- Posts: 108

- Thank you received: 15

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

MIDAS HOLDINGS

13 years 1 month ago #12953

by GEO

Replied by GEO on topic MIDAS win contract news release on 16 Jan 2013

16 Jan 2013 : NEWS RELEASE: MIDAS’ JV COMPANY NANJING SR PUZHEN RAIL TRANSPORT WINS FIRST 100% LOW-FLOOR TRAM CONTRACT VALUED AT RMB338 MILLION

The topic has been locked.

13 years 1 month ago #12975

by ZEN

Replied by ZEN on topic Re:MIDAS HOLDINGS secured RMB 3.13 billion + 1.4billion + 860 million contract

who else made a whopping 40% gain from MIDAS last few months ??

The topic has been locked.

13 years 1 month ago #12976

by BlueSky

Replied by BlueSky on topic Re:Re:MIDAS HOLDINGS secured RMB 3.13 billion + 1.4billion + 860 million contract

Hi Zen ,

Thanks.

I still vested small qty (10 only ) .

Thanks.

I still vested small qty (10 only ) .

The topic has been locked.

13 years 1 month ago #12977

by Val

Replied by Val on topic Re:MIDAS HOLDINGS

The topic has been locked.

13 years 1 month ago - 13 years 1 month ago #12996

by Joes

Replied by Joes on topic Re:MIDAS HOLDINGS

There are a no. of happy shareholders here? Welcome to the party. The analysts are trumpeting this stock way ahead of the profits that may come fr hi-speed rail projects. Still, here is further fuel

Midas Holdings: S$0.52 BUY (TP: S$0.75)

23-Jan-13 (DMG / OSK)

Year of Recovery

Recently we played host to Midas at our ASEAN Corporate Day held in Singapore. The key takeaways from the meetings were: (i) outlook is healthy, especially for 2014 and 2015, as the government continues to increase spending on rail infrastructure, which would buoy the demand for high-speed trains; (ii) Midas is taking steps to diversify beyond 2015; (iii) it does not expect its operations/activities in 1H13 to differ much from those in 2H12, and any orders secured now are likely to be delivered from 2014. Midas expects to release its 4Q12 results before end-Feb. We reiterate our BUY recommendation and SGD0.75 TP as the potential order flow looks good given the government’s commitment to expand China’s rail network.

Government to pour in RMB650bn in 2013. This is slightly more than the RMB631bn spent in 2012, as the government strives to achieve the goals set out in its 12th Five-year (2011–2015) plan for the rail industry. In order to achieve its goal of having a “four vertical and four horizontal” high-speed railway network by 2015, the government may have to spend at least an estimated least RMB500bn on railway construction in each of the next three years, With this number of railways anticipated to come up, we expect some orders for high-speed train cars to start flowing.

Preparing for years beyond 2015. Midas, which plans to diversify into the production of aluminium alloy plates and sheets, has set up a JV company with Jilin Kaitong Engineering, in which it has a 55% stake. It is building a plant with an expected capacity of 200,000 tonnes, which is envisaged to be operational in 2015 when the government’s plans for the rail industry are expected to come to fruition. Aluminium sheet plates can be used in the aviation, shipbuilding and automobile industries. As part of the funding for this plant will be from bank loans, this will raise Midas’ net gearing going forward. Management has indicated that its net gearing could go up to ~40% from 22% as at 3Q12 as it expands its operations.

Things to pick up in 2013. While Midas’ order book deliveries are expected from FY13, we think the bulk could be delivered in FY14 and FY15 as the government pushes to achieve its 2015 target. Management has highlighted that since it generally takes between 18 and 24 months to deliver an order, any order secured now is likely to be handed over from 2014 onwards. This will give a boost to the company’s FY14 earnings.

Â

Midas Holdings: S$0.52 BUY (TP: S$0.75)

23-Jan-13 (DMG / OSK)

Year of Recovery

Recently we played host to Midas at our ASEAN Corporate Day held in Singapore. The key takeaways from the meetings were: (i) outlook is healthy, especially for 2014 and 2015, as the government continues to increase spending on rail infrastructure, which would buoy the demand for high-speed trains; (ii) Midas is taking steps to diversify beyond 2015; (iii) it does not expect its operations/activities in 1H13 to differ much from those in 2H12, and any orders secured now are likely to be delivered from 2014. Midas expects to release its 4Q12 results before end-Feb. We reiterate our BUY recommendation and SGD0.75 TP as the potential order flow looks good given the government’s commitment to expand China’s rail network.

Government to pour in RMB650bn in 2013. This is slightly more than the RMB631bn spent in 2012, as the government strives to achieve the goals set out in its 12th Five-year (2011–2015) plan for the rail industry. In order to achieve its goal of having a “four vertical and four horizontal” high-speed railway network by 2015, the government may have to spend at least an estimated least RMB500bn on railway construction in each of the next three years, With this number of railways anticipated to come up, we expect some orders for high-speed train cars to start flowing.

Preparing for years beyond 2015. Midas, which plans to diversify into the production of aluminium alloy plates and sheets, has set up a JV company with Jilin Kaitong Engineering, in which it has a 55% stake. It is building a plant with an expected capacity of 200,000 tonnes, which is envisaged to be operational in 2015 when the government’s plans for the rail industry are expected to come to fruition. Aluminium sheet plates can be used in the aviation, shipbuilding and automobile industries. As part of the funding for this plant will be from bank loans, this will raise Midas’ net gearing going forward. Management has indicated that its net gearing could go up to ~40% from 22% as at 3Q12 as it expands its operations.

Things to pick up in 2013. While Midas’ order book deliveries are expected from FY13, we think the bulk could be delivered in FY14 and FY15 as the government pushes to achieve its 2015 target. Management has highlighted that since it generally takes between 18 and 24 months to deliver an order, any order secured now is likely to be handed over from 2014 onwards. This will give a boost to the company’s FY14 earnings.

Â

Last edit: 13 years 1 month ago by Joes.

The topic has been locked.

13 years 4 weeks ago #13055

by Val

Replied by Val on topic Re:MIDAS HOLDINGS

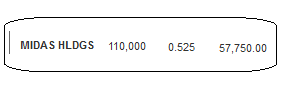

Who was the first to champion Midas in NextInsight forum? If I am not mistaken, it's Zen. Then got a few others who also started to recognise its recovery potential. me, i just read and think and, luckily, did act. Â Midas is a runaway train now! Everyday going further and further. Now zoomed past 57.5 cent. I have 1 worry -- I hope it doesn't crash! Â It is looking to have priced in 2014 earnings,, or even 2015. It's way too rich? What do you think?Â

The topic has been locked.

Time to create page: 0.247 seconds