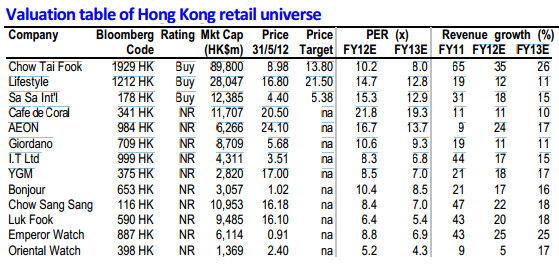

Bocom: CONSUMER STOCKS ‘Outperform’

Bocom International said it is maintaining its “Outperform” recommendation on Hong Kong-listed consumer plays despite “disappointing” April retail sales in Hong Kong.

“Hong Kong retail sales growth came in at 11% in April, easing from 17% in March and lower than the consensus estimate of 16%, suggesting the consumption slowdown seemed to have come faster and bigger than expected amid the macro headwind,” Bocom said.

The brokerage added that the growth slowdown was widespread nearly across all segments, except for supermarkets and F&B which showed a “moderate improvement.”

The key segments seeing slowing growth were clothing and footwear (from +15.7% to +7.2%) and medicines and cosmetics (from 23.4% to 13.1%), followed by department stores (from 14.5% to 9.8%), and jewelry/watches (from 18.4% to 15.5%).

“While we believe sustained Chinese tourist arrival growth (+23.9% in April vs. +24.3% in March, with Jan-Apr 2012 +21.8% vs. +23.9% in 2011) should help to provide some support.

"YTD slower-than-expected growth has prompted us to believe the sector growth forecast in the coming months is under rising downward pressure.”

However, Bocom still expects key consumer sector plays like Sa Sa (HK: 178) and others to help boost the sector.

See also:

CHOW SANG SANG Sales Surge; Move Over, India?

PRC RETAIL, PROPERTY: The Good And The Ugly

Bocom: INSURERS ‘Outperform’

Bocom International said China’s insurance industry watchdog – the China Insurance Regulatory Commission (CIRC) -- is reportedly set to relax its regulations over insurers’ overseas investments.

This prompted to brokerage to maintain its “Outperform” recommendation on the sector.

“Local media reported that the CIRC would allow insurance companies to invest in markets outside mainland China and Hong Kong with an amount of no more than 15% of the insurers’ total assets. The market scope will be limited to 100 countries,” Bocom said.

Bocom added that while it thinks the regulator might have already drafted such a policy, it believes it will not be a near term announcement.

“One of the CIRC’s ten regulations for insurers’ investments relates to the opening up of overseas markets. It is possible that the reported measures might be the detailed implementation of this regulation, in our view.”

However, regardless of when the new measures might be implemented, Bocom said expanding the scope of investment options for the massive sums of cash in China’s insurance sector can only be a net positive.

However, the brokerage said that insurers should tread carefully when looking for attractive buys overseas.

“Given the current weak global economy and volatile macroeconomic environment, even if the reported measure materializes, the investment yield from the new investment channels might not be attractive when compared to that of the domestic market.”

As for Hong Kong-listed insurance plays, Bocom said they were bound for a rally.

“The insurance sector has underperformed the benchmark Hang Seng Index since May. Current sector valuations are attractive.”

Bocom’s top pick among Hong Kong-listed insurers is New China Life Insurance (HK: 1336).

See also:

ISAAC CHIN: "2011 Was My Most Difficult Year In Investing"

Bocom: BANKS ‘Outperform’

Bocom said it is reiterating its “Outperform” call on banks listed in Hong Kong.

“We are maintaining our recommendation as the positive impact of the PRC’s “maintaining steady growth” policy on credit supply was not fully reflected in May,” Bocom said.

The brokerage said local media reported that the new loans of the Big Four commercial lenders in May reached approximately 253 billion yuan as of May 31.

“According to the media reports, the new credit supply of the four big banks just reached 34 billion yuan as of May 20, but the credit supply of the Big Four exceeded 220 billion in late May. This was mainly attributable to the acceleration of infrastructure project approval under the policy of ‘maintaining steady growth’,” Bocom said.

Photo: Bocom

Commercial banks, especially the state-owned banks, sped up their credit supply effort.

The positive impact of “maintaining steady growth” policy on credit supply was not fully reflected in May due to the time-lag effect, the brokerage said.

“Credit supply may miss expectations and the percentage of bill discounts may remain high in May, but we expect that the percentage of mid-to-long term loans (new loans that are granted for infrastructure projects) will increase further in June,” Bocom said.

The brokerage is maintaining its credit supply forecast of 7.9 trillion yuan for the year and the estimated supply in the proportion of 3-3-2-2 for each quarter.

“It is expected that new loans in 2Q12 will reach about RMB2.37tn, i.e. RMB700bn in May and RMB980bn in June. H-share banks are trading at FY12E average P/E of 5.30x and P/B of 1.05x -- historical low levels.”

Bocom added that it maintains its “Outperform” rating on the sector as the economy is likely to reach a trough in 2Q12 and the “moderately easing” policies will bring cyclical opportunities to the banking sector in 2H12.

See also:

CASH COWS: Banks Top 2011 China Earners

Bocom: CHINA PROPERTY ‘Market Perform’

Bocom International said it is restating its “Market Perform” rating on China-based developers listed in Hong Kong.

“However, we remain cautious despite decent contracted sales,” Bocom said.

Contracted sales revenue rose 19% month-on-month, on average in May, but it was at the expense of a 2% m-o-m decline in average selling prices.

“Also, the performance among developers was mixed, as some of them showed m-o-m declines in contracted sales revenue during the period. Looking forward, given the large volume to be launched and the support of user demand, we expect contracted sales to remain steady for the next few months.”

However, Bocom said the strong sequential growth in May is not likely to occur again.

The sector is currently trading at a 53% discount to 2012E NAV, compared with the valuation range of 40-62% during 2010-11.

“While the contracted sales performance will continue to support the momentum in the short term, we see limited opportunity for policy relaxation this year and a breakthrough in valuations.”

See also:

Buy Right Property -- The Essential Guide By Getty Goh