|

Excerpts from CGS International report

Analysts: Natalie Ong & Then Wan Lin

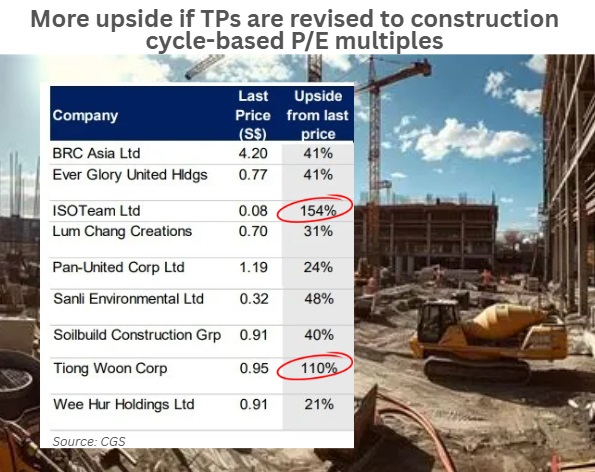

■ BCA has raised its 2026F construction demand forecast, supporting our view of an extended upcycle and earnings peaking later in FY28F/29F. ■ There could be 1-24% upside to our TPs. Our TPs are conservative, with implied FY27F P/Es only at their respective historical averages. ■ Maintain Overweight on the construction sector. We expect names under our coverage to deliver FY26F-28F EPS growth of 16-41% and ROE of 16-24%. ■ Top picks: SANLI, SOIL, TWC, with 28-32% upside to our respective TPs. |

| Earnings growth extended, to peak in FY28F/298F |

We now believe EPS growth will continue into FY29F and earnings will peak in FY28F/FY29F (previously FY27F/FY28F).

We see 1-24% potential upside to our TPs, which are conservative with implied FY27F P/Es (for 7 out of 9 names under our coverage) only at their respective historical averages.

Our scenario analysis, which pegs our hypothetical TPs to the respective stage-of-cycle multiples, posits potential 21-154% upside to our cycle-adjusted hypothetical TP; early-cycle players like building material names BRC, and PAN are pegged to +0.5 s.d. of their historical P/Es while late-cycle beneficiaries like mechanical and electrical (M&E) engineering, design and fit-out players (with later earning peaks) are pegged to +1 s.d. of their FY27F P/Es.

We maintain our Overweight call on this sector, expecting names under our coverage to deliver FY26F-28F EPS growth of 16-41% and ROE of 16-24%; we now expect the Singapore construction upcycle to extend into FY29F.  Natalie Ong, analystOur top picks are SANLI, SOIL and TWC; despite 28-32% upside to our respective TPs, implied FY27F P/Es are undemanding at their average historical forward multiples (10-15x). Natalie Ong, analystOur top picks are SANLI, SOIL and TWC; despite 28-32% upside to our respective TPs, implied FY27F P/Es are undemanding at their average historical forward multiples (10-15x). Re-rating catalysts: strong offtake volumes and earnings-accretive M&As. Downside risks: project delays due to bottlenecks in other construction services and work stoppages. |

→ See the CGS report here

→ See the CGS report here

→ See also: Margin Recovery, Multi-Year Backlogs for Construction Companies. Which are UOB KH's picks?