boon Wee. NextInsight file photoMTQ CORPORATION has doubled its 1HFY2014 Group revenue after it acquired a 86.81% stake in ASX-listed Neptune Marine Services in a deal that was completed in April.

Group revenue shot up 103% year-on-year to S$159.3 million.

However, gross margin was 3.5 percentage points lower at 32.6% due to a higher cost base at Neptune.

This includes higher staff costs, operating lease expenses and audit, legal and professional fees.

Profit attributable to shareholders was S$12.0 million (up 23%).

Cash flow from operations doubled to S$19.2 million (up 119%), boosting its cash reserves to S$45.3 million as at 30 September.

The Group paid down its bank loans, resulting in lower net gearing of 12.8%, compared to 19.9% as at 31 March 2013.

It has proposed an interim cash/scrip dividend of 2.0 Singapore cents per share, payable on or about 7 January next year.

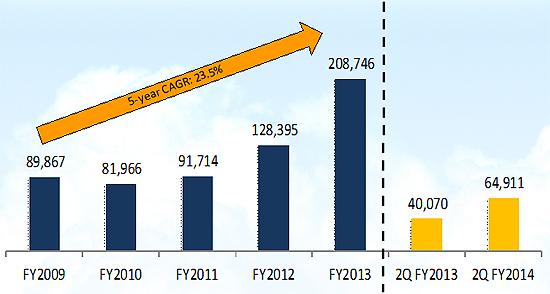

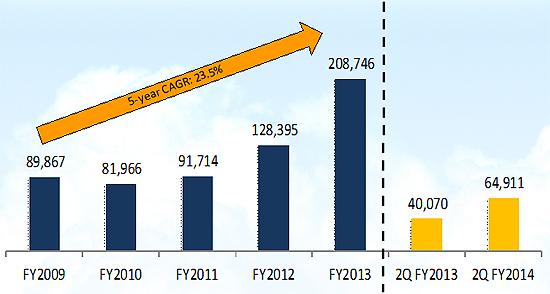

MTQ Group revenue in S$000

MTQ Group revenue in S$000

When MTQ announced its takeover offer for Neptune in October 2012, the Aussie subsea engineering and project management solutions provider was incurring losses.

”We are now into Neptune’s 3rd quarter of profitability,” said MTQ Group CEO Kuah Boon Wee during its analyst briefing on 30 October. Mr Kuah was appointed Neptune’s Chairman in June.

"We want to maintain margins, cut cost and retain valuable people," he said.

The main contributor to the significant increase to Group revenue was the inclusion of the Neptune subsea businesses, which became part of the Group in December 2012.

Revenue contribution from MTQ’s Oilfield Engineering business was lower due to weaker sales recorded from agency activities compared to the previous period.

MTQ provides oilfield equipment repairs and reconditioning services to drilling contractors, oil companies and oil service companies.

It also manufactures components, as well as provides fabrication and rental services. Its focus is on high-pressure drilling equipment, notably, the Blow-Out Preventor and related products.

CFO Dominic Siu"The Middle East and Southeast Asia are the two largest markets for jack-up rigs in the world. Our workshop in Singapore captures the Southeast Asian market while and our workshop in Bahrain caters to the Middle Eastern market,” said CFO Dominic Siu, who was also present at the analyst briefing.

CFO Dominic Siu"The Middle East and Southeast Asia are the two largest markets for jack-up rigs in the world. Our workshop in Singapore captures the Southeast Asian market while and our workshop in Bahrain caters to the Middle Eastern market,” said CFO Dominic Siu, who was also present at the analyst briefing.

The Group intends to focus on growing its Oilfield Engineering business, with a focus on ramping up productivity at Bahrain.

Below is a summary of questions raised at the briefing and the replies provided by Mr Kuah and Mr Siu.

Q: Are there more contract enquiries at Bahrain? When will it break even?

Yes, the enquiry level for oilfield engineering services at Bahrain is healthy. Order book is also healthy.

Losses have continued to narrow and it is now cashflow positive. To become profitable, we need to have regular monthly revenue and execute the work well. In the past, we had regular monthly revenue but because the workforce was not up to standard, we made more mistakes. We are no longer making the same errors.

Q: I understand that cost cutting is still going on at Neptune. What overheads do you expect to achieve for Neptune over the next 3 to 4 years?

Neptune is restructuring to relocate its facilities to one single purpose-built facility in Welshpool, Western Australia. In addition to rent savings, the consolidation of Neptune’s four current locations in Perth will result in operating efficiencies and other cost savings.

The new facility is under construction and the relocation is expected to happen in March 2015.

It is difficult to bring overheads in Australia down to Singapore levels, but the ratio is improving. However, Singapore is facing cost challenges and the cost structure difference between the two countries is likely to decrease.

Q: You have a large amount of cash. If there are no acquisitions over the next 12 months, can we hope for a higher dividend payout?

We will retire some debt. Some debt is good for hedging if the spread is sizable. If there are no strategic acquisitions, we don’t want to keep more cash than is sensible.

Much of our debt is for hedging. We have a sizable Aussie dollar debt to hedge currency exposure for our operations in Australia. We also have USD debt for our operations in Bahrain.

Q: Is there business seasonality at Neptune?

During the typhoon season, many offshore activities are halted. There is also a revenue surge during diving campaigns, when we generate revenue with minimal cost by sub-letting vessels. This year’s revenue will not be as good as in last January to March when we had a diving campaign.

Other than that, there is not much seasonality.

MTQ's stock price has nearly doubled year-to-date. Bloomberg

MTQ's stock price has nearly doubled year-to-date. Bloomberg

Recent story: @ MTQ AGM: Shareholder Queries On M&A

MTQ Group CEO Kuah Boon Wee. NextInsight file photoMTQ CORPORATION has doubled its 1HFY2014 Group revenue after it acquired a 86.81% stake in ASX-listed Neptune Marine Services in a deal that was completed in April.

MTQ Group CEO Kuah Boon Wee. NextInsight file photoMTQ CORPORATION has doubled its 1HFY2014 Group revenue after it acquired a 86.81% stake in ASX-listed Neptune Marine Services in a deal that was completed in April. MTQ Group revenue in S$000

MTQ Group revenue in S$000 CFO Dominic Siu"The Middle East and Southeast Asia are the two largest markets for jack-up rigs in the world. Our workshop in Singapore captures the Southeast Asian market while and our workshop in Bahrain caters to the Middle Eastern market,” said CFO Dominic Siu, who was also present at the analyst briefing.

CFO Dominic Siu"The Middle East and Southeast Asia are the two largest markets for jack-up rigs in the world. Our workshop in Singapore captures the Southeast Asian market while and our workshop in Bahrain caters to the Middle Eastern market,” said CFO Dominic Siu, who was also present at the analyst briefing. MTQ's stock price has nearly doubled year-to-date. Bloomberg

MTQ's stock price has nearly doubled year-to-date. Bloomberg NextInsight

a hub for serious investors

NextInsight

a hub for serious investors