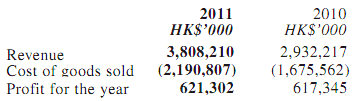

MAN WAH Holdings Ltd (HK: 1999), the PRC’s No.1 recliner sofa manufacturer and No.5 in the US market, saw its year-to-March revenue surge to 3.8 bln hkd from 2.9 bln a year earlier, boosted by a 55% jump in sales to the US.

However, its bottom line only managed a 0.6% rise due to skyrocketing transport fees, higher raw material costs, a strengthening yuan and rising wages, said Man Wah Chairman and Managing Director Wong Man Li, with the company's shares nearing 52-week lows.

“Although we were facing pressure from soaring transport costs, we still realized a net profit of 621 mln hkd. The problem of sharply increased raw material prices and labor costs as well as yuan appreciation affected all types of enterprises worldwide,” said Mr. Wong.

Basic earnings per share (EPS) stood at 64.5 HK cents, rising faster than the bottom line at 2.1%.

The company’s Board of Directors recommending a final dividend of 13.0 HK cents compared with 22.0 cents a year earlier, together with an interim dividend of 13.4 cents (vs: nil) bringing the total basic dividend for the year to 26.4 cents (vs: 22.0 cents), representing a year-on-year increase of 20%.

The total basic dividend payout ratio increased to 41% versus 35% a year earlier.

“For FY2011, Man Wah successfully kept the gross profit margin stable at 42.5% (FY2010: 42.9%) which reflects our outstanding abilities on stringent cost controls and success in sales strategy adjustments,” Mr. Wong said.

He added that the Group continued to maintain its “healthy financial position” by maintaining a strong balance sheet with cash on hand and bank balances rising 329.1% year-on-year to approximately 1.6 bln hkd, while bank loans dropped 88.1% to 17.5 mln, allowing the firm’s acid-test ratio to jump to 5.81 from 2.04.

“Fortunately we maintained profitability through improving economies of scale and working efficiency, and also over 100 new sofa models we launched which were supported by our enhanced research and development (R&D) capability.”

The chairman added that Man Wah boosted its average selling price (ASP) of exported sofas and domestic sales sofas by 7% and 13%, respectively.

The US market continues to be the biggest breadwinner for Man Wah, with FY2011 sales up 55% to 2.1 bln hkd, accounting for 54.3% of the Hong Kong-listed firm’s total revenue.

“Our US revenue surged due to improving brand recognition for our “CHEERS” line which boosted orders from American retailers,” said Mr. Wong.

This helped Man Wah’s market share in the US jump to 7.3% compared to just 2.6% in 2008.

“Man Wah was the fastest growing furniture supplier to the US in terms of sales gains by percentage increase from 2009 to 2010 and moved to No.5 in the US from No.8,” he said.

Man Wah’s phenomenal success in the US did not mean the PRC-based company was neglecting its home market.

“The PRC is our No.2 market, accounting for a quarter of our sales in FY2011, comprised of both sofa sales and bedding sales, contributing 20% and 5%, respectively, to our top line,” Mr. Wong said.

In the 12 months to March, PRC sofa sales rose 36.5% year-on-year to 760 mln hkd while bedding sales stood stable at 193 mln.

“We continued to strengthen our exploration of the PRC market, and maintained our twin-pronged strategy of self-operated stores and distributor stores,” he said.

“We continued to strengthen our exploration of the PRC market, and maintained our twin-pronged strategy of self-operated stores and distributor stores,” says Man Wah Chairman and MD Mr. Wong Man Li. NextInsight file photo of analyst visit

“We continued to strengthen our exploration of the PRC market, and maintained our twin-pronged strategy of self-operated stores and distributor stores,” says Man Wah Chairman and MD Mr. Wong Man Li. NextInsight file photo of analyst visit

As of March 31, 2011, the total number of “CHEERS” and “ENLANDA” brand retail outlets reached 660 from 509, up 30% from a year earlier. Of these outlets, “CHEERS” brand retail outlets rose 36.8% to 405 stores while “ENLANDA” brand retail outlets added 19.7% to 255 stores.

Man Wah’s self-operated store network (including both “CHEERS” and “ENLANDA”) now covers 18 Tier I and Tier II cities in Mainland China including Shanghai, Shenzhen and Guangzhou, with two new cities added – Chongqing and the Fujian Province city of Quanzhou.

“We will continue to develop a high quality nationwide sales network in the future, with an aim to hit 1,000 stores by the end of FY2013. At last check, we were tops in the PRC with a 19.8% market share in 2010, up from 16.2% in 2008,” said Mr. Wong.

Looking Ahead

Mr. Wong said the company would continue to strengthen its "CHEERS" market-leading position and brand recognition in both the international and domestic market by enhancing product quality and extending Man Wah's retail network.

"In the US, we will further cooperate with retailers as well as focus on popular recliner chairs, targeting to further increase our US market share. Meanwhile, in the PRC, we will devote more resources to promote the recliner sofa theme and further elevate the brand recognition of both 'CHEERS' and 'ENLANDA'."

He said there was much room for growth as the sales percentage of recliner sofas was only 6.8% of the total PRC sofa market, much lower than the 36.7% seen in the US over the past year.

See also:

MAN WAH: Breaks Into Top 10 In US Furniture Market

MAN WAH Chairman "Confident Of Strong 2H" After Record 2 Bln Hkd Interim Revenue