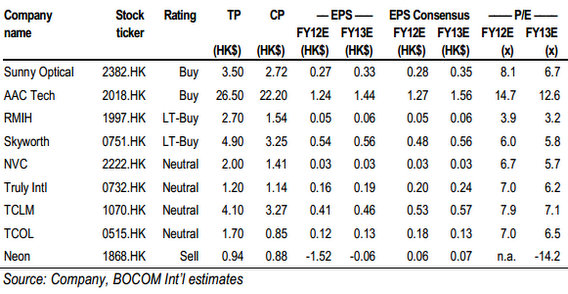

BOCOM: ELECTRONICS ‘Outperform’

Bocom said it is keeping its “Outperform” recommendation on HK-listed electronics plays.

In 2Q 2012, Apple reported 22% YoY growth in revenue and 20.5% YoY growth in net profit. The quarterly results were below Street estimates, largely attributable to (a) the effects of the macro economy; (b) the lagging release of new iPhone products; (c) seasonal effects; and (d) inventory management.

“In our view, shipments of the iPad reached a healthy level of 17mn units, increasing by 84% yoy or 44% qoq. We believe this is negative to AAC Tech (HK: 2018), neutral to Sunny Optical (HK: 2382) and positive to Regent Manner (HK: 1997),” Bocom said.

Apple is AAC Tech’s largest customer and accounts for approximately 25% of its total revenue.

“The consensus iPhone shipment figure is negative to AAC Tech, but it could be offset by the imminent release of the iPhone 5 and healthy shipments of iPads. There will be no direct impact on Sunny Optical as Apple is not its customer so far,” Bocom said.

It added that the healthy iPad shipments, coupled with the possible release of the iPad Mini, are positive to Regent Manner as the primary LED light bar supplier.

By staying “Outperform” on Hong Kong-listed electronics plays, Bocom expects a more than 10% sector upside in 12 months.

See also:

HK RETAIL RUNDOWN: Summer Of Shivers

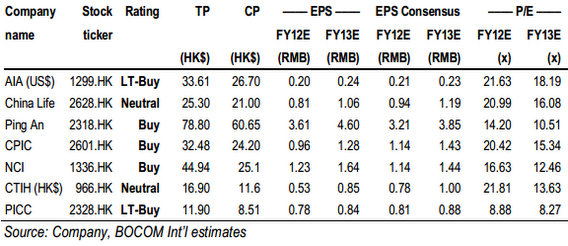

BOCOM: INSURANCE ‘Outperform’

Bocom said it is maintaining its ‘Outperform’ call on Hong Kong-listed insurers.

“First half profits are generally weak versus a strong HOH net asset increase. We expect the pure life insurers’ first half net profits to decrease, as some of the AFS losses in 2011 could be included in the income statement,” Bocom said.

It said the estimated net profit growth rates of Hong Kong listed insurers, by descending order, are: Ping An (+14.89%), CTIH (+8.2%), PICC (+6.04%), NCI (-12.98%), China Life (-20.08%), AIA (-23.15%) and CPIC (-55.51%).

“However, we expect the insurers’ real profitability to improve as the capital market performed better than in 1H11. This can be verified by the insurers’ substantial HOH net asset growth. We expect PICC, Ping An, China Life, CPIC and NCI to report HOH net asset growth of 22.38%, 11.73%, 11.81%, 9.23% and 9.48%, respectively,” Bocom added.

Decline in new premium income and NBV

The research house said it expects China Life, Ping An and CTIH’s FYP from individual channels to drop 7.1%, 19.8% and 5.3%, respectively.

“Also, we estimate the Chinese life insurers’ banc assurance FYP to decline by more than 25%, and hence, we expect their total FYP to decrease by double-digits. However, we expect the Chinese life insurers’ ANPs to be better than FYPs, owing to structural improvement.”

It added that it expects CPIC’s 1H NBV to grow by 14%, the highest among the Chinese insurers, while China Life, Ping An and CTIH’s 1H NBV to decline by 8.3%, 3.1% and 5.9%, respectively.

“Investors should be cognizant of the risk of lower-than-expected NBV for the latter three. Life insurers’ HOH EV growth is estimated to be higher than 10% for most of the Chinese insurers.”

P&C ratios expected to rise

“We expect their 1H combined ratio to rise to around 95.5% from 93%, due to intensified competition and new regulation of accelerating claim cycle launched by CIRC. However, the decline in underwriting is expected to be offset by rising investment.”

As a result, Bocom said P&C insurers could report better net profit.

“We expect PICC’s 1H results to beat our expectation, as it can use reserves to balance its profit. ROIs are expected to rise given better capital market performance. We expect the insurers’ net ROIs to continue to rise in 1H12 as the recent rate cuts have yet to see results.

“We estimate Ping An, CPIC and NCI’s real ROI to increase by 169bps, 234bps and 205bps to 5.35%, 5.39% and 5.2% in 1H12, respectively, attributable to the rebound of capital markets.”

Bocom is cutting its target prices for for AIA, Ping An, NCI and CTIH by 0.2%, 3.01%, 4.56% and 7.55%, respectively, to HK$33.61, HK$78.8, HK$44.94 and HK$16.90.

“This moves comes as we adjust our EV and NBV forecasts, and lower the P/E for non-life businesses. We lower our 2012 profit forecasts for AIA, China Life, CPIC, NCI and CTIH by 6.6%, 6.8%, 13.44%, 7.9% and 7.7%, respectively, given weaker-than-expected net profit growth of life insurers.”

That being said, Bocom said it is still positive on the insurance sector given its improving business data, enhanced financials and policy support.

“Ahead of the 1H results, we recommend investors lighten up on China Life in light of its high valuation and low 1H NBV growth. We advise investors to add to NCI on weakness during the upcoming results release given our anticipation of a strong rebound in NBV in 2H12.”

See also:

HK Market: CONSUMER, INSURANCE

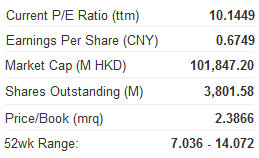

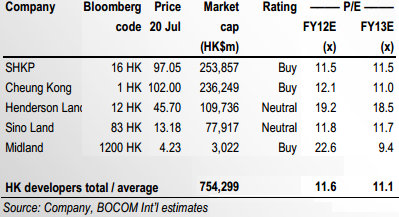

BOCOM: PROPERTY ‘Market-perform’

Bocom said it is keeping its “Market-perform” recommendation on Hong Kong-listed property developers.

“The sales momentum of the property market was maintained in July, given a 14% MoM growth in sales volume for the first three weeks of July. The 1st-tier cites and 2nd/3rd-tier cities recorded 11% and 15% MoM increase in sales volume during the period, respectively,” Bocom said.

The research house added that among the 1st-tier cities, Shanghai led the pack with 33% MoM growth in sales volume, followed by Tianjin (up 20% MoM) and Guangzhou (up 16% MoM).

“On the other hand, property prices stayed roughly flat during the period, as both price cuts and withdrawal of price discount were employed by various developers. We expect most of the developers to record modest MoM growth in contracted sales revenue in July, probably from single-digits to low double-digits.”

Bocom said the “exciting” sales performance in June may not occur again in July.

“The sector is currently trading at an average 49% discount to NAV. We maintain our view that policy headwinds and slowdown of MoM contracted sales revenue growth would remain as overhangs on the sector.”

See also:

Top 1H HONG KONG GAINERS: Property King Of The Hill

BOCOM: CONTAINER SHIPPERS ‘Underperform’

Bocom said it is maintaining its “Underperform” call on Hong Kong-listed container shippers.

“The planned capacity retrenchment announced by the CKYH alliance on the Asia-Europe tradelane effective from July 25 is important news, as we think capacity retrenchment during the typical peak season underlines the demand weakness on the tradelane,” Bocom said.

The research house added that the Shanghai Container Freight Index (SCFI) continued to decline.

“Last week, the SCFI lost another 3.3% WoW, with the Asia-Europe tradelane losing 4.6% WoW. Insufficient demand remains the main driver pushing the rates lower, in our view, as Shanghai Shipping Exchange said that the load factor on vessels heading to Europe was only about 80%.”

It said the load factor on the Transpacific tradelane was, however, slightly better last week at about 90%, but the freight rate on the Transpacific tradelane was still down 3.5%.

“Freight rates on other non-core tradelanes, such as the Asia-Middle East tradelane, were in general lower, WoW.

Rising concerns on demand strength

The Euro debt crisis triggered a round of sell-offs of container shipping stocks again this week.

“Other than sentiment, the fundamentals are also not in favor of the container shipping companies. Growth of imports into Europe had decelerated further with a 7.4% YoY decline in May, worse than the 5.0% YoY decline in April.”

Bocom said it continues to worry about the weakening cargo demand on the Asia-Europe tradelane for the remainder of the year, which will dampen the freight rate outlook ahead.

“We are skeptical of the sustainability of the rate hikes in August, as the rate hikes of the past two months did not take hold.”

See also:

AmFraser On YANGZIJIANG