|

The share price of Ley Choon Group -- which provides services related to underground utility infrastructure and road works -- ran up an eye-popping 14.6% (from 4.8 cents to 5.5 cents) today after The Business Times published an article on it.

|

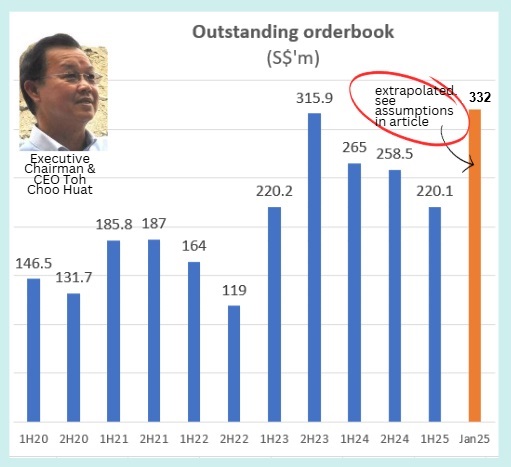

Now, in that Jan announcement Ley Choon did not update its outstanding orderbook but it's easy to make an educated guess.

We plotted (chart below) the past outstanding orderbooks (announced with half-year results).

It was last at S$220 million when Ley Choon released its 1HFY25 results back in Nov 2024.

We assume Ley Choon fulfills ~S$10 million of contracts a month, an average that was seen in FY2024 and FY2023.

Thus, from the outstanding $220 million in Nov, subtract $20 million (2 months of contract fulfilled) + $132 million (newly announced contracts) = $332 million oustanding orderbook.

As the chart shows, the order book is at its highest in the past 5 years.

Another positive is that the gross margin has been trending up (table below), which portends well for future net profits.

|

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

1H |

|

|

GP margin |

7.5 |

7.9 |

11.7 |

13.2 |

16.3 |

20.6 |

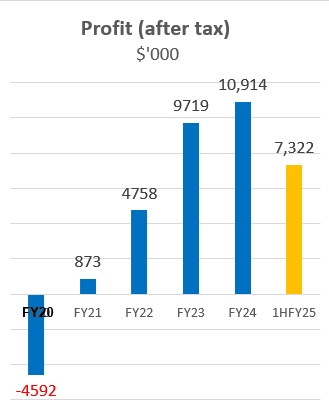

Reflecting its gross margin expansion, Ley Choon's net margin jumped to 11.4% in 1HFY2025, compared to 8.6% the year before.

1H2025 revenue saw a modest bump of 2.5% year-on-year to S$64.4 million, but net earnings soared by 35.9% (chart below), thanks to lower finance costs.  EPS for 1HFY25 was 0.486 cent/share. Annualised PE for FY25 is 5.7X

EPS for 1HFY25 was 0.486 cent/share. Annualised PE for FY25 is 5.7X

See also: LEY CHOON: 8 years on, fulfills its debt repayment. It can't wait to reward shareholders too