This article on HK-listed Lever Style was originally published on Weighted Capital.

Lever Style

Operation Performance > Stock Price Expectation

|

Lever Style Corporation, an investment holding company, engages in the design, production, and trading of garments. Its products include seamless-bonded, activewear, performance wear and outwear, sweaters, denim, bottoms, soft wovens, shirts, cut-and-sewn knit, fashion outwear, leather, and tailoring products for men, women, and kids. The company operates in Mainland China, Hong Kong, Macau, Taiwan, the United States, Europe, Oceania, and internationally. Lever Style Corporation was founded in 1956 and is based in Kwun Tong, Hong Kong. -Tikr.com |

|

I happened to learn about Lever Style when I visited HK with Swen Lorenz - Undervalued Shares and Michael Fritzell - Asian Century Stocks last April 2024. |

Unlike Li & Fung, who rides the trend of low cost textile manufacturing (low mix, high volume) in China, Lever Style is riding the trend of fast fashion (high mix, low volume).

It means that fashion brands need to be much in tune with their supply chains - which means dealing with lots of small orders and through many small factories.

This also means that fashion brands either

|

1. beef up their design, purchasing and operation department to deal with multiple factories working on multiple designs with ever shortening timeline 2. work with someone like Lever Style to navigate these challenges |

Coupled with the threat of a Trump’s tariff on almost every country in the world, wouldn’t most fashion brands take up Lever Style’s services than create a department who may or may not navigate the complexities of dealing with multiple factories, multiple designs, multiple tariffs while mulling how to get a quicker design and production period?

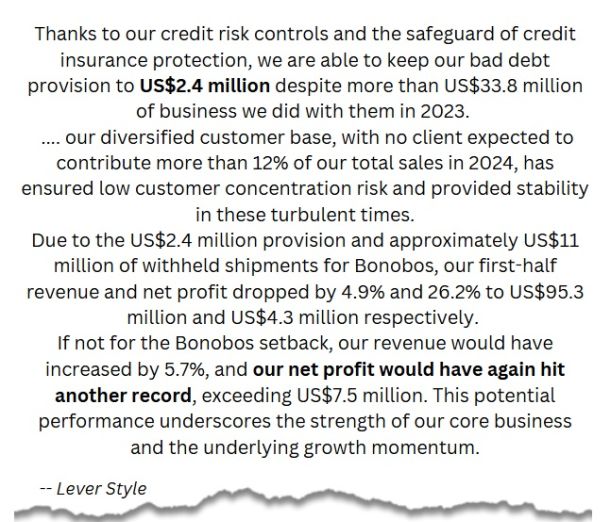

Lever Style announced their 2024 2Q results on 5th August 2024 with a drop in revenue and net profit for FY2024 due to some bad debt provision.

I got into a conference call with the management and managed to clear most of my concerns in regards to their business and their bad debt situation. 20242Q 5th August 2024

20242Q 5th August 2024

The management started buying at HKD 0.78 and I also joined in the party and have continued to average up since.

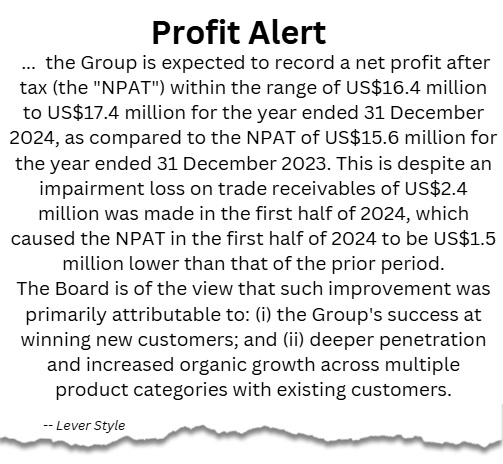

On 15th January 2025, Lever Style issued a profit alert sending the share price significantly higher than before.

15th January 2025

15th January 2025

The latest profit alert highlights the attractiveness of Lever Style’s business model.

Lever Style high mix low volume business model is the trend forward and it has allowed them to win new customers and grow organically with their existing customers.

With Trump screaming “Tariffs!”, I expect the trend for brands to continue building redundancies and resilience into their supply chain.

Lever Style is going to be more needed than before. The stock trades at ~6X PE based on the forecast profit mentioned in the company's profit alert for FY2024. Trailing dividend yield is 7.3%.

The stock trades at ~6X PE based on the forecast profit mentioned in the company's profit alert for FY2024. Trailing dividend yield is 7.3%.

I have been buying since 25th September 2024 and the average price paid is HKD 0.92.